Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of October.

Market Action

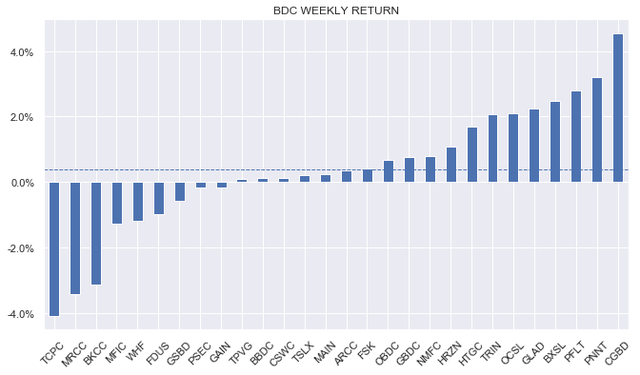

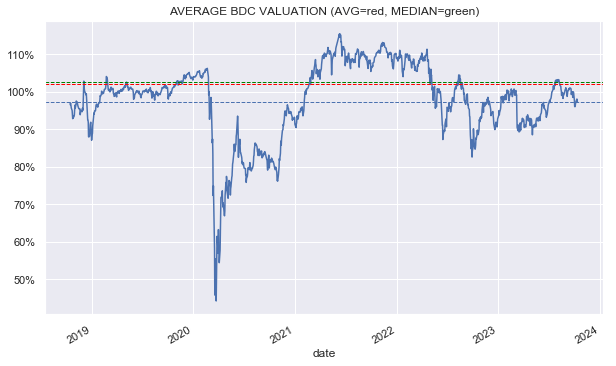

BDCs were marginally up this week as markets whipsawed on geopolitical concerns and higher-than-expected inflation readings. Despite a positive week, the sector remains down around 2.5% on the month.

Systematic Income

Valuations have recovered slightly from the recent slide but stand around 5% below the recent peak.

Systematic Income

Market Themes

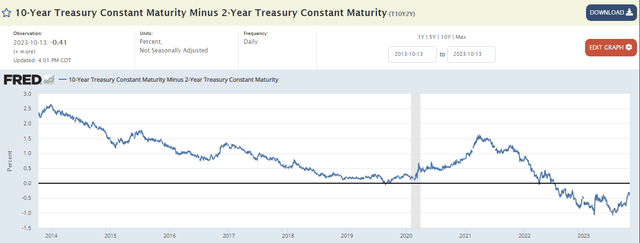

Many investors have noticed the rise in longer-term Treasury yields over the past couple of weeks as the 10Y yield moved close to 5%. This is despite very little change in the front-end of the curve as inflation remained well-behaved and the Fed did not signal any unexpected hikes. This dynamic bears directly on the term premium which is defined roughly as the additional compensation investors require for lending at longer-term rates than at shorter-term rates.

We can see this rise in the term premium a couple of different ways. One academic definition of the term premium shows that it’s moved into positive territory and is not far off the top of the range.

FRED

Perhaps a more intuitive definition of the term premium is simply the difference between 10Y and 2Y Treasury yields as shown below. This has risen as well but remains well below its longer-term range.

FRED

What drives the term premium? A common answer is the debt load – the higher the debt, the higher the term premium investors require and vice-versa. US debt outstanding has been rising sharply over the past couple of years which has now been followed by a rising term premium.

However, today’s dynamic is unusual as, historically, the term premium behaved in the opposite way than we would expect – higher debt loads coincided with a falling term premium and vice-versa. This is likely because higher debt loads have been associated with recessions and during recessions inflation falls, giving investors more confidence in buying longer-dated bonds, while at the same time investors also seek safety in higher-quality assets, boosting demand for Treasuries.

Rather, the historically down-trending term premium appeared to be driven by a stronger level of inflation anchoring due to increased Fed credibility and transparency. A subdued level of inflation volatility, until recently, has also helped as well as strong buying of US Treasuries by foreigners, particularly foreign central banks given an increase in global FX reserves.

Foreign holdings as a share of America’s national debt have now been on the decline, falling to around 27% while commercial banks have been sellers as well (BTFP has mitigated this somewhat) and the Fed itself is allowing Treasuries to roll off its balance sheet.

Inflation volatility has jumped sharply though it appears to be slowing down once again. Fed’s credibility has been dinged however long-term inflation expectations remain low, suggesting that inflation remains well anchored across markets and the sharp hawkish turn by the Fed has helped shore up its inflation-fighting credentials.

Overall, the term premium will likely remain elevated and higher than what we saw in the decade preceding COVID, however, two of the three pillars remain mostly in place which suggests that the term premium is unlikely to move back to the top of its multi-decade range.

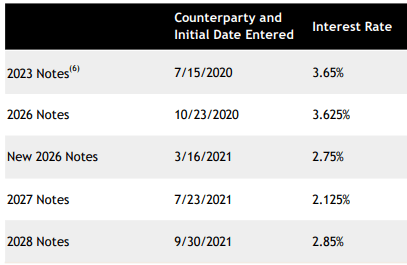

The most direct impact of an elevated term premium on BDCs is through their cost of debt. Many BDCs were able to refinance their fixed-rate bonds in 2021 at, what now look like, incredibly low levels. This was because both Treasury yields and credit spreads were both very low in 2021.

For example, BXSL issued 5 bonds in just over 14 months starting in July 2020 at coupons that are miles below today’s Treasury yields, locking in an amazing net interest margin for years.

Blackstone

One of these bonds already rolled off in July and others will follow in subsequent years. Unless rates collapse from here this means that many BDCs will be refinancing bonds with coupons of 2-3% to bonds with coupons of 6.5%+, in effect more than doubling their cost of funding on each issue.

Some BDCs, like BXSL, have longer-term debt than others so those will be better off for a while however after 2-3 years nearly all will be forced to refinance the majority of their low-coupon bonds.

BDCs will have an option whether to refinance with 3-5 year bonds or whether to borrow via a floating-rate credit facility and that will depend on the shape of the yield curve – a very upward sloping curve will push many to use the credit facility over issuing bonds. This might make more sense as a credit facility has a lower credit spread, being unsecured and shorter-term, and can be terminated in short order whereas a bond, even a callable one, can sit on the balance sheet for years.

Overall, a higher cost of debt is almost inevitable and this will create a headwind to BDC net income over the coming years.

Market Commentary

BDC Saratoga Investment Corp (SAR) is reporting early results in the sector. Recall that SAR doesn’t follow typical calendar quarters but quarters that are shifted by one month from nearly all other BDCs.

The NAV fell marginally as retained income mostly offset unrealized depreciation (which was around 1%). Non-accruals rose to 2 from 1 (out of 55 portfolio companies) and stand at 1.6% on fair-value / 4.5% on cost.

Overall, it was a good quarter from the company and, while anecdotal, suggests that the sector should deliver decent Q3 results. While borrowers are feeling some pain from high base rates, so long as the economy hums along, sector portfolio quality should remain stable overall.

BDC Main Street (MAIN) said that in Q3 it originated $107m of new commitments and funded $137m of investments. The larger fundings figure reflects commitments made prior to Q3 and funded only in Q3. This compares fairly well against fundings of $148m in Q2 and just $44m in Q1.

All of this suggests that the lending market is fairly favorable – borrowers aren’t too scared to borrow, repayments aren’t falling off a cliff and lenders have the confidence to put money to work.

Stance And Takeaways

BDCs have remained relatively expensive in aggregate over the past couple of months so our focus has been more on modestly downshifting exposure and looking out for relative value opportunities. The upcoming Q3 earning results period is likely to lead to additional volatility in the sector with more opportunities opening up for investors.

Read the full article here