Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the first week of October.

Market Action

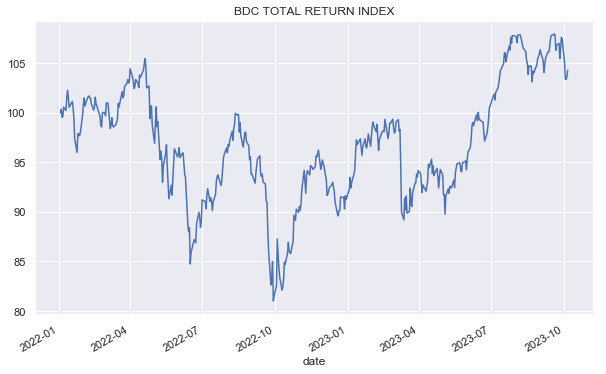

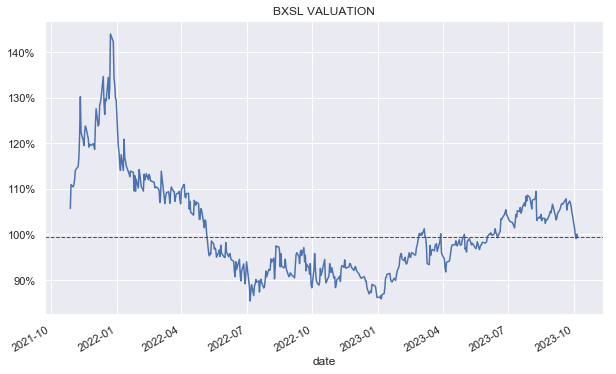

BDCs had an off week with a 3% drop as only two BDCs in our coverage finished in the green. The sector has deflated by close to 5% since its most recent peak.

Systematic Income

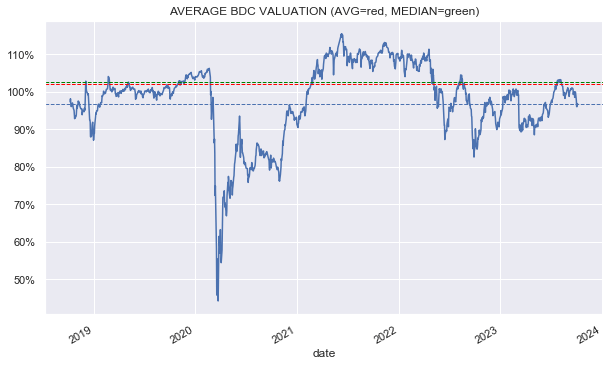

Average valuation has moved to just under 97% after trading north of 100% for several weeks. Our view has been that BDCs are somewhat expensive and while this drop is welcome it’s too early to back up the truck in our view.

Systematic Income

Market Themes

As highlighted above, over the last couple of weeks BDC valuations have come off. However, their fall is larger than it is in reality because of the way BDC prices work.

The convention when discussing BDC valuations is to use the current price divided by the last available NAV. The obvious challenge here is that BDC prices (as other exchange-traded income securities) are quoted “dirty” i.e. the opposite of “clean” or “stripped”, meaning the dividend is part of the quoted price.

This means that when the dividend falls out on the ex-div date, the price will fall, all else equal. This is why occasionally investors see a drop in the stock’s price and get the impression that it has now become more attractively valued. The reality, of course, is that often this is just due to the dividend falling out which sends the erroneous value signal that the stock’s valuation has fallen. This effect is currently magnified because most BDCs have been increasing their dividends over the past 18 months due to the rise in short-term rates.

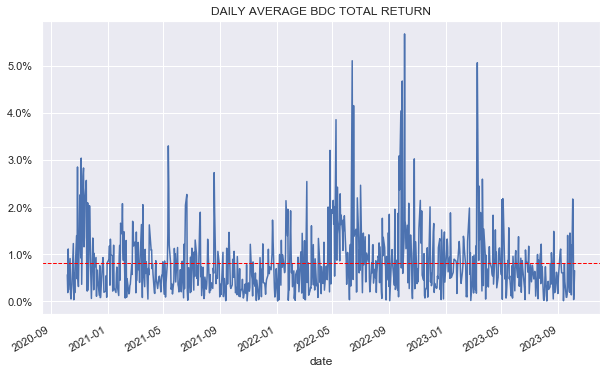

It is particularly challenging to keep track of this dynamic because 2.5%+ daily price moves (roughly what each dividend is worth) are not uncommon (especially as many individual BDCs will obviously exceed this average). This means that investors are getting a potentially false value signal much more often.

Systematic Income

Outside of valuation tracking, investors are also occasionally caught out when entering limit orders a bit below the current price which happens to be filled on an ex-div date at a worse stripped price than had investors bought prior to the ex-div date.

Other income securities such as CEFs don’t have this issue because the vast majority of CEFs provide daily NAVs which also take into account the impact of dividends.

One way to solve this issue is to carefully make a daily adjustment to the valuation – in effect, to come up with a bespoke valuation which takes the dividend bias into account. The way this would work is it would use both clean NAVs (i.e. NAV stripped of the accrued dividend) as well as clean prices. This process would make much more sense, however, it would run into a ton of questions from readers since it would use a different convention than what the rest of the market is used to.

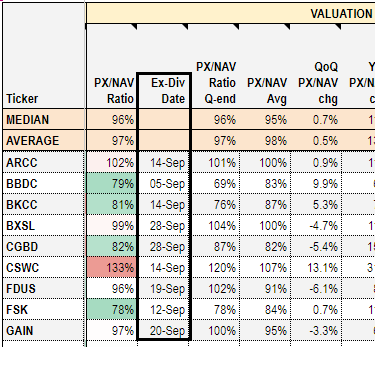

A simpler way for BDC investors to mitigate the impact of the ex-div dates is to simply be aware of these dates. For example, to make this easier for our subscribers we show the latest Ex-Div date so they can be aware of this effect. Alternatively, investors can make an extra allowance for their entry points or limit orders to make sure they are not triggered by the dividend falling off rather than the valuation truly becoming more attractive.

Systematic Income BDC Tool

Market Commentary

Moody’s has reaffirmed the Baa3 investment-grade rating of Hercules Capital (HTGC). This is equivalent to the more familiar BBB- S&P/Fitch style rating and is the lowest investment-grade rating. Fitch rates the company at BBB-.

The supporting factors here are relatively low leverage (1.01x vs 1.14x median BDC in our coverage), low loan loss history and a relatively high proportion of secured loans (though this is primarily due to an above-average level of second-lien loans).

Systematic Income BDC Tool

As of the most recent reporting quarter, HTGC accrued a weighted-average debt interest expense of around 5%, below the 6.3% median figure of the BDCs in our coverage.

A minority of BDCs have investment grade ratings, something which allows them to boast a lower level of debt interest expense and generate a higher level of net income, all else equal.

Stance And Takeaways

Given the discussion above we do need to be careful around BDC valuations. That said, a number of BDCs have fallen well in excess of their rolled-off dividends meaning valuations are indeed lower than they were a couple of weeks ago. A number of BDCs are beginning to look more reasonably valued. These include Carlyle Secured Lending (CGBD), Fidus Investment Corp (FDUS) and the Blackstone Secured Lending Fund (BXSL), among others.

Systematic Income

Read the full article here