Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of September.

Market Action

The sector fell around 1% this week in line with other higher-beta income assets. Month-to-date, BDCs are roughly flat with BKCC outperforming because of an announced merger with TCPC.

Systematic Income

The sector aggregate valuation remains around 100% – not much below its longer-term average level.

Systematic Income

Market Themes

The Q2 reporting period is over so this week we sum up what happened over the quarter across a number of key metrics. Here we focus on the subset of companies we have processed so far.

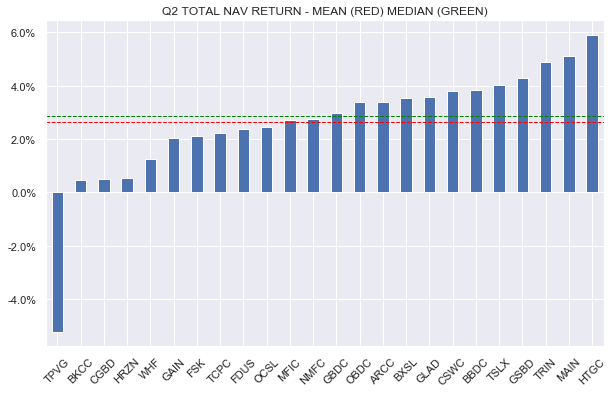

First, the total NAV return came in very strong with the median figure at 3% with only one company in our subset in the red. This quarterly result is slightly below what we saw in Q1 but above the previous three quarters. The bulk of the return was due to investment income as the median NAV change was only slightly above zero.

Systematic Income

Second, the median non-accrual figure fell 0.1% on the quarter. This is certainly a good result in light of an increase in defaults in public credit. However, this result was due in large part to credit events. A number of loans were either restructured or written down which, while reducing non-accruals, also generated economic losses for shareholders. Overall, these losses were not enough to override an otherwise positive total return.

Third, the median BDC net income increased by 4%. This is well off the high single-digit pace we saw in earlier quarters given the slowdown in the Fed hiking trajectory. If the Fed hikes only one more time as the market views most likely we expect net income to rise slightly for a couple of more quarters, stabilize for several quarters and then start to fall due to refinancing of fixed-rate debt to higher coupons by BDCs. This trend will accelerate if the Fed also starts to cut rates.

Overall, while we are no longer in the Goldilocks period of large net income jumps and little to no adverse portfolio events, the Q2 result was a very good one for BDC investors. The rest of the year should see solid results however we are less certain that 2024 will be as strong as this year.

Market Commentary

As highlighted above, The Black Capital Investment Corp (BKCC) entered into agreement to merge with the BlackRock TCP Capital Corp (TCPC). BKCC has been the worst performer in our coverage with a horrible-looking NAV profile below. The company has generated a 1.4% annualized total NAV return over the last 10 years with the 5 year total return below zero.

Systematic Income

As far as TCPC, it reported OK results for a 2.2% total NAV return during the quarter – a bit below the 2.6% average. The company also declared a new $0.10 special dividend. Its performance has been running below the sector average for a bit over a year now. A number of chunky writedowns and realized losses are a part of that. The company has had a few stumbles in its underwriting so we are staying clear for the time being particularly as its valuation is not far from the sector average.

Systematic Income BDC Tool

Stance and Takeaways

The sector continues to bob around its long-term average. After downsizing our allocation to the sector and taking advantage of a couple of relative value opportunities we continue to wait for a better entry point which is likely to come during the remainder of the year.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Read the full article here