Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the third week of September.

Market Action

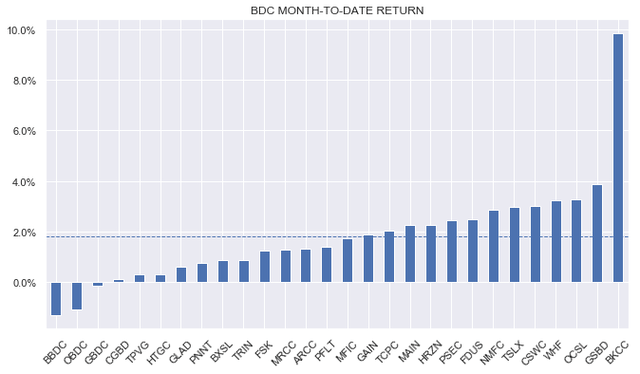

BDCs had a strong week with a total return above 2%. All companies in our coverage finished in the green with Prospect Capital Corp (PSEC) besting the sector as it finally managed to produce a delayed 10K.

Month to date, BKCC – due to merge with another BlackRock BDC – is so far in the lead.

Systematic Income

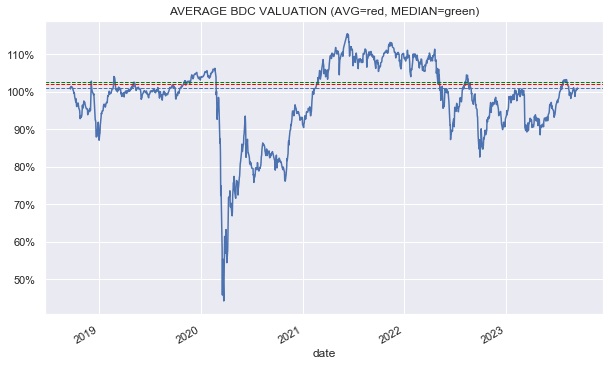

Valuations have continued to creep higher and are very close to the historic average.

Systematic Income

Market Themes

As highlighted last week, BKCC is merging with another BlackRock BDC TCPC. Merging BDC underperformers are not unusual. Recall that the First Eagle Alternative Capital BDC (FCRD) – another horrible performer – merged with CCAP not too long ago.

There are several reasons why a merger like this can make sense. One, growing the asset base quickly is attractive to an acquirer which can lead to greater scale, more fees etc.

Two, the acquisition is relatively cheap – underperforming RICs typically trade at large discounts to book. BKCC was trading at a valuation of 82% or close to 20% below the sector average.

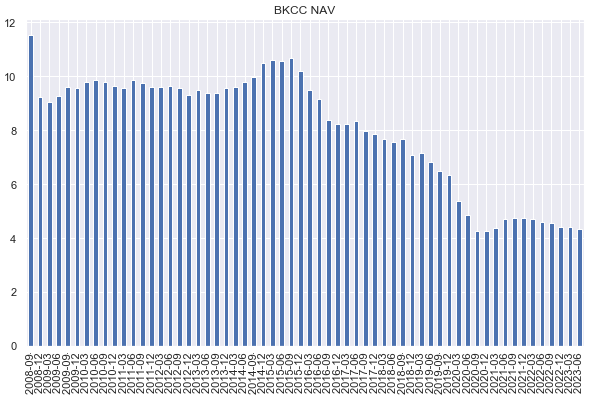

Three, the acquired entity has typically seen a large drop in its asset base due to realized losses which often makes it difficult to sustain its operations. We see this in the NAV chart for BKCC below.

Systematic Income

BDCs need a critical amount of assets to fund salaries and operating expenses – without these the BDC can’t carry on. Underperforming BDCs will struggle to grow their asset base organically as they will tend to trade at a discount to book. Issuing new shares at a discount to book is dilutive to the NAV and is frowned upon by BDC shareholders.

Finally, acquired BDCs typically have poor quality portfolios which create a terminal problem for the BDC but less so for the acquirer which can dilute the portfolio among higher-quality assets.

With BKCC and FCRD now gone, there are fewer horrible underperformers in the sector. One consequence of this is that the existing BDC population looks better than it would have had these two BDCs existed. This survivorship bias is one aspect of investing that is important to keep in mind when evaluating long-term sector performance.

Market Commentary

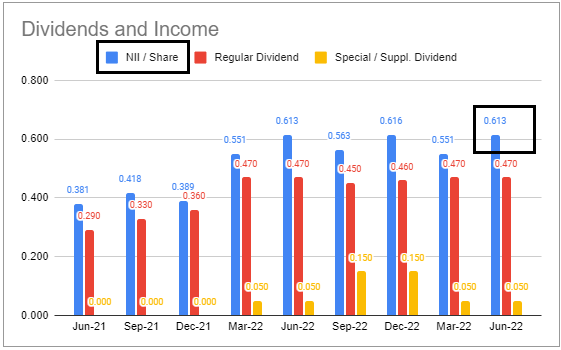

Trinity Capital (TRIN) raised the base dividend by a penny to $0.49 and also declared a $0.05 supplemental for a total dividend of $0.54. Last quarter’s net income came in at $0.61 so there is a bit more room for the dividend to grow.

Systematic Income BDC Tool

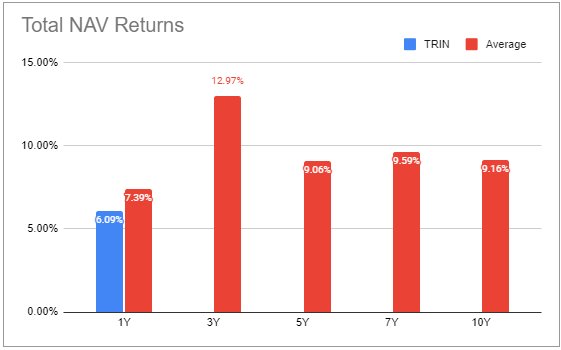

The company’s total dividend yield is north of 15% versus a sector average of 11.8% in the sector. This largely explains the stock’s premium to the sector (109% vs. sector average of 101%). Leverage and non-accruals remain elevated while total NAV performance over the past year was subpar so it’s not an obvious holding here.

Systematic Income BDC Tool

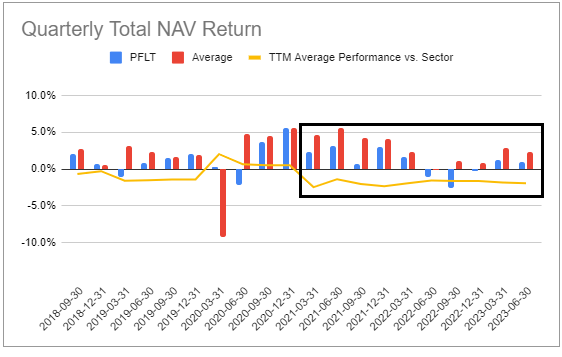

PennantPark Floating Rate Capital (PFLT) had an OK quarter with a total NAV return of 1% – above zero but well below the sector average. One problem with PFLT is that it always has an OK quarter. Its last 10 quarters were underperformers.

Systematic Income BDC Tool

This is reflected in its longer-term returns. Its 5Y total NAV return is almost exactly half the sector average while its 1Y return is negative – 8% below and below the sector average.

Systematic Income BDC Tool

However, PFLT investors are unredeemed optimists who don’t mind this historic trend and are happy to own the stock at a valuation that’s nearly on par with the sector (99% for PFLT and 101% for the sector average). It’s not clear what’s driving the optimism here, however.

Stance and Takeaways

This week we upsized our allocation to the Blue Owl Capital Corporation (OBDC) which trades at a 11.6% dividend yield and a 10% discount to book. The company has a total dividend coverage of 119% and a net investment income yield of 13.9%. It has outperformed the sector in each of the last four quarters and maintains a high-quality portfolio. It remains one of the few Buy-rated BDCs in our Income Portfolios.

Read the full article here