In a complex business environment, understanding a company’s performance, especially in terms of its quarterly financials, provides crucial insights into its operations and strategies. This article delves into Bel Fuse’s Q2 2023 performance, highlighting key financial and operational aspects, and using the outcome to form an educated opinion on Bel Fuse (NASDAQ:BELFB). Based off of our analysis and Bel Fuse’s operational successes we give Bel Fuse a rating of ‘Buy’ with a price target of $65.

Financial Overview Q2

Bel Fuse’s sales saw a slight decline, moving from $171 million in Q2 2022 to $169 million in Q2 2023. Despite this dip, there was a noticeable improvement in gross margins, which rose from 26.6% in Q2 2022 to 32.9% in Q2 2023. This indicates a shift in sales towards higher-margin products or a better handle on cost management. It’s worth noting that this is the seventh consecutive quarter where the company has reported a year-over-year gross margin improvement and despite their slowing sales that they are able to improve margins through operational excellence and through better product mix. Having this level or gross margin improvement while sales are down is a great sign.

Divided across the 3 segments of the business, each segment showcased distinct financial patterns in Q2 2023. The Power Solutions and Protection segment led the pack, accounting for $87.1 million in sales, marking a 23% growth from the previous year and now accounts for over half of total sales. This growth has been attributed to the surging demand in the networking end market. This portion of the business supplies power conversion and power supply units for data centers, electric and hybrid cars and bitcoin miners. All sectors that have significant tailwinds and high growth potential.

The Connectivity Solutions Group followed with sales of $54.8 million, a 19% increase from Q2 2022. Its gross margins rose to 37.4% in Q2 2023, up from 27.6% in the prior year, indicating successful efficiency improvements and contract renewals. This side of the business is focused on aerospace and military end market. With connectivity being a key component of aerospace systems and sensors and with more military doctrine moving towards more numerous and expendable UAV’s we see this business continuing to grow. Geo-political tensions seem to be ever-increasing and the future of the battlefield is in UAV’s of all shapes and sizes and Bel Fuse is likely to benefit due to their wide array of off the shelf and custom connectors.

However, the Magnetic Solutions Group faced challenges with sales of $26.8 million, a 50% decrease from the same period the previous year, and a dip in gross margin to 24.6% from 28.2% in Q2 2022. This is the only portion of the business that has seen any weakness over the past couple of quarters and we believe that much of the future growth will continue from the other two divisions instead of this one but with the opening of the new factory in June we expect to see rebounds in gross margins from this side of the business but time will tell.

Operations Improvements

We see the consolidations of operations in China and across the Connectivity group as a likely driver of margin improvement through reduction of duplicate costs, greater leverage of machinery and higher inventory turns. A decrease of $13.4 million of inventory since the end of last year has improved their inventory rotation, clocking 2.9 times in Q2 2023 from the earlier 2.6 times. We believe that the consolidation of their various operations will enable even higher inventory turns and higher Operation Income for the foreseeable future. Especially as inventory is burned down post-consolidation.

The company anticipates further cost reduction in baseline business and opportunities for continuous improvement in profitability as they start executing on the themes discussed at their recent offsite. Speaking from experience off-sites allow management and team leaders to get together to find effective sources of improvement and is generally very effective and shows to us that management is taking a proper approach to change in their organization.

Cash Flow and Debt Management

In Q2 2023, Bel Fuse’s cash reserves decreased modestly, starting the year at $70.3 million and ending the quarter at $65.1 million. Their free cash flow for the first half of 2023 was impressive at $33.6 million, marking an increase of $26 million from the same timeframe in 2022. This uptick is particularly notable given that capital expenditures in the first half of 2023 were more than twice that of 2022.

On the debt front, Bel Fuse demonstrated proactive financial prudence. They channeled the free cash flow to trim down the variable rate portion of their outstanding debt, which was previously exposed to a higher interest rate. A substantial chunk of $40 million was cleared in Q2, streamlining the outstanding debt to a more manageable $60 million. To shield themselves from interest rate fluctuations, the company engaged in swap agreements, pegging the outstanding debt to a stable interest rate of 2.5%.

Pivoting to strategic moves, Bel Fuse leaned into divestments for improved fiscal health. They offloaded their non-core Czech business to PEI-Genesis. Another feather in their cap was the sale of their former Jersey City corporate headquarters, bagging $5.3 million and a gain of $3.7 million in Q2. The shift to a new hub in West Orange, New Jersey, is projected to slash annual operating costs. Adding another layer of fiscal flexibility, they’ve sustained a shelf offering since 2014, renewed triennially.

Future Prospects

Looking into the future, Bel Fuse’s management has provided a promising outlook. They are forecasting Q3 2023 sales to be between $157 million to $165 million, a range that takes into account the strategic decision to move away from approximately $9 million of annual low-margin sales. This is a drop from Q3 of 2022 when revenues were $177.7 million however management anticipates Q3 2023 gross margins to align with those of Q2 2023. If gross margins can remained elevated we believe that the current valuation is more than fair and offers significant upside. Add in revenue growth and our position shifts from ‘Buy’ to ‘Strong Buy’ very quickly.

Risks

Our perspective on Bel Fuse suggests that there are some risks on the horizon. Chief among them is the potential for earnings and gross margins decrease as a result of heightened competition. Presently, Bel Fuse enjoys a substantial competitive advantage, underpinned by their wide and diversified moat. However, this moat isn’t impervious; aggressive competitors can, and often do, find ways to bridge such gaps, thereby diluting Bel Fuse’s market dominance. Their high margins are a blessing and a curse in this regard as their large margins will likely draw higher competitor attention.

Another point of concern is the company’s revenue trajectory. The current trend, which oscillates between stagnation and slight decline, is not ideal from our perspective. We expect strategic acquisitions to be the most viable route to allow Bel Fuse not only the opportunity to increase their revenue but also diversify their portfolio even more. Acquisitions are always risky due to the capital required and ensuring they receive a great deal on any acquisition. A miss on an acquisition would cause a significant re-rating from our perspective.

Valuation

Why did we go into all of this detail concerning their recent announcement? Well because it gives us a detailed view of the business’ many operations and gives us insight into the business and management style before we dive into the valuation of the company.

As it stands, Bel Fuse’s performance presents a mixed bag of financial and operational outcomes. They currently are experiencing a marginal decline in overall sales, yet they are showing a track record of commendable improvement in gross margins for the seventh consecutive quarter. Different business segments displayed varying financial trajectories, with the Power Solutions and Protection segment experiencing significant growth, while the Magnetic Solutions Group faced challenges. Operationally, the consolidation of major facilities, especially in China, is progressing well, signaling operational efficiency improvements. The company also effectively managed its inventory and successfully reduced outstanding debt, showcasing sound financial prudence and guidance is still strong.

We believe that this is a solid business that is well capitalized with minimal dilution and dilution risk. This is a “boring” manufacturing business that is focused on internal profit growth rather than purely top line sales increases. The company is well-positioned for potential acquisitions and is likely to see sales increases and profit improvement from their consolidated operations.

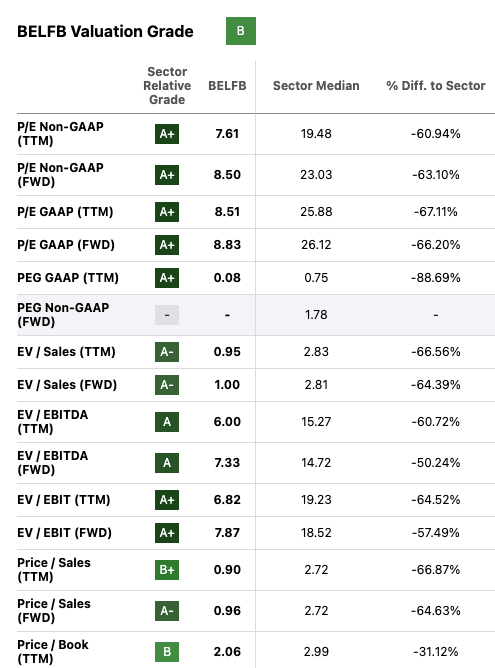

Seeking Alpha

BELFB’s current valuations, by most metrics, present a compelling argument for its potential. With a TTM EV/EBITDA standing at a mere 6, we see this as a prime opportunity to invest in a company that consistently amplifies its value. Although they might not be charting astronomical revenue growth, BELFB has showcased a knack for maximizing profits from every additional revenue dollar, thanks to their excellent business operations.

Their escalating earnings signal that it might be time for a dividend uplift. The dividend has remained stagnant since Q4 2007, even though the business has expanded significantly in those years. As their debt approaches a more controllable level, we anticipate one or more of four potential moves: an acquisition, further debt reduction, a dividend hike, or share buybacks. Our assessment places the probability of these actions in that sequence.

We project that revenue growth will primarily stem from acquisitions, and with interest rates and valuations (typically) being inversely proportional we believe that BELFB will be able to capitalize on this.

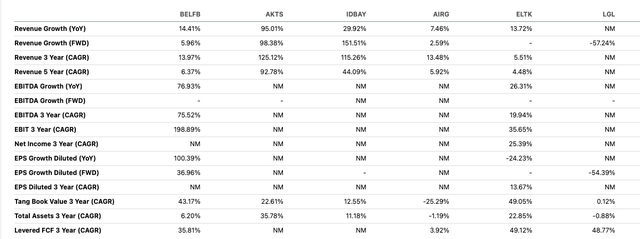

Seeking Alpha

Compared to many of their peers Bel Fuse has not grown revenue dramatically YoY but they have significantly improved their earnings YoY and looking into the future. We believe that at current prices and coupled with the sectors they have exposure to that BELFB is more than well-positioned for success.

Conclusion

We believe given the limited float and the company’s attractive valuation, a share repurchase program could yield a higher capital return than a dividend boost but wouldn’t be surprised or sad with either outcome. BELFB has good sector tailwinds, operational excellence, limited dilution risk and growing profit margins. BELFB should be a standout component of our ‘boring compounder’ portfolio, which also includes stalwarts like WSM, NVO, and LIND. We trust management and this will be added to our fire-and-forget portfolio. We list them as a buy up to ~$65.

Read the full article here