Very few people would argue about the statement that Warren Buffett is, if not the greatest investor in the world, certainly one of the all-time greats. He created a perpetual money machine from the failing textile mill known as Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B). And if you remove all of the major technology companies that are publicly traded today, that perpetual money machine is the largest publicly traded firm in the US. Mr. Buffett is known for his view that the perfect holding period for an investment is forever. That is how he accumulated not only a massive portfolio of publicly traded securities, but also how Berkshire Hathaway came to be a global conglomerate that owns outright somewhere around 70 different firms. But nobody has a perfect batting average. And over time, one investment that has come to be suboptimal that’s still on the company’s books is McLane, a wholesale distribution services firm that delivers groceries and other goods to convenience stores, discount retailers, wholesale clubs, drug stores, and a variety of other enterprises.

Even though the overall assets owned by McLane have grown over the years, margins have come under significant pressure. It is my assertion that Berkshire Hathaway would be better off divesting of the business, or, if it so desired, it could merge the firm into another similar enterprise. Even though this seems unlikely, investors should not ignore the value that such a maneuver would likely bring to Berkshire Hathaway and its shareholders. Extracting value, no matter how it’s done, would only prove more bullish for investors than the bullish case they already have to own the company.

A change would be value-accretive

If this topic regarding Berkshire Hathaway and McLane gives you a sense of deja vu, there is a reason for that. Back in May of 2018, I initially presented this idea. In that article, I pointed out how McLane had shown signs of weakness over the prior couple years leading up to that point. My belief was that the enterprise, which had been purchased by Berkshire Hathaway in 2003 for $1.5 billion, had potential to perform better either as a standalone company or by being merged with some other player in its space. Given how much time has elapsed since then, I felt it appropriate to revisit this theme and to see if and to what extent the picture has changed.

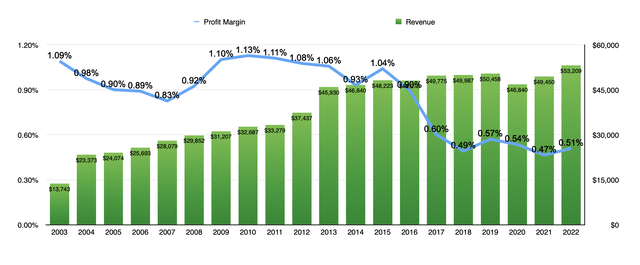

As a massive fan of both Mr. Buffett and Berkshire Hathaway, my hope in looking at this picture again was that McLane had pulled itself together. Unfortunately, that has not been the case. In the chart below, for instance, you can see revenue, as well as the pre-tax profit margins, generated by McLane for each year starting in 2003 when the company was acquired and extending through 2022. For much of its operating history under Berkshire Hathaway, the company did just fine. As revenue expanded from $13.7 billion in 2003 to $48.1 billion in 2016 gamma pretax profit margins remained in a fairly narrow range of between 0.83% and 1.13%. Fast-forward two years to 2018, and even though revenue for the enterprise grew further to nearly $50 billion, the firm’s pretax profit margin plummeted to only 0.49%. These kind of movements may not sound like much. But for every 1% of additional profit you get on $50 billion of revenue, it adds up to an extra $500 million per year on the bottom line.

Author – SEC EDGAR Data

There was a part of me that thought that this pain might be short-lived. But ever since the decline, the pretax profit margin has remained range bound, not once even hitting as high as 0.60% after 2017.

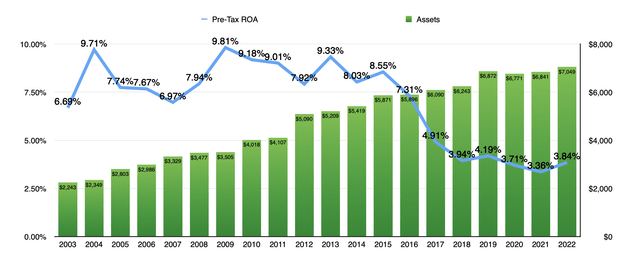

There is another way to look at the value of the business and how operations have deteriorated over time. And that is to look at the pre-tax return on assets McLane generates. From 2003 through 2016, the pre-tax return on assets of the company ranged between 6.69% and 9.81%. By 2018, this number had plummeted to 3.94%. And ever since then, it has remained range bound, never going above 4.19% or below 3.36%. This has occurred even as the total value of assets have grown, hitting $7 billion by the end of 2022.

Author – SEC EDGAR Data

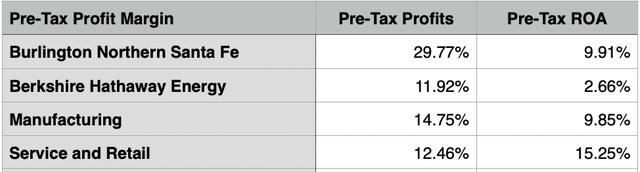

It is worth mentioning that these kinds of returns are a significant departure from what the rest of Berkshire Hathaway ‘s companies generate. Excluding its insurance operations, the pre-tax profit margins of its major operating units ranged between 11.92% and 29.77% during the 2022 fiscal year. It is true that Berkshire Hathaway Energy has a smaller pre-tax return on assets than McLane does. But the same cannot be said of the other major operations of the conglomerate.

Author – SEC EDGAR Data

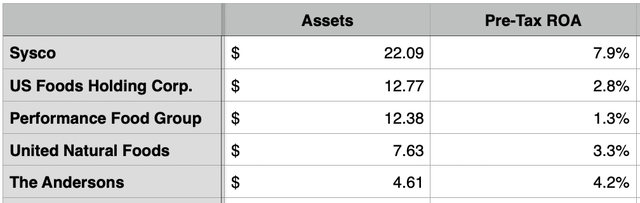

To be clear, McLane is not exactly alone in its space when it comes to its level of profitability. As part of my analysis of the company, I looked at five similar firms. One of these, Performance Food Group (PFGC) reported a pre-tax profit margin of only 0.33% in 2022. But its operating history is plagued with volatile bottom line results, with pre-tax profits ranging from negative $222.2 million to positive $218.3 million over the past five fiscal years. By comparison, McLane has been quite stable. The problem with a company with volatile bottom line results is that you can cherry-pick a single year to make the picture look better than it might otherwise be in the long run.

Author – SEC EDGAR Data

*$ in Billions

If we ignore that isolated example, you end up with a range of between 0.86% and 2.55% per annum, with Sysco (SYY) leading the way. It’s also worth noting that, with the exception of Performance Food Group, Sysco is the only one of the five companies with revenue that puts it in the same league as McLane. It also boasts a pre-tax return on assets of 7.9%, significantly exceeding the 3.84% reported by McLane during its 2022 fiscal year.

Author – SEC EDGAR Data

*$ in Billions

If we apply the same pretax profit margin to McLane as what Sysco is generating and valued McLane using the same pre-tax trading multiple of 21 that Sysco is going for, you would end up with an enterprise worth nearly $28 billion. Even if we assume that margins could improve to around the 1.06% that US Foods Holding Corp (USFD) is going for and applied its trading multiple, you would end up with a value of nearly $16 billion. For an asset that was purchased for only $1.5 billion twenty years ago, that would be an attractive return. Instead, the company is generating subpar profit margins, eking out only a modest return for shareholders of Berkshire Hathaway.

Takeaway

Mr. Buffett’s goal over his long and massively-successful career has been to allocate capital as efficiently as possible. In the overwhelming majority of cases, his decisions have been correct. The investments Berkshire Hathaway has made have resulted in one of the largest publicly traded enterprises on the planet. But this doesn’t mean that every investment has been a winner. The fact of the matter is that, relative to some other major players in its space, McLane has gone from doing quite well for itself and the shareholders of Berkshire Hathaway to underperforming rather significantly. An easy solution to this would be to sell or spin off McLane in its entirety. But a more interesting solution might be to use the value of the firm to merge with another player that is operationally superior to it. The synergies created from such a transaction and the value delivered to shareholders of Berkshire Hathaway would be a net positive at the end of the day.

Read the full article here