Earnings of Berkshire Hills Bancorp, Inc. (NYSE:BHLB) will most probably increase this year on the back of loan growth. On the other hand, pressure on the margin will restrict earnings growth. Overall, I’m expecting the company to report earnings of $2.35 per share for 2023, up 16.7% year-over-year. Compared to my last report on the company, I haven’t changed my earnings estimate much. The year-end target price suggests a high upside from the current market price. Therefore, I’m upgrading Berkshire Hills Bancorp to a buy rating.

Conflicting Factors Likely to Hold the Margin Almost Stable

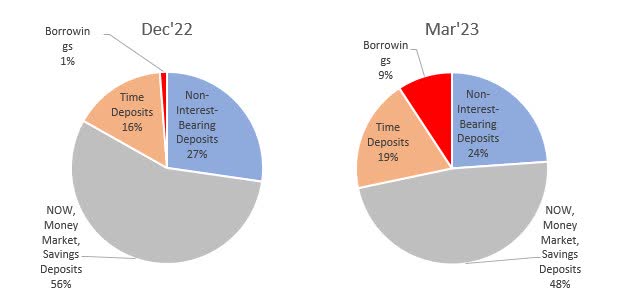

Berkshire Hills Bancorp took on a large amount of short-term debt during the first quarter following the depositors’ run on SVB Financial (OTCPK:SIVBQ). As a result, the company’s total borrowings went from $126 million at the end of 2022 to $1,026 million at the end of March 2023. Although this step decreased the company’s risk level amid the current banking crisis, it notched up the cost of funds. Total borrowings carried a rate of 5.06% during the quarter, which is much higher than the average interest-bearing deposit cost of 1.09%. Further, Berkshire Hills attracted deposits in its costly time deposit accounts, while deposits flowed out from cheaper accounts. As a result, the company’s interest expenses jumped during the quarter and the margin plunged. The following pie charts show how the funding mix changed over the first quarter.

SEC Filings

I’m expecting the mix to deteriorate even further as the large difference between rates on non-interest-bearing and interest-bearing accounts will incentivize depositors to chase yields.

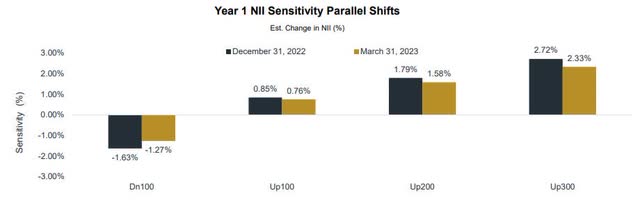

On the plus side, the rate hikes in the second quarter of the year will offer slight support to the margin. The Fed funds rate has already increased by 25 basis points this quarter and I’m expecting a further 25 basis points hike in the mid of June. The results of the management’s rate sensitivity analysis given in the presentation show that a 200-basis points hike in rates could potentially increase the net interest income by 1.58% over twelve months.

1Q 2023 Earnings Presentation

Considering these factors, I’m expecting the margin to contract by five basis points in the second quarter of the year before stabilizing for the remainder of the year.

Loan Growth Slowdown Ahead

The high-growth trend witnessed last year continued through the first quarter of 2023 as Berkshire Hills Bancorp’s loan portfolio grew by 4.2% during the quarter. I’m expecting the growth to slow down for the remainder of the year because of the high-rate environment. Further, the pipeline at the end of the first quarter was modestly lower than the pipeline at the end of December 2022, as mentioned in the conference call.

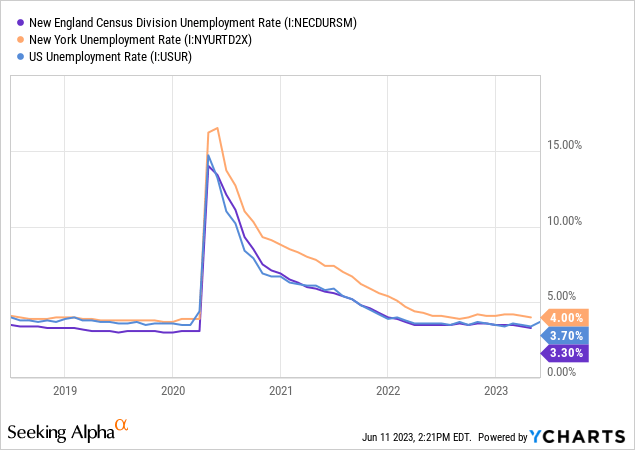

On the other hand, the current economic condition of Berkshire Hills Bancorp’s markets bodes well for loan growth. The company operates in the region of New England and the state of New York. New England’s unemployment rate currently seems quite good when compared to its history as well as the national average, which shows that business activity in the region is robust. Therefore, I’m positive about loan growth in the New England states.

Considering these factors, I’m expecting a loan growth of 8.9% for 2023, as shown below.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 8,982 | 9,439 | 7,954 | 6,720 | 8,239 | 8,976 |

| Growth of Net Loans | 8.9% | 5.1% | (15.7)% | (15.5)% | 22.6% | 8.9% |

| Other Earning Assets | 2,003 | 2,281 | 3,708 | 4,073 | 2,578 | 2,955 |

| Deposits | 8,982 | 10,336 | 10,216 | 10,069 | 10,327 | 10,527 |

| Borrowings and Sub-Debt | 1,518 | 828 | 572 | 111 | 126 | 1,033 |

| Common equity | 1,512 | 1,718 | 1,188 | 1,182 | 954 | 1,048 |

| Book Value Per Share ($) | 32.7 | 34.8 | 23.6 | 23.9 | 20.8 | 23.8 |

| Tangible BVPS ($) | 20.8 | 22.6 | 22.9 | 23.3 | 20.2 | 23.3 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Significant Earnings Growth Likely for this Year

Earnings of Berkshire Hills Bancorp will receive a boost from loan additions this year. Meanwhile, the margin contraction this year will limit the earnings growth. Further, inflation-driven growth in non-interest expenses will constrain earnings. Overall, I’m expecting Berkshire Hills Bancorp to report earnings of $2.35 per share, up 16.7% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 356 | 365 | 317 | 291 | 345 | 402 |

| Provision for loan losses | 25 | 35 | 76 | (1) | 11 | 28 |

| Non-interest income | 74 | 84 | 66 | 143 | 69 | 67 |

| Non-interest expense | 267 | 290 | 840 | 286 | 289 | 312 |

| Net income – Common Sh. | 105 | 96 | (533) | 119 | 93 | 104 |

| EPS – Diluted ($) | 2.29 | 1.97 | -10.60 | 2.39 | 2.02 | 2.35 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report, I estimated earnings of $2.40 per share for 2023. There was no reason to change my estimate significantly as the first quarter’s results were in line with expectations and my outlook is mostly unchanged.

Above-Average Risk Level

Due to the following two reasons, Berkshire Hills Bancorp’s risk level is currently above its historical trend. However, I’m not too concerned as the elevated risk level still appears manageable.

- Unrealized losses on the Available-for-Sale (“AFS”) securities portfolio totaled $214.6 million at the end of March, which is around 22% of the total equity balance. Please note that I always exclude unrealized losses from my tangible book value calculation. Therefore, the fair value determined below already incorporates the worst-case scenario.

- Banks that have lent money for office properties can get into trouble as the market value of these properties can drop and the loans can default amid the persistent work-from-home and hybrid-word culture. As of the end of March, office loans made up 6.4% of the total loans of Berkshire Hills Bancorp, which is material but not large enough to be a cause for concern.

Upgrading to a Buy Rating

Berkshire Hills Bancorp is offering a dividend yield of 3.14% at the current quarterly dividend rate of $0.18 per share. The earnings and dividend estimates suggest a payout ratio of 31% for 2023, which is close to the five-year average (ex-2020) of 33%. Therefore, I’m not expecting an increase in the dividend level.

I’m using the peer average price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Berkshire Hills Bancorp. Peers are trading at an average P/TB ratio of 1.27 and an average P/E ratio of 10.56, as shown below.

| BHLB | LBAI | OCFC | OBK | NIC | Peer Average | |

| P/E (“ttm”) | 10.25 | 8.93 | 6.62 | 9.61 | 17.08 | 10.56 |

| P/E (“fwd”) | 9.86 | 9.76 | 7.71 | 10.55 | 17.59 | 11.40 |

| P/B (“ttm”) | 1.01 | 0.86 | 0.60 | 0.96 | 1.10 | 0.88 |

| P/TB (“ttm”) | 1.03 | 1.15 | 0.89 | 1.16 | 1.89 | 1.27 |

| Source: Seeking Alpha | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $23.3 gives a target price of $29.6 for the end of 2023. This price target implies a 29.3% upside from the June 9 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.17x | 1.22x | 1.27x | 1.32x | 1.37x |

| TBVPS – Dec 2023 ($) | 23.3 | 23.3 | 23.3 | 23.3 | 23.3 |

| Target Price ($) | 27.3 | 28.4 | 29.6 | 30.8 | 31.9 |

| Market Price ($) | 22.9 | 22.9 | 22.9 | 22.9 | 22.9 |

| Upside/(Downside) | 19.1% | 24.2% | 29.3% | 34.3% | 39.4% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $2.35 gives a target price of $24.8 for the end of 2023. This price target implies an 8.4% upside from the June 9 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.6x | 9.6x | 10.6x | 11.6x | 12.6x |

| EPS 2023 ($) | 2.35 | 2.35 | 2.35 | 2.35 | 2.35 |

| Target Price ($) | 20.1 | 22.5 | 24.8 | 27.2 | 29.5 |

| Market Price ($) | 22.9 | 22.9 | 22.9 | 22.9 | 22.9 |

| Upside/(Downside) | (12.1)% | (1.8)% | 8.4% | 18.7% | 29.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $27.2, which implies an 18.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 22.0%.

In my last report, I adopted a hold rating as my target price was quite close to the market price at that time. Since the issuance of that report, the market price has plunged. Based on my updated total expected return and the risk level, I’m upgrading Berkshire Hills Bancorp to a buy rating.

Read the full article here