Introduction

The share price of Berry Global (NYSE:BERY) has outperformed the S&P 500 since my previous article was published in September. Whereas the S&P saw a 13.2% gain, BERY’s share price has increased by in excess of 22%. As the company is getting close to reporting its H1 2023 results, I wanted to check up if my investment thesis is still valid and if I should add ahead of the earnings catalyst.

Seeking Alpha

2023 should be another year of strong cash flows

This article is meant as an update to a previous thesis. For a more detailed background overview of Berry Global, I would recommend you to read my older articles on BERY, like this one. Odds are you have held several Berry products in your hands as the company is a supplier to, for instance, Coca-Cola (KO) for its PET-bottled products.

Berry Global Investor Relations

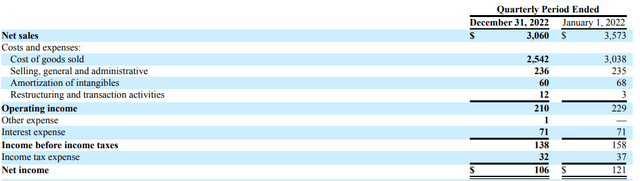

The company’s financial year ends in September which means its Q1 2023 results are based on the December quarter of the calendar year 2022. During that quarter, Berry Global reported a total revenue of $3.06B which is a decrease of in excess of 10% compared to the first quarter of the previous financial year.

Berry Global Investor Relations

Despite the disappointing revenue, Berry’s total operating income only decreased by approximately 8%, and if we would exclude the impact of the restructuring activities, the operating profit would have decreased by just 4%. So a decreasing revenue but increasing margins. The pre-tax income came in at $138M and the net income was $106M which translated into $0.86 per share. The lower revenue was caused by a 6% decrease in sales volumes which was caused by a softer market demand (which was something most packaging producers complained about during that quarter) and about a fifth of the revenue decrease was caused by FX changes. Fortunately, Berry’s margins were relatively protected as the company started to see the benefit of its attempts to pass on the impact of inflation to its customers.

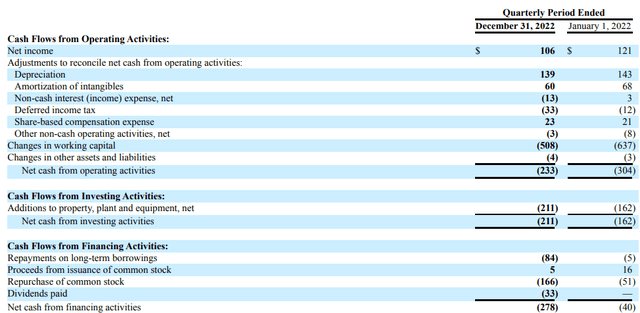

In my previous articles, I emphasized Berry’s ability to generate a positive free cash flow and that still is the reason why I am interested in this company. As you can see below, the reported operating cash flow was a negative $233M but this was entirely driven by a $508M cash investment in working capital elements (which is pretty normal as for instance inventory levels increased a little bit while Berry also reduced its accounts payable). This means the underlying operating cash flow was approximately $275M and roughly $308M if you also add back the deferred income tax that was paid on top of what the company actually owed based on the Q1 FY 2023 pre-tax income.

Berry Global Investor Relations

The total capex was $211M which means the underlying free cash flow was $97M or approximately $0.80 per share based on the current share count of 121.4M shares.

That would result in an annualized free cash flow of around $3.20 per share and that would make Berry’s share price in the mid-$50 level not very appealing. That being said, I expect the first quarter to be the weakest quarter of the year, both in terms of operating cash flow as well as free cash flow.

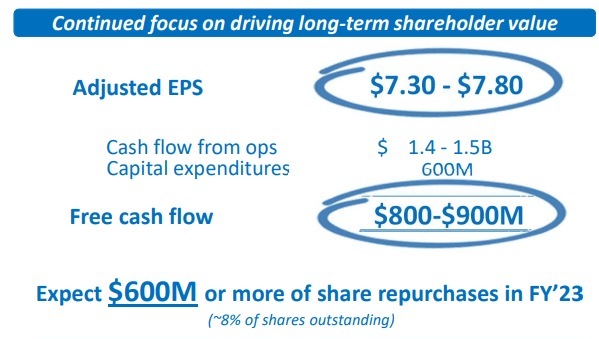

According to the company’s official guidance for this year, it expects to generate $1.4-1.5B in operating cash flow and spend about $600M on capital expenditures to end up with a free cash flow result of $800-900M. While this does include changes in the working capital position (which could boost the reported operating cash flow if there is a working capital release). But the main takeaway from the full-year guidance is the $600M capex guidance.

Berry Global Investor Relations

That means the company has already spent about 35% of its full-year capex guidance in the first quarter of the year and the average capex level in the next three quarters will be just around $130M. It also means that if I would use the normalized quarterly capex of $150M ($600M divided over four quarters), the underlying free cash flow result would have been $158M in Q1, or approximately $1.30 per share. And as I expect the operating cash flows to recover from the temporary dip in demand, I am pretty comfortable aiming for an adjusted free cash flow result of $5.5-6/share (excluding changes in the working capital position).

Investment thesis

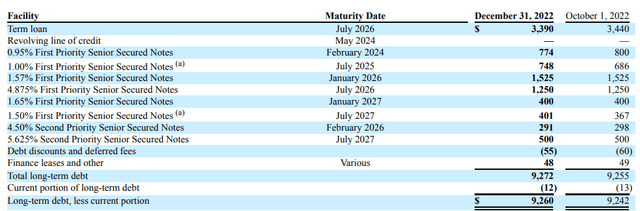

2023 should be a good year for Berry Global, but keep in mind the interest expenses will increase from next year on as that’s the start date of almost all of its debt coming up for renewal over the subsequent three years. As the company is still enjoying the tailwinds of low-cost debt, we should expect the interest expenses to increase from 2024 on as the odds it can refinance the 0.95% yielding 2024 bonds at the same terms is pretty much zero. Just to give you an idea, the 5.625% 2027 secured notes are trading slightly below par, indicating the yield to maturity is close to 6%.

Berry Global Investor Relations

This means we will see the interest expenses gradually increase over the next few years, and while as a shareholder I do enjoy Berry’s continuous and aggressive share buybacks, perhaps the company should keep some cash aside to reduce the total amount of debt it has to refinance.

I currently have no position in the common shares of Berry Global, but I have written put options which currently are out of the money. I also own the company’s 1.57% January 2026 senior secured notes. Those are currently trading at 91 cents on the dollar for a yield to maturity of approximately 5.2% which I think provides good value for the remaining 2.75 year term as it offers a 150 basis point spread over the 3 year US treasury.

Read the full article here