Introduction

Almost every single article I write is about a company or multiple companies that I like. Hence, people keep asking me to write about companies that I wouldn’t buy. One of them is Best Buy (NYSE:BBY), the star of this article.

However, I decided to go against covering companies that I wouldn’t touch with a ten-foot pole.

I believe covering stocks that are actually on people’s radars adds more value than giving people a stock they wouldn’t buy anyway. Also, BBY does offer some value, as I will explain in this article.

Hence, Best Buy is great food for thought for a number of reasons:

- It’s part of a lot of dividend portfolios, thanks to its massive footprint in the retail landscape, its juicy yield, and its relatively good track record.

- The company tells us a lot about the health of the consumer, which is always interesting (and important!) to know.

- I believe there is a way to benefit from BBY, although it comes with timing risks.

Additionally, I’m not writing this article to scare anyone out of Best Buy. It’s just an alternative view supported by my personal strategy.

So, without further ado, let’s get to it!

Volatile Consumer Dividends

I’ve often made the case that I’m not a fan of consumer-focused dividend stocks. I tend to stay away from being exposed to consumer trends. This includes fashion and most car manufacturers (also for other reasons).

With that said, Best Buy is well-protected against these trends, as it’s just a convenient way for consumers to compare and sometimes test products before buying them. It doesn’t care much for competition between brands as it offers almost all of them.

Now, I don’t have to explain what Best Buy is, but I wanted to briefly highlight what I’m looking for in a consumer stock. Best Buy is essentially a Home Depot (HD) for electronics, which is mainly dependent on three things:

- Competition from physical stores. I believe these risks are somewhat subdued because of Best Buy’s massive brand recognition and service levels.

- Competition from online stores (it does have its own omnichannel operations)

- Consumer sentiment

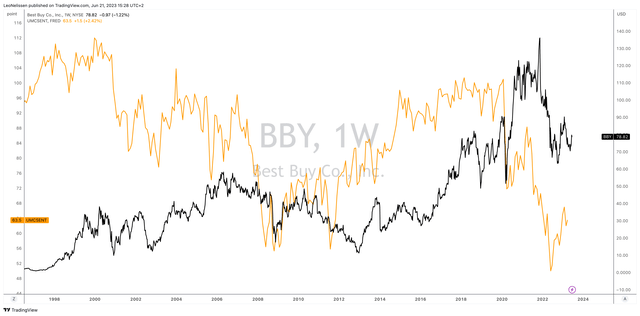

Looking at the chart below, we see a comparison between the BBY stock price and the University of Michigan consumer confidence. There is no meaningful short-term correlation. However, major trends matter. For example, between 2006 (housing peak) and 2012 (housing bottom), shares were in a long-term downtrend, which included the Great Financial Crisis and a brief post-crisis rally. Then, in 2021, inflation started to heat up, boosted by energy prices, supply chain bottlenecks, and trickle-down effects of labor inflation and other factors. Now, consumer sentiment is back at Great Financial Crisis levels.

TradingView (BBY, Michigan Consumer Sentiment)

While BBY has always bounced back from major setbacks, the company has a very disappointing long-term risk/adjusted return.

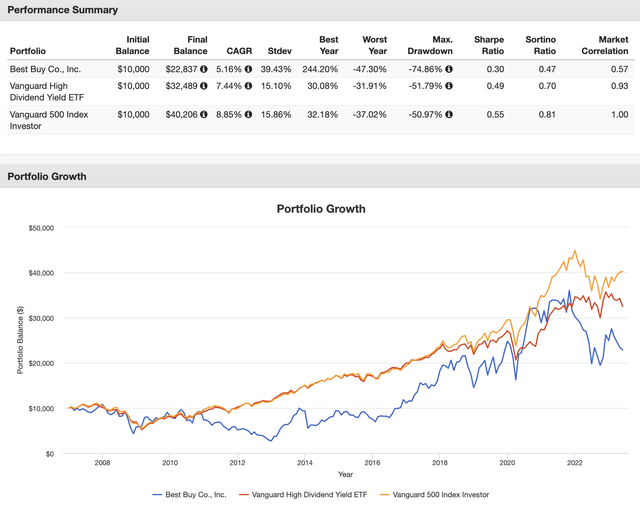

Going back to 2007:

- BBY shares have returned 5.2% per year with a standard deviation of 39%. This results in a Sharpe Ratio of just 0.30. That’s one of the worst numbers among larger dividend stocks that I’ve seen in recent years.

- The S&P 500 has returned 8.9% during this period, with a standard deviation of 15.9%.

- The Vanguard High Dividend Yield ETF (VYM) has returned 7.4% per year with a 15.1% standard deviation. This ETF currently yields 3.3%.

Portfolio Visualizer

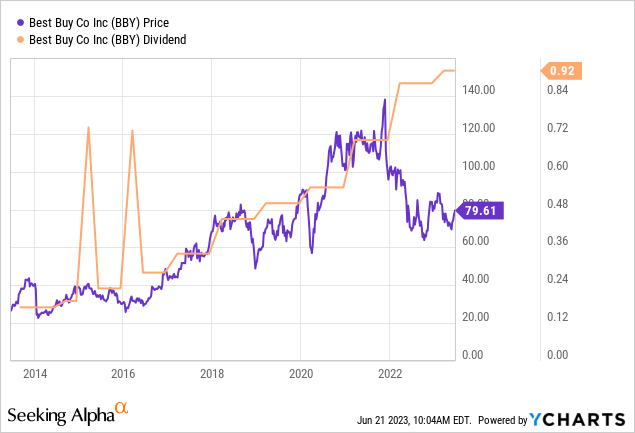

One of the biggest benefits of owning BBY – maybe the biggest benefit – is its dividend yield.

After hiking by 4.5% in March, the company currently pays $0.92 per share per quarter, which translates to a yield of 4.6%. That’s 130 basis points above the aforementioned VYM yield.

However, the dividend doesn’t come with a very convincing dividend scorecard, which confirms its volatile behavior.

While dividend growth has averaged 17.9% per year over the past five years, which is a lot for a high-yield stock, it’s not backed by very convincing growth in underlying fundamentals.

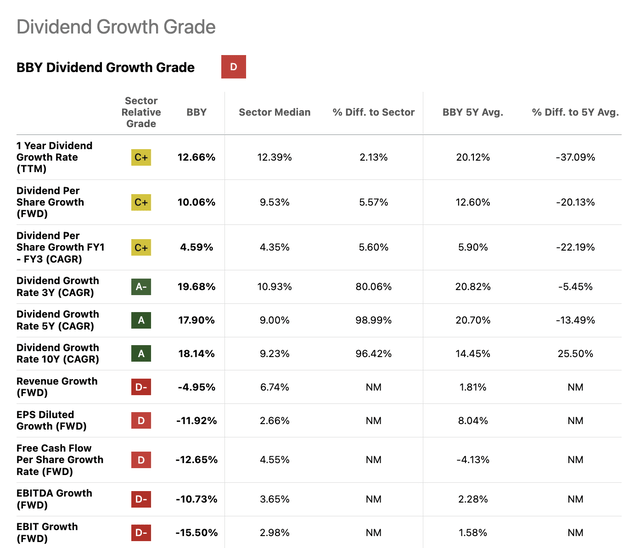

For example, when looking at the breakdown of the company’s dividend growth grade (a big fat D), we see that the company does score very high on dividend growth. Ever since the housing crisis ended, dividend growth has been strong.

Unfortunately, revenue growth, EPS growth, and free cash flow growth are highly volatile, which causes a steep drop in the company’s dividend growth grade.

Seeking Alpha

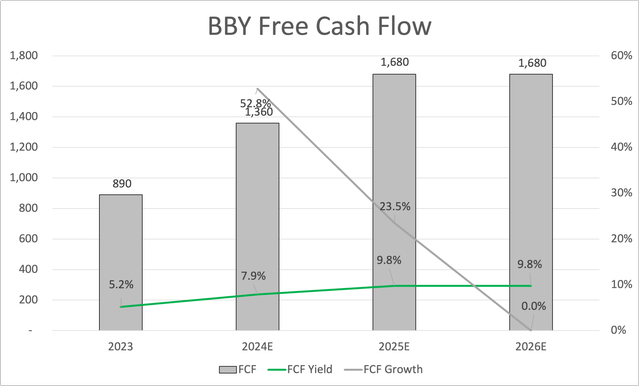

While the dividend is backed by an expected full-year 7.9% free cash flow yield (implying a 58% cash payout ratio) and expectations that free cash flow will come close to $1.7 billion in the 2025 fiscal year, free cash flow in the past was highly volatile.

Leo Nelissen

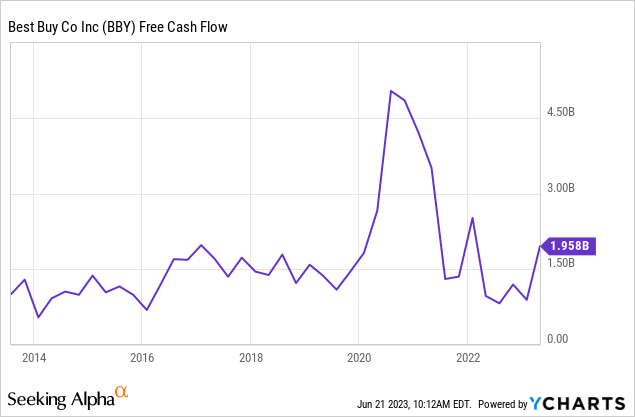

During the past ten years, free cash flow hovered close to $1.5 billion, with one major outlier in 2020 and 2021 when people rushed to buy electronics for personal use at home.

Even worse, it’s far from certain that the company can boost free cash flow in the years ahead as consumer headwinds are mounting.

Mounting Consumer Troubles

As the overview below shows, lower consumer sentiment has hit the company.

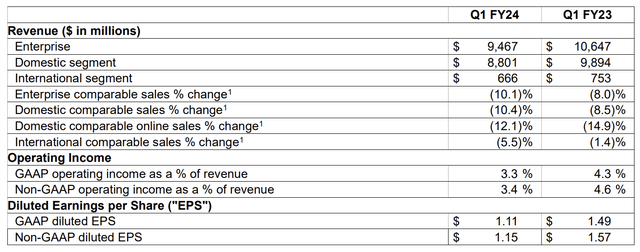

In the first quarter, Best Buy reported a decline in enterprise revenues of 10.1% on a comparable basis. The non-GAAP operating income margin declined by 120 basis points to 3.4%.

Best Buy

In the Domestic segment, revenue decreased by 11%, primarily due to a 10.4% decline in comparable sales. Computing, appliances, home theater, and mobile phones were the main contributors to the sales decline, partially offset by growth in gaming and service categories.

In other words, the bigger-ticket items suffered as consumers focused on must-haves instead of nice-to-have products. Or, as the company put it:

In this environment, customers are clearly feeling cautious and making trade-off decisions as they continue to deal with high inflation and low consumer confidence due to a number of factors.

In the International segment, revenue decreased by 11.6%, driven by negative foreign exchange rates and a comparable sales decline of 5.5% in Canada.

With that said, during its earnings call, BBY maintained its full-year guidance provided in March.

- The expected range for Enterprise revenue is $43.8-$45.2 billion, with a comparable sales decline of 3-6%.

- The guidance assumes sales trends closer to the midpoint of the annual comparable sales guidance, with revenue softening in the second quarter compared to the fiscal year 2020.

- The full-year outlook includes an extra week, which is expected to contribute approximately $700 million of revenue.

Despite poor revenue growth expectations, the company aims to achieve a gross profit margin expansion of 40-70 basis points compared to the fiscal year 2023.

This is expected through optimization efforts, membership programs, health initiatives, and relatively neutral impacts from promotions, supply chain costs, and profit sharing from the private label credit card.

To put things into perspective, SG&A as a percentage of sales is guided to increase by roughly 100 basis points compared to the previous year, primarily driven by higher incentive compensation and increased depreciation expense.

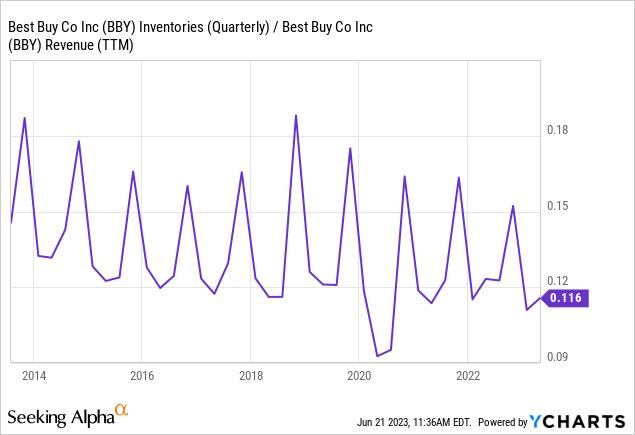

Moreover, the company reduced its inventory by 17%.

Looking at the chart below, we see that BBY doesn’t have an inventory issue – unless revenues fall at an unprecedented rate, which I do not expect to happen.

So, if the company were to achieve its gross margin targets, that would be impressive, but not a game changer to me.

Balance Sheet & Valuation

Another thing that helps BBY is its balance sheet. The company ended the past quarter with $1 billion in cash. The company is expected to end this year with roughly $320 million in net cash, which means the company has more cash than gross debt.

Hence, despite its volatile business, it has a BBB credit rating.

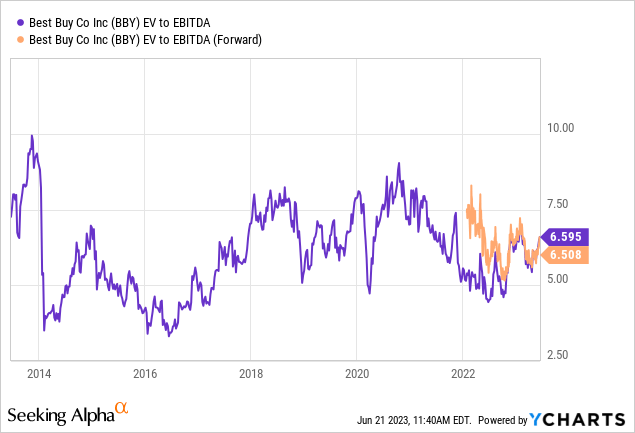

The company is trading at 6.5x NTM EBITDA, which I believe is fair but not very attractive – especially because I do not believe that consumer confidence will turn into a sudden tailwind.

I believe in prolonged inflation and a hawkish Fed, which would benefit certain non-consumer value stocks. Not companies that depend on healthy consumers.

Again, I might be wrong, but I just dislike the risk/reward – despite the stock’s poor performance.

So, what would I do?

This is a tricky question for one major reason: Best Buy yields close to 5%, and it’s not likely that BBY will cut that dividend despite consumer weakness. That’s a good thing for investors.

However, it makes finding an alternative tough. After all, it gets tricky to find better consumer exposure with a similar yield. I would make the case it’s close to impossible.

While I might upset some people, I would either allocate funds to another sector or buy an ETF like the Schwab High Yield ETF (SCHD), which currently yields 3.8%. I covered SCHD in a recent article, which you can access here.

I believe that SCHD, or similar ETFs, will have a superior total return with better diversification. I do not like the consumer alternatives that come with a 5% yield.

There’s also a second option.

If my thesis is right and BBY dips again, investors could buy BBY because of its yield and speculate on a rally the moment consumer sentiment starts a meaningful uptrend.

Let’s say the stock drops to $60. At that point, the longer-term risk/reward would be attractive. With the support of potentially higher consumer sentiment down the road, the stock could recover to $120 again.

At that point, I would sell and move my funds (with a large profit) into a safer long-term investment – like SCHD.

This is a riskier play, but it’s a play that would incorporate the company’s ability to withstand economic troubles and potential stock price recovery in the long term.

Pros & Cons – Of Buying BBY

Pros:

- Strong brand recognition and high service levels.

- Attractive dividend yield of 4.6%.

- The business is capable of withstanding headwinds.

Cons:

- Volatility and lower risk-adjusted returns.

- Uncertain long-term growth potential.

- Challenges from consumer headwinds.

Takeaway

Best Buy may be a popular choice for dividend portfolios due to its significant presence in the retail market, attractive yield, and decent track record.

However, as an investor, I personally wouldn’t consider buying this company. While Best Buy is insulated from some consumer trends, its long-term risk-adjusted return has been disappointing compared to other dividend stocks.

The stock’s performance has been volatile, and its dividend growth doesn’t come with long-term free cash flow growth.

Additionally, mounting consumer troubles have impacted the company’s revenues.

Although Best Buy’s dividend yield is tempting, I would explore alternatives like the Schwab High Yield ETF SCHD, which offers better diversification and the potential for superior total returns.

Alternatively, if BBY experiences a significant dip, it could be an opportunity to buy and capitalize on a potential recovery driven by improved consumer sentiment. However, this strategy carries more risk.

Ultimately, my preference lies with safer long-term investments like SCHD, as boring as that may sound.

Read the full article here