The Iron Ore Investment Thesis Remains Mixed Ahead

We previously covered BHP Group Limited (NYSE:BHP) in April 2023 with a Hold rating, discussing its mixed prospects, due to China’s less than impressive reopening demand and the uncertain recovery of the property market.

While the miner had also been diversifying to electrification metals, its stock prices might remain tied to the cyclical iron ore prices, since the commodity comprised the majority of its top and bottom lines.

For now, BHP has reported a mixed FY2023 earnings call, thanks to the lower realized iron ore prices of $92.54 (-18.1% YoY). Since the commodity comprises 59.7% of its adj EBITDA (-6.3 points YoY), it is unsurprising that its overall adj EBITDA has also declined drastically to $27.95B (-31.2% YoY).

China’s Portside Inventory

Macro Micro

Then again, the potential improvement in the iron ore spot prices may be supported by China’s minimal portside inventory of 121.28M MT as of August 31, 2023 (-2.6% MoM/ -13.5% YoY).

With the inventory level being the lowest it has been over the past three years while nearing the August 2019 levels of 121.44M MT, we are cautiously optimistic that things may still improve ahead.

Iron Ore Contracts Through June 2024

Market Watch & Trading Economics

For example, the commodity’s contracted rates through June 2024 in China are still excellent, currently ranging between $117.13 for September 2023 contracts to $104.91 for June 2024 contracts.

Therefore, while we have been previously bearish on BHP’s prospects, it appears that our pessimism may have been overdone, especially due to the drastic improvement compared to the pre-pandemic spot prices of $90s.

Most importantly, with iron ores contracted rates remaining stable at these elevated levels nearing the current spot prices of $118.19, it appears that the miner’s top and bottom line expansion may still remain excellent over the next few quarters.

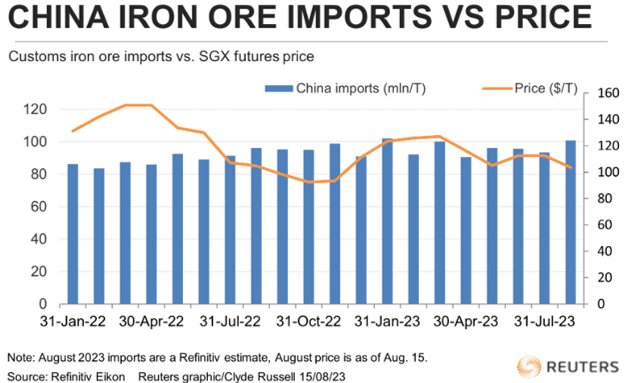

China’s Expanding Imports Of Iron Ore

Reuters

China’s iron ore demand appears to be picking up as well, with its imports growing in August 2023, likely to sustain the spot prices for a little longer.

The same has also been reported in the dry bulk shipping sector, with Star Bulk Carriers (SBLK), the second largest dry bulk company by fleet deadweight operated, recently recording excellent FQ2’23 Capesize TCE rates of $20.53K (+22.2% QoQ/ -32.1% YoY).

Its FQ3’23 Capesize TCE guidance of $20.10K (-2% QoQ/ -20.8% YoY) remains excellent as well, suggesting the robust demand for the fleet. This is important indeed, since up to 77% of the global Capesize fleets are commonly used for iron ore transports.

The Chinese government has also offered greater stimulus to support the struggling domestic property market, further boosting the iron ore spot prices and the Capesize spot rates over the past two weeks.

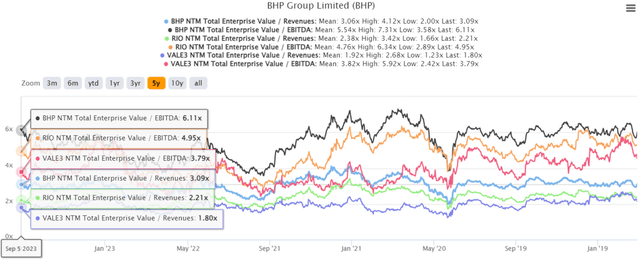

BHP 5Y EV/Revenue and EV/ EBITDA Valuations

S&P Capital IQ

Due to these promising developments, it is unsurprising that BHP now trades at NTM EV/ Revenues of 3.09x and NTM EV/ EBITDA of 6.11x, improved compared to its 1Y mean of 2.91x/ 5.31x and nearing its pre-pandemic mean of 3.20x/ 6.12x, respectively.

The same optimism has also been witnessed with its mining peers, such as Rio Tinto (RIO) at NTM EV/ EBITDA of 4.95x and Vale (VALE) at 3.79x, compared to their pre-pandemic mean of 5.20x/ 4.30x, and the mining sector’s median EV/ EBITDA of 4.84x.

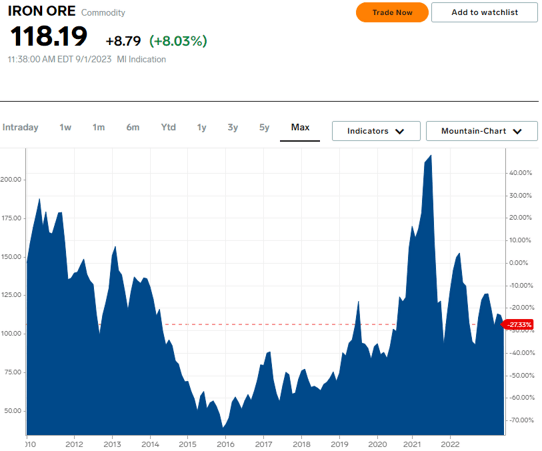

Iron Ore Spot Prices Since 2010

Market Insider

Then again, while the forward iron ore contracts imply elevated prices through mid 2024, it remains to be seen which direction it may go in the long-term, with the commodity’s historical trend being highly volatile since 2010.

Forward projections from market analysts remain highly mixed as well, with bullish analysts from Trading Economics expecting the commodity to hit $129.65 over the next twelve months, as bearish analysts from S&P Global projects spot prices of $94.00 by December 2023.

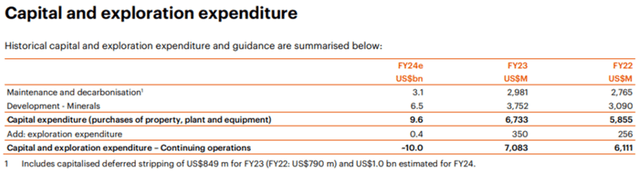

Intensified Capital Expenditure Guidance Implies Impacted Free Cash Flow Generation

BHP’s FY2024 Capital Expenditure Guidance

BHP

BHP investors may also want to reign in their exuberance momentarily, due to the projected expansion in its FY2024 capital expenditure to $10B (+41.2% YoY) and medium term to $11B, compared to the FY2023 levels of $7.08B (+15.8% YoY) and FY2019 levels of $7.12B.

This is mostly attributed to the intensified efforts towards future-facing commodities, including copper and nickel, which has already impacted its Free Cash Flow generation to $5.6B (-76.9% YoY) in the latest fiscal year.

BHP investors must also note its growing long-term debts to $22.3B (+35.9% YoY), thanks to the acquisition of OZ Minerals Limited for the copper and nickel assets. This has naturally expanded its interest expenses to $997M (+103% YoY) and average interest rates to 5.71% (+2.81 points YoY) in FY2023.

Assuming that the miner sustains its annual net operating cash flow of $18.7B and capital expenditure of $10B over the next few years, we may see its overall dividend payout drastically reduced to $4.35B (-67.2% from FY2022 levels of $13.3B), based on the ~50% payout policy.

As a result of these developments, it is unsurprising that there are growing concerns about BHP’s near-term Free Cash Flow generation, consequently impacting its eventual deleveraging and variable dividend payouts.

So, Is BHP Stock A Buy, Sell, or Hold?

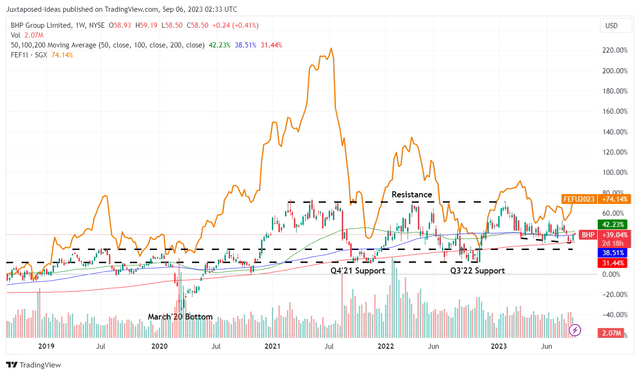

BHP 5Y Stock Price Relative To Iron Ore Spot Prices

Trading View

As a result of the mixed prospects, BHP investors must be aware of the cyclical/ volatile nature of mining stocks, since they closely mirror the spot prices of commodities, worsened by the intensified capital expenditure and impacted Free Cash Flow generation.

It is also difficult to offer an optimistic rating at this juncture, since we have been seeing the BHP stock record lower highs and lower lows over the past few months, potentially retesting its previous support levels of $52 in the near term.

Therefore, interested investors may be well advised to wait for those levels for an improved margin of safety, while potentially unlocking higher dividends yields depending on the miner’s variable payouts.

For now, we prefer to rate the BHP stock as a Hold (Neutral) here.

Read the full article here