Despite having AI in its name, BigBear.ai Holdings (NYSE:BBAI) doesn’t have the characteristics of a fast-growing cutting edge company, nor its margin profile.

Company Profile

BBAI calls itself as an artificial intelligence (AI) and machine learning (ML) firm for decision support. It offers supply chain & logistics, autonomous systems, and cybersecurity solutions.

Its supply chain & logistics solution has three products, including its Observe Data-as-a-Service (“DaaS”) solution, ProModel discrete event simulator, and Dominate forecasting tool. Observe is used to collect and process data from multiple domains to provide insights, while ProModel is used to simulate different scenarios without directly changing a model. Dominate, meanwhile, is used to help forecast future outcomes based on different decision options.

Its cybersecurity solutions include its BEARCLAW and SpaceCrest products. The former uses AI and ML to assess vulnerabilities using automation and data collections, while the latter is used in a laboratory environment to study and evaluate the vulnerabilities of space assets. Its autonomous solutions, meanwhile, are used by the Department of Defense for geospatial tracking, anomaly detection, computer vision capabilities, and AI at the edge.

The company’s main customers come from U.S. defense and intelligence agencies, manufacturing, distribution and logistics, healthcare and life sciences industries. It says a significant portion of its revenue comes from the federal government and government agencies. It also notes that a large percentage of its contracts require its data scientists and software engineers to co-locate on-premises to help tailor its solutions.

AI Or Something Else

While AI is in its name, BBAI’s background it that of a systems integrator and analytics firm for the U.S. government defense industry. The company was formed through the merger of systems integrator NuWave and data analytics company BigBear under the watch of private equity firm AE Industrial Partners in 2020. Analytics firm Open Solutions and the Government Services division of analytics firm ProModel Government Solutions were also quickly added to the mix under AE before the end of 2020.

The firm was later combined with a SPAC and went public in December 2021. While over 93% of holders voted for the combination, just over two-thirds redeemed their shares.

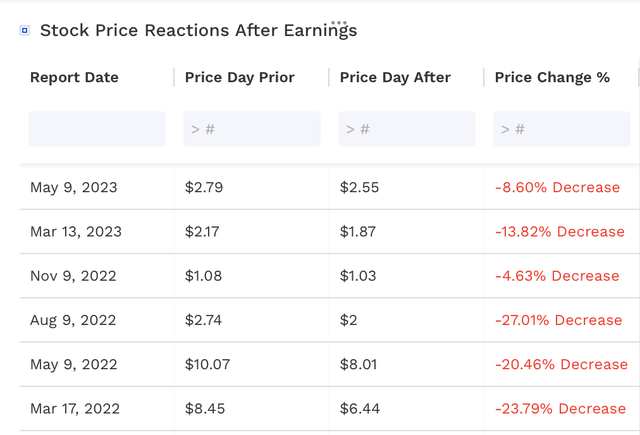

The company has had a rough go living up to expectations in the early days of being a public company as evidenced by its history of steep decline following earnings. The stock has traded lower the session after earnings the past 6 quarters, including being down double digits 4 of those times and over 20% 3 times.

BBAI Earnings Reactions (FinBox)

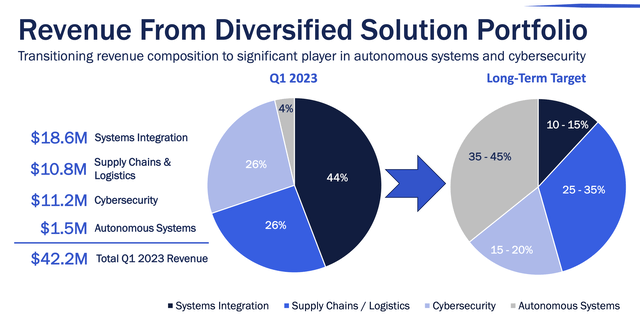

BBAI hasn’t exactly been a growth juggernaut. The company grew revenue 6.5% in 2022 to $155 million and then forecast 2023 revenue to be between $155-170 million, representing 0-10% growth. More recently, though, the company has seen more growth with Q4 revenue growth of 21% and Q1 growth of nearly 16%. However, the company has noted that its revenue can be lumpy based on when contracts are rewarded and milestones achieved.

Company Presentation

The company’s backlog also declined in the quarter, falling -10%, or -$22 million, to $197 million. This was largely due to the bankruptcy filing or Virgin Orbit and its subsequent removal from its backlog. It also has to book some bad debt reserves against receivables it was owed by the company.

Gross margins is another interesting thing to look at with BBAI. For Q1, gross margins declined -300 basis points to 24%. The company said additional costs from the GFIM program, which will completed in Q2, ate into margins as it continues to invest in critical capabilities before it becomes a production contract.

Now mid 20% gross margins does not seem like it would be typical of an AI-type business. SaaS companies typically have gross margins in excess of 80%, while C3.ai (AI) has subscription gross margins of about 66% and SoundHound AI (SOUN), which I recently wrote about, has gross margins of about 70%. BBAI’s long-term gross margin target, meanwhile, is only 35-40%.

One area where the company has done well is reducing expenses. It has lowered it total operating expenses by over 65% in the past year, and recurring operating expenses by over 30%. This has been through headcount reductions and operating efficiencies. However, this is also not exactly what you would want to be seeing from a young, innovative company.

Valuation

Determining a good way to value BBAI isn’t easy. The company is expected to generate negative EBITDA next year and minimal EBITDA next year.

The company had about $172.3 million in net debt at the end of Q1. It’s also burning cash, generating cash flow from operations of -$12 million in Q1 and it was -$48.9 million in 2022. The company has been raising cash through selling $25 million in stock and warrants in January and then again in June.

From an EV/Sales multiple it trades at 3.4x the 2023 consensus of $165.3 million and 3.1x the 2024 consensus of $179.1 million. Revenue is projected to grow 6% this year and 8% next year.

Given its low margins, though, a multiple based on revenue isn’t that appropriate. Apply 25% gross margins this year and 30% next, and it would have gross profit of $41 million and $54 million. On that basis, it is trading at nearly 14x 2023 gross profit and nearly 10.5x 2014 gross profit. This is not a valuation befitting the growth of the company.

Conclusion

Despite having AI in its name, BBAI remains primarily a systems integrator and data analytics firm for the U.S. government defense industry. It’s a mid to high single-digit revenue grower with mid-20% to 30% gross margins, and it should be treated as such. Note that the past two years its grown revenue 4.7% in 2021 and 6.5% in 2022 and gross margins have ranged from 23.4% to 27.7%.

However, after getting pummeled for most of its existence and almost getting de-listed last year, the stock has made a big comeback from its lows, helped by the hype of AI. The company has won some nice contracts with the government and done a good job of getting is expenses in control, but this is not a fast-growing, cutting AI firm with robust margins.

Maybe the company can continue to ride the AI hype higher, but eventually reality should catch up to it.

Read the full article here