The business cycle has four phases: expansion, peak, contraction, and trough. Our portfolio allocation changes depending on what phase of the business cycle we are currently experiencing. Today, we believe we are in the contraction phase of the business cycle. We publish on this subject frequently.

Given this premise, the allocation in our portfolio to cash and cash equivalents is relatively high. One of our preferred assets to park cash and earn substantial yield is U.S. Treasury bills.

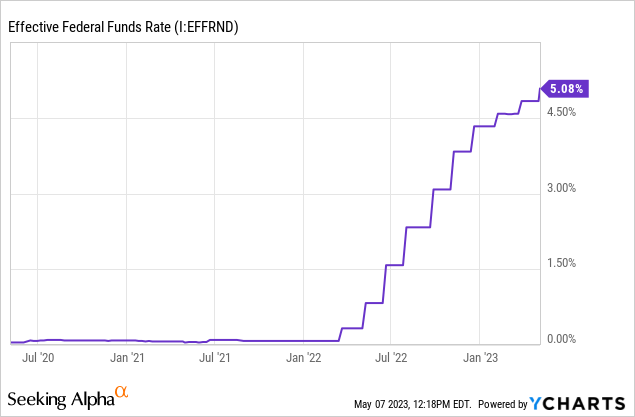

Picking the right bill or bond, in terms of duration, greatly depends on where interest rates are expected to go. If interest rates are expected to decline one may prefer longer duration and vice versa. The Federal Reserve has been aggressively hiking short term interest rates through the Federal Funds Rate over the past 12+ months. During that period of time we leaned toward the shortest duration bonds with our greatest preference on floating rate notes which have ultra-low convexity to rates. Convexity is the measure of how a bond’s price changes with changes in rates. Essentially, it is a measure of interest rate risk. During a rising interest rate environment the best performing bonds will have the lowest convexity.

This week, the Fed announced another 25 basis point raise to the Fed Funds rate. In response, we published a new article called That’s It, Hikes Are Done And Rates Have Peaked At 5%. In it, we forecast that this is likely the last rate hike of this cycle. We highly encourage you to review that article to understand why.

So, this begs the question. If we expect rates to pause, do we change our duration exposure? The answer is it depends.

The SPDR Bloomberg 3-12 Month T-Bill ETF (NYSEARCA:BILS) is a fund that invests in a balanced mix of Treasury bills which results in an average maturity of 0.42 years or about 5 months. One could manage their own portfolio of Treasury bills but the gross expense ratio is 0.135% which is reasonable for smaller portfolios given the time you can save not having to setup the transactions. The effective convexity for this fund is 0% according to the fund’s website.

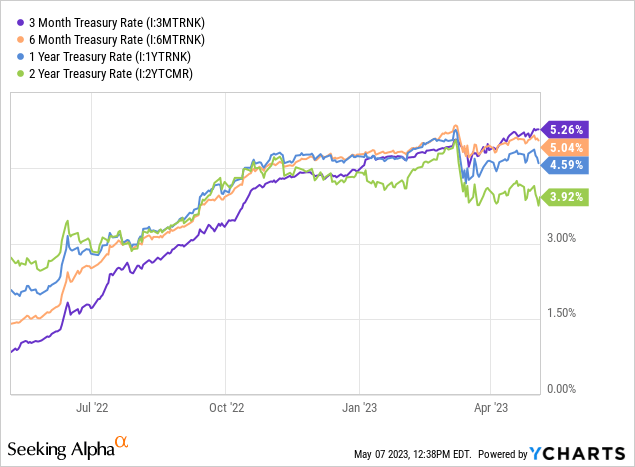

The fund offers 5% yield to maturity. This is the determinant. While 5% is higher than what the 1 year and 2 year Treasuries offer, it is below the 3 month and 6 month Treasury. For the part of our portfolio that we want to lock in yields for 6 months, we would be better off buying a 6M Treasury for 5.04% than a 5M ETF for 5%.

Alternatively, we continue to prefer floating rate notes for the majority of our cash allocation. Floating Rate Notes offered by the Treasury pay a variable rate as determined by the latest 3 month T-bill rate plus a spread. Spreads have been attractive lately with 0.2% recently offered and 0.169% offered today. We are long the iShares Treasury Floating Rate Bond ETF (TFLO) which invests in floating rate notes and offers a yield to maturity of 5.35%. This fund also has a convexity of 0 but the effective duration is 0.01.

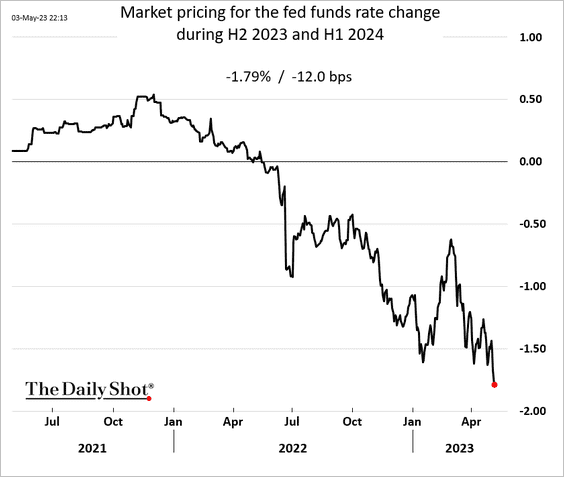

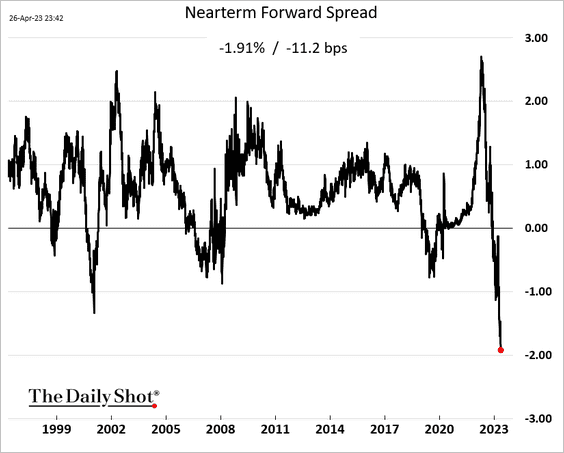

If rates were to begin to fall, floating rate notes would no longer be attractive. Until that happens, BILS offers a decent but not superior yield. Bond markets are pricing in steep cuts to interest rates soon. Futures markets are pricing in a 1.79% decrease in the Fed Funds rate by H1 2024. The near-term forward spread is even deeper at -1.91%. Futures are pricing in a 76% probability of lower rates within the next 4 months.

The Daily Shot (used with permission) The Daily Shot (used with permission)

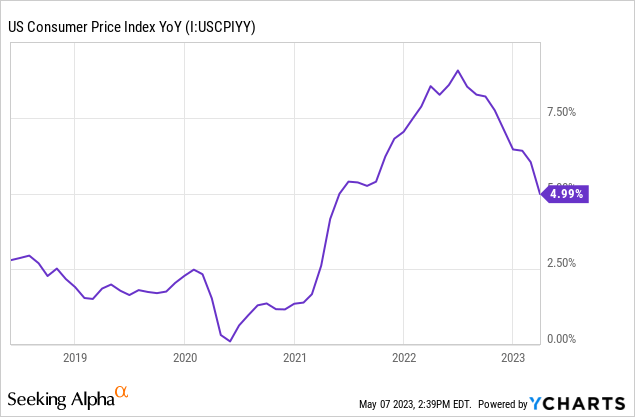

If futures markets are right, the total return between BILS and floating rate notes over the next 5 months is likely to be a tossup. BILS won’t experience much capital appreciation due to the low convexity and it will have to catch up to the yield offered by FRNs through rate cuts. Contrary to markets, we do not expect rate cuts to be imminent. The Fed dot plot indicates that the FOMC expects to hold rates above the current level through the end of the year. We believe them, at least over the next 6 months. This is because inflation remains sticky and Fed was caught off guard and appeared foolish when they said it was transitory. Leading indicators of inflation suggest that the CPI should remain above 3% through the end of the year, above the Fed’s 2% target.

Even if we expected rate cuts to begin today, the 6 month Treasury offers slightly better return than BILS without management expenses and an extra month of duration. For these reasons, we do not prefer BILS in our portfolio at this time. The 5% yield is fine, but not quite good enough.

Read the full article here