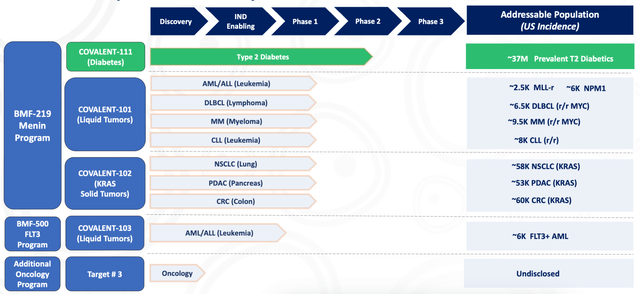

Biomea (NASDAQ:BMEA) is a clinical stage company developing oral covalent small-molecule drugs targeting genetically defined cancers and metabolic diseases. Its pipeline is this:

BMEA PIPELINE (BMEA WEBSITE)

Biomea’s platform is called Fusion. The platform develops covalent small molecule drugs, synthetic compounds that strongly bind to their target proteins. The idea is to produce irreversible drugs that do not need constant systemic exposure and thus do not pose safety and tolerability issues. The aim is to produce a bond between the protein and the molecule that persists throughout the target protein’s lifetime.

A number of the top management people at Biomea have significant experience in developing ibrutinib, one of the first major covalent drugs.

Coming to the pipeline, lead candidate BMF-219 is an oral covalent menin inhibitor. BMF-219 is being developed for genetically defined AML, ALL, DLBCL, and MM patients. In AML and ALL, BMF-219 works by blocking the interaction between menin and Mixed Lineage Leukemia (MLL). Menin-MLL inhibition has shown strong efficacy signals in models of MLL-rearranged leukemias. As has been noted:

Relapsed acute myeloid leukemia (AML) rapidly evolves into a chemotherapy-resistant disease and is incurable with standard approaches. The genetic factors driving the leukemia also govern chemotherapy resistance and prognosis after treatment.

MLL-rearranged (MLL1, KMT2A) leukemias are an aggressive clinical subgroup of AML and acute lymphoblastic leukemia (ALL’) with poor clinical outcomes, particularly in the context of therapy-associated AML and infant ALL. In the past 10 to 15 years, the molecular pathways governing MLL-rearranged oncogenic transformation have been carefully elucidated, demonstrating the importance of MLL-fusion protein interactions with chromatin-associated protein complexes. This work has led to the identification of novel drug targets, including DOT1 inhibitors, bromodomain inhibitors, and drugs that interfere with the Menin-MLL1 interaction. Menin binds to the N-terminus of MLL-fusion proteins and is required for MLL-fusion proteins to regulate aberrant gene expression pathways via the action of DOT1L.

BMF-219 blocks the interaction of menin and MLL (AML, ALL), and limits the activity and/or expression of NPM1, MYC, HOX, and MEIS1, all known drivers of oncogenic proliferation and survival.

Biomea’s lead program using BMF-219 is actually T2DM. Here, they are in a phase 2 trial. The next program is in a number of liquid tumors, where they are in phase 1. Lastly, they have a number of KRAS mutated solid tumors.

In both diabetes and cancer, Menin dependent effector genes create problems. In diabetes, these cells present in beta-cells express proteins that repress beta-cell growth, and in cancers, express or regulate proteins that drive oncogenesis. BMF-219 helps bring about cell homeostasis and can have benefits in both diseases. Thus it has the potential to become a pipeline in a pill. Biomea’s approach in T2DM is novel because other menin inhibitors are almost all directed towards cancer.

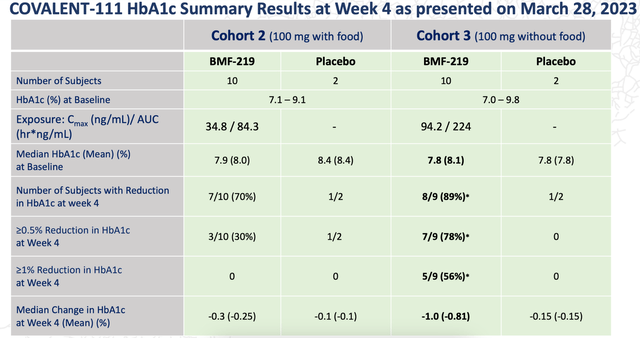

In human donor islets ex vivo, BMF-219 was seen to statistically significantly increase beta cells, pancreatic cells that make insulin and which are destroyed by menin. In March, BMEA presented clinical data that showed that “89%of Type 2 diabetes patients in its Phase 2 trial for lead asset BMF-219 indicated a decline in blood glucose levels after four weeks of therapy.”

In a second non-fasting cohort, BMF-219 was able to reduce HbA1c in 70% patients in 4 weeks. There were no dose reductions or serious adverse events. The data is summarized here:

BMF-219 DATA (BMEA WEBSITE)

This compares well with even blockbuster Mounjaro’s pivotal data. As Evaluate pointed out:

The magnitude of the cuts in blood sugar were encouraging on a cross-trial basis. In one of Mounjaro’s pivotal diabetes trials, Surpass-2, in which the GIP/GLP-1 inhibitor was used in combination with other diabetes therapies, the HbA1c reduction at the four-week mark was approximately 0.75-1.0 with the highest dose.

Obviously, though, larger trials will be needed with more robust designs to differentiate BMF-219 adequately. However, the company is very upbeat. As CEO Thomas Butler said:

Our goal with BMF-219 is to deliver the first disease-modifying treatment for patients with diabetes by addressing the root biological cause of the disease and its inevitable progression: the loss of insulin-producing beta cells.

The company noted that the benign safety profile of BMF-219 resulted from the fact that the molecule does not completely destroy menin, it simply decreases its levels transiently.

Financials

BMEA has a market cap of $1.1bn, quite high for an early stage company; and a cash balance of $259mn. R&D expenses were $24mn and G&A were $5.5mn. At that rate, they have cash for 9-10 more quarters. In March, right after the data, they made a $125mn secondary offering. Since they had only around $113mn in December, it appears that this money has been added in.

BMEA has very high institutional presence, and only 2% of the company is held by retail. Key holders are FMR, Cormorant and so on. Insiders have a nice mix of purchases and sells.

The company owns two issued U.S. patents, more than fifty U.S. and outside U.S. pending patent applications, “directed to compositions of matter, methods of treatment, and methods of making with respect to our product candidates, including BMF-219 and BMF-500.” These patents expire between 2039 and 2042.

Bottomline

Before March, the company was trading at cash. The stock went up four-fold in a matter of days, and is selling quite high right now. The approach is interesting, and there are no missteps in its past anywhere. I will keep this under observation.

Read the full article here