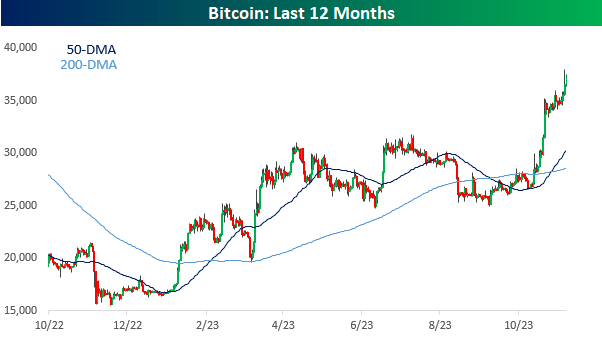

Even for a volatile asset class, it has been quite a week for crypto-related assets. With a gain of nearly 8% for the week, Bitcoin (BTC-USD) rallied to 52-week highs and crossed above 35K, 36K, and 37K in the process.

Year to date, the largest cryptocurrency is up over 125%, but looking at the chart below, all of the year’s gains have been confined to a handful of trading days in January, March, June, and now.

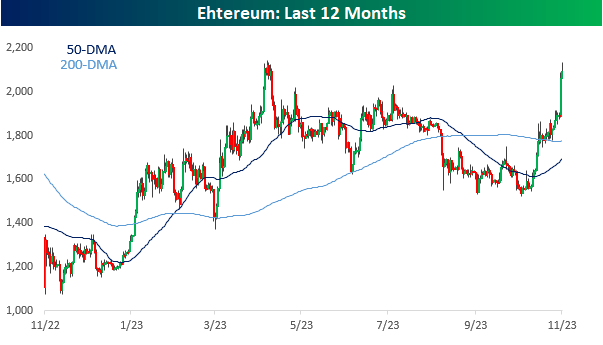

Ethereum had an even bigger week, rallying by over 14.5% and nearly doubling the gain in Bitcoin. Unlike Bitcoin, Ethereum was trading just shy of its YTD high from back in April.

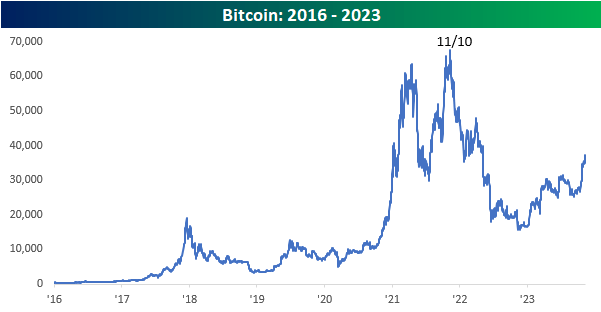

The fact that Bitcoin is at 52-week highs today is ironic given the fact that its all-time high of just below $69K was exactly two years ago today.

Given where prices are now, it doesn’t seem likely that those highs will be tested again any time soon, although stranger things have happened.

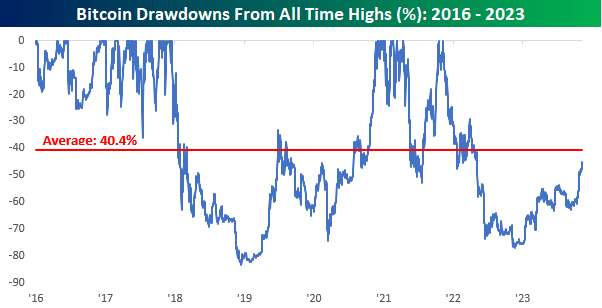

The chart below shows Bitcoin’s drawdowns from all-time highs over time.

Perhaps the most notable aspect of Bitcoin’s rally is the fact that even after rallying more than 100% this year, the current drawdown of 45% is deeper than the average drawdown of 40.4% for all days since 2016.

Just to get back to that historical ‘average’ drawdown, Bitcoin would need to rally back above $40K.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here