With the backdrop of a US Securities and Exchange Commission that has been dropping bombs throughout the cryptocurrency industry via lawsuits with Binance (BNB-USD) and Coinbase (COIN), the altcoin market has dealt with a substantial amount of selling pressure in the month of June. Much of that pressure is in reaction to accusations by the SEC that several major cryptocurrencies are unregistered securities.

Bitcoin Dominance Is Growing

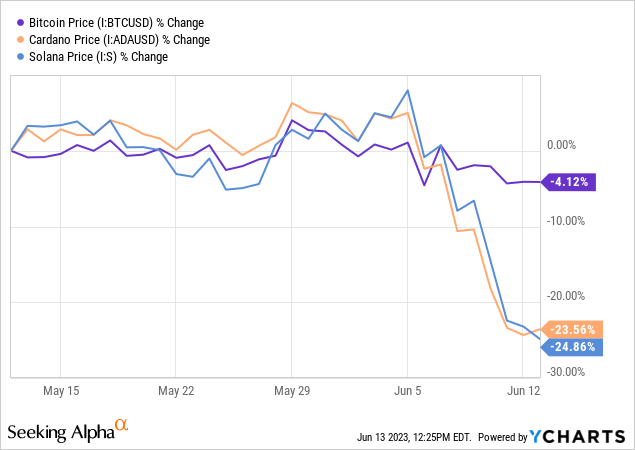

In the SEC’s lawsuits against Binance and Coinbase, the agency has added language that claims top altcoins like Cardano (ADA-USD), Solana (SOL-USD), and Polygon (MATIC-USD) are all unregistered securities. Since those designations, the performance of those coins has been abysmal with some of them declining by as much as 20% in just a 15 minute period in early morning trading on June 10th.

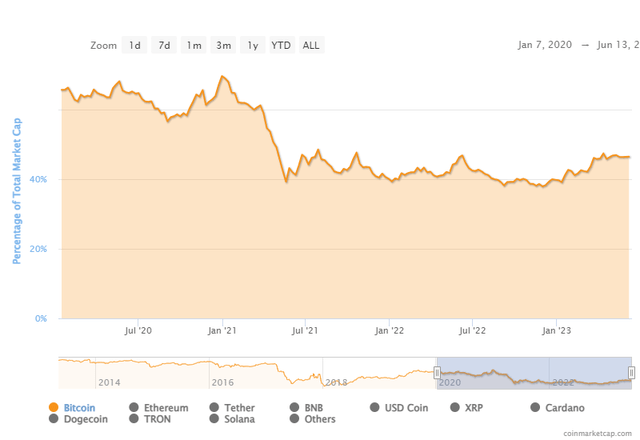

With the SEC wielding its sword in the altcoin market, Bitcoin (BTC-USD) dominance is at a two year high of 48%. The chart below shows Bitcoin’s dominance against the full crypto market and includes the top stablecoins like Tether (USDT-USD) and USD Coin (USDC-USD):

Bitcoin Dominance (CoinMarketCap)

On its own, Bitcoin’s resiliency against other coins in the crypto market this year is notable. In my view, it gets even more impressive when we look at Bitcoin’s dominance against just the other proof of work coins in the market like Litecoin (LTC-USD), Bitcoin Cash (BCH-USD), and ZCash (ZEC-USD):

Bitcoin Dominance (Bitbo.io)

There we see Bitcoin at a 95.7% dominance figure. This is also a 2 year high Proof of Work coin dominance figure and not far from a six year high of 96.4% from February 2017. At that time, the price of BTC was closer to $1,000 per coin. I suspect that this resurgence in broad dominance can continue given the regulatory environment for the rest of the crypto market.

SEC Chair Gary Gensler has insinuated in the past that BTC is the only coin in the crypto market that isn’t an unregistered security. To be clear, dominance doesn’t mean BTC’s price can’t go down. But there are potential macro catalysts that could push BTC higher even as other coins move lower given the regulatory environment.

Fed Pivot?

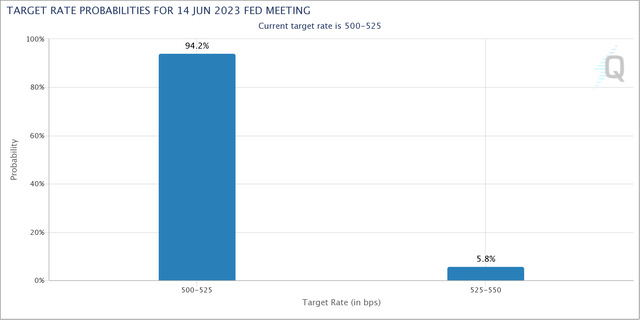

There has been a lot of anticipation for the Federal Reserve’s June rate hike decision both from crypto market participants and from the broader financial markets. Following the release of May CPI on June 13th, the target rate probability for “unchanged” at the June 14th Fed meeting jumped to over 94%:

Target Rate Probability (CME FedWatch)

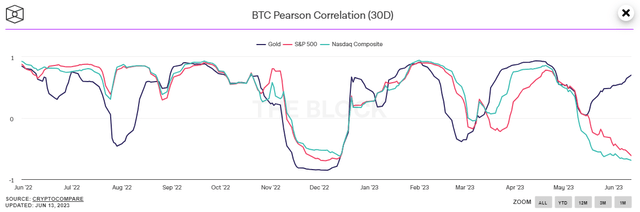

With the prospect of no hike, the equity markets have been rallying for most of June. As of article submission, that month to date rallies in both the S&P and the Nasdaq are approaching 5%. Given Bitcoin’s previous correlation with the equity markets, one might expect to see the same price move in BTC. However, since Mid-May bitcoin has been more correlated to Gold and negatively correlated to equities:

BTC Correlations (The Block/Crypto Compare)

As of June 12th, BTC’s 30 day correlation with the Nasdaq is minus 0.69 while the correlation with metal is 0.7. Though it should be noted that the last time the correlation with equities was this negative, there was a dramatic reversal one month later. If history repeats, this could be an indication that either BTC is set to rally or stocks could soon roll over.

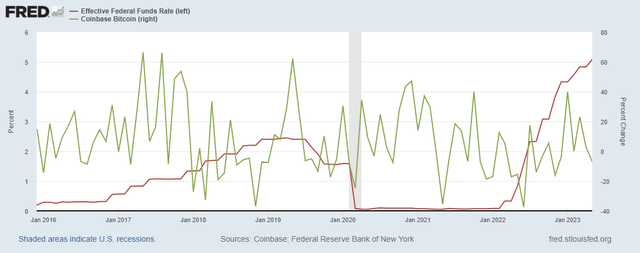

What we don’t know is whether or not any halt in rate hikes in June would indeed be the end of this hike cycle. But if one takes the view that it is the end of the cycle and looks to 2019 as a comparison, it is possible that Bitcoin’s bottom is either already in or is not too far away:

FRED

In the chart above, I’m showing the month end level for the effective federal funds rate overlayed with the monthly price change in BTC. We observe a 62% increase in the price of BTC in May 2019. This would have been 5 months after the rate level increases were essentially over. Of course, this may not be a perfect analog for our current situation because of the vastly different regulatory climate. Beyond that, the institutional demand for BTC and other cryptos appears to be waning.

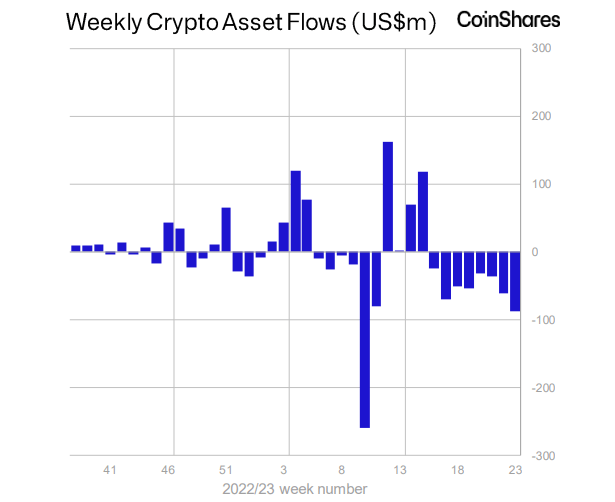

Fund Flows

CoinShares publishes a weekly report that tracks the flow of funds in many of the major digital asset investment products globally. These products include funds from Grayscale, ProShares, and numerous others. As of the June 12th report, CoinShares notes 8 consecutive weeks of crypto fund outflows totaling $417 million:

Digital asset fund flows (CoinShares)

Looking at the flows from a year to date standpoint, the biggest contributor to the outflow globally has been Canada at -$286 million. However, in the report CoinShares stated that the firm believes the outflows are monetary policy related and indicative of investor caution regarding the hiking cycle. If that is true, the digital asset fund outflow problem could be coming to an end soon. I’m not willing to say I agree with that concerning all crypto assets, but it is a possibility to consider for BTC specifically.

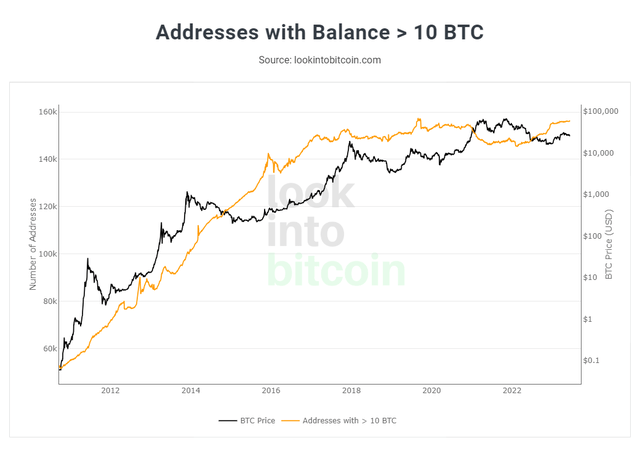

10 BTC Holders (LookIntoBitcoin)

I think it is also fair to wonder if some of the investment fund outflow is explained by repositioning to self-custody. At a little over 156k unique wallet addresses, the amount of on-chain holders with at least 10 BTC has been slowly grinding up near the all-time high of 157k over the last several months.

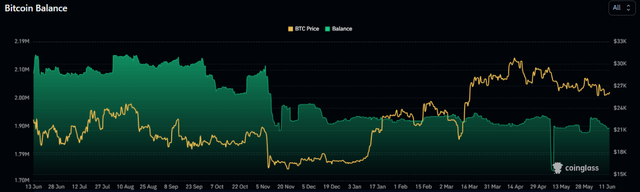

BTC Exchange Balances (CoinGlass)

Furthermore, the long term trend in exchange balance is trending lower. Currently there are just 1.89 million BTC on exchanges. This is down from over 2.1 million leading up to the collapse of FTX last year according to data from CoinGlass.

Summary

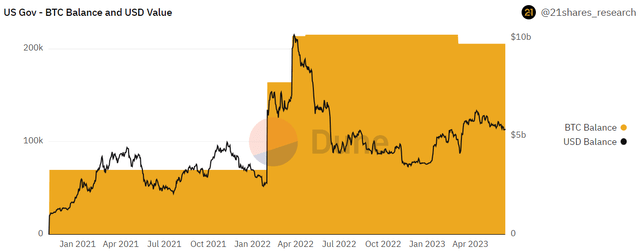

None of this means the price of Bitcoin has to go up. In fact, I suspect we may even see a short term decline in the price of BTC as the markets digest the Fed’s June meeting. Even though the end of the hiking would likely be very good for BTC’s price, headwinds remain. There doesn’t seem to be much doubt the US federal government is in the “fight them” phase of its crypto journey. Despite that, the US government still controls over 205k BTC from Bitfinex and Silk Road seizures:

BTC Holdings (Dune Analytics/21Shares)

That Bitcoin is valued at over $5.3 billion at current market prices. In the investment world, fund flows have been negative year to date yet BTC is up over 50%. BTC is coming off exchanges and large wallet holders are rising judging by the 10 BTC minimum and whole-coiner growth metrics. Bitcoin has been battling a tough rate hike cycle that could be coming to an end shortly. It’s not up against the same regulatory pressure as competing cryptocurrencies. Short term direction is anyone’s guess. But medium to long, I think BTC ends up higher from here. In the world of the coins, BTC is still the king.

Read the full article here