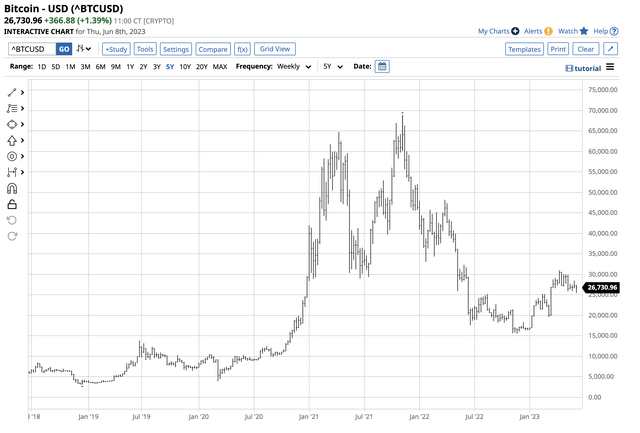

After reaching a $68,906.48 high in November 2021, Bitcoin ran out of its incredible upside steam, leading to a 77.5% plunge to the $15,516.53 November 2022 low. The decline was ugly, but it was not the first time the leading cryptocurrency tanked, and previous declines since 2010 were even more significant on a percentage basis.

Bitcoin is a protocol implementing a public, permanent, decentralized ledger that revolutionizes traditional finance. Bitcoin is a virtual currency that acts as money and a form of payment outside the control of any person, group, or entity operating in a global environment.

In late 2017, the Chicago Mercantile Exchange rolled out futures contracts on Bitcoin. While physical Bitcoin is mostly unregulated, the futures fall under the CFTC’s supervision. The ProShares Bitcoin Strategy ETF product (BITO) tracks Bitcoin futures prices higher and lower.

Bitcoin rallies from the November 2022 low

The decline from the November 2021 high was ugly. With some crypto devotees calling for $100,000 per token or higher, Bitcoin plunged, causing latecomers to the asset class more than a little pain.

Physical Bitcoin Price Chart (Barchart)

The chart highlights the 77.5% fall from the record peak. Meanwhile, the leading crypto nearly doubled at the most recent $30,970.16 mid-April 2023 high before settling into a trading range at over $25,000 and below the $30,000 level.

Consolidation is a cleansing

A significant price move often leads to a quiet period in markets, and Bitcoin has been no exception.

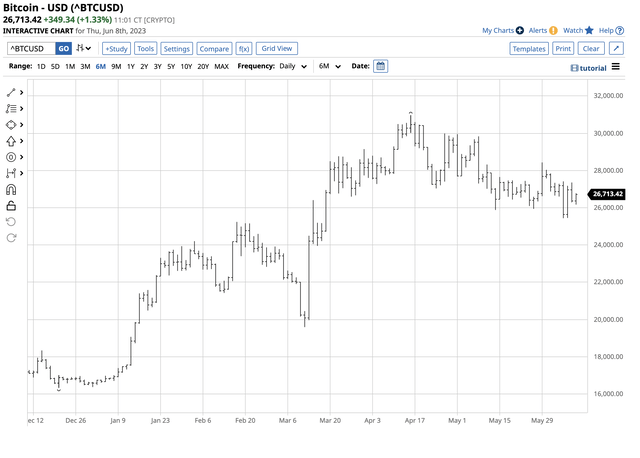

Short-Term Physical Bitcoin Chart (Barchart)

The six-month chart illustrates that the short-term trend is marginally bearish, as Bitcoin has made lower highs and lower lows since April 14. However, the price action has been consolidating far above the November 2021 low. Technical support below the bottom end of the current trading range is at the $20,000 level, with a wall of resistance at $30,000 per token. While this may seem like a wide range for an asset, in Bitcoin, it is narrow, considering that the top crypto was as low as five cents in 2010 and as high as nearly $69,000 in late 2021.

Consolidation periods cleanse markets of weak longs or shorts, and cryptos have many passionate participants on both ends of the spectrum.

The case for higher Bitcoin and cryptocurrency prices

The following factors support an eventual break to the upside:

- Fiat currencies derive value from the faith and credit of the countries that issue the legal tender. Economic and political factors that could lead to de-dollarization have eroded fiat currency values over the past years. Debt and geopolitical tensions have challenged the U.S. dollar and other fiat reserve currencies, role in the worldwide financial system, opening the door for alternatives. Bitcoin and other cryptocurrencies have filled the void for some technologically savvy investors and traders.

- More businesses are accepting Bitcoin and the other leading cryptos as a means of exchange. Growing acceptance favors higher prices.

- Responding to customers’ requests, the leading financial institutions have allowed for investments in the burgeoning asset class.

- Memories of the appreciation that took Bitcoin from five cents in 2010 to nearly $69,000 per token in late 2021 support speculative activity in the asset class.

- The loss of faith in governments has increased the demand for assets that transcend the money supply control. Bitcoin’s value is a function of bids and offers in the market, without government intervention to control or determine price levels against fiat currencies.

Cryptos have become an alternative asset class with growing participation for these reasons and more. Moreover, futures, ETF products, and crypto-related companies trading on stock exchanges have allowed market participants to invest in the asset class without cryptocurrency wallets or holding cryptos on unregulated exchange platforms. While the regulated products provide some sense of security, they continue to provide volatility and correlation when prices move higher or lower.

The case for lower Bitcoin and cryptocurrency prices

On the extremes, crypto devotees like Jack Dorsey believe that Bitcoin will “change the world.” Others, like Charlie Munger, think Bitcoin is “disgusting and contrary to the interests of civilization.” The case against Bitcoin and cryptos includes:

- There is no intrinsic value other than the prices buyers and sellers establish.

- While prices are transparent, ownership is not, leading to a utility for nefarious purchases.

- The potential for systemic risks has caused regulators to crack down on cryptos. The SEC sued Binance and Coinbase for operating as unregulated exchanges. In both civil cases, SEC Chairman Gary Gensler called the crypto industry the “Wild West,” undermining investor trust in the U.S. capital markets. China has banned Bitcoin and other cryptos as it plans to roll out a central bank-issued digital currency. While the potential for systemic risk is low, with the market cap of the entire asset class at $1.122 trillion on June 8, it rose to over $3 trillion in late 2021. The higher the market cap, the more the risk of destabilizing the financial system.

- While blockchain revolutionizes finance, and many private and public sector financial institutions have embraced the technology, many view cryptocurrency as an unwanted offshoot of blockchain that increases speed, efficiency, and record keeping.

- Money is power, and governments have rejected innovations that limit or deny their control of the money supply. Governments will likely embrace their digital currencies, but cryptos are another story.

The debate will likely continue, with the temperatures rising with Bitcoin’s price. The boom-and-bust history suggests that the odds favor another boom period of speculative frenzy.

BITO for Bitcoin bulls

Bitcoin bulls or speculators looking to participate in the next rally if Bitcoin breaks above the $30,000 level have investment options. The most direct route is through the physical market, which involves holding Bitcoin in a computer wallet or an unregulated exchange with additional risks. The wallet requires a password, which risks hackers stealing the cryptos. The exchanges can go belly-up after a hack, government shutdown, or other reasons. Exchange customers can lose all their cryptos without recourse.

The ProShares Bitcoin Strategy ETF product (NYSEARCA:BITO) offers two levels of regulatory supervision. BITO’s fund summary states:

Fund Summary for the BITO ETF (Seeking Alpha)

BITO holds futures contracts regulated by the U.S. Commodity Futures Trading Commission. The CFTC regulates futures markets. As BITO trades on NYSEARCA as an ETF, the Securities and Exchange Commission offers another regulatory level. While regulators or governments can ban Bitcoin, crushing the price, the ETF will likely go along for the ride if Bitcoin takes off on the upside.

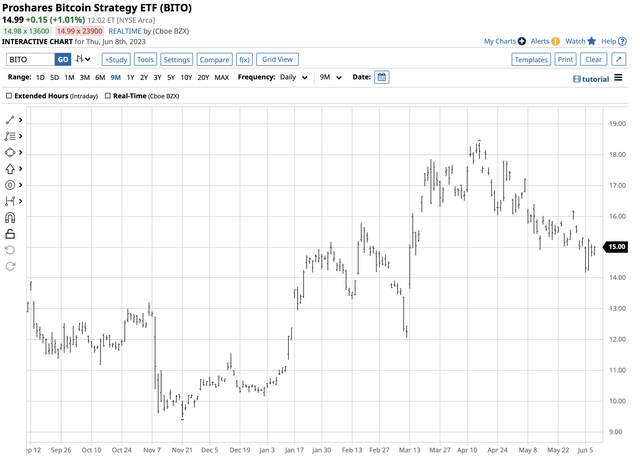

Bitcoin nearly doubled from the November 2022 low to the April 2023 high.

Chart of the BITO ETF November 2022 low and April 2023 high (Barchart)

The chart shows the BITO ETF rose from $9.48 to $18.39 per share, or 94% from late November 2022 through mid-April 2023. BITO did an excellent job tracking Bitcoin’s price. At around $15 per share on June 8, BITO had $843.838 million in assets under management. The ETF trades an average of over 7.25 million shares daily and charges a 0.95% management fee.

When it comes to Bitcoin, BITO, or any crypto-related investment, only use the capital you are willing to lose, as risk is always a function of the potential reward. In the boom-and-bust cryptocurrency world, the potential for incredible profits comes with the risk of a total loss. Bitcoin and BITO are sleeping in a narrow range, but the price history tells us that another explosive or implosive move is right around the corner.

Read the full article here