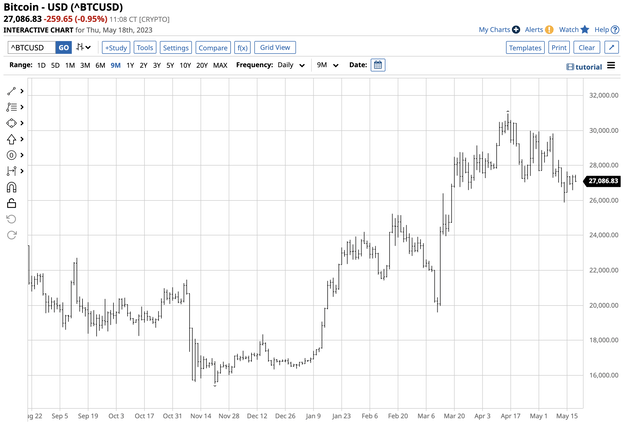

After reaching a low in November 2022, Bitcoin (BTC-USD) recovered, reaching its latest high at just below the $31,000 per token level on April 14.

Since mid-March, Bitcoin has primarily traded between $26,000 and $30,000, extending to the nearly $31,000 high and the recent low under the $26,000 level. At $27,100 per token on May 18, the price continues to consolidate at almost double the level at the November 2022 low.

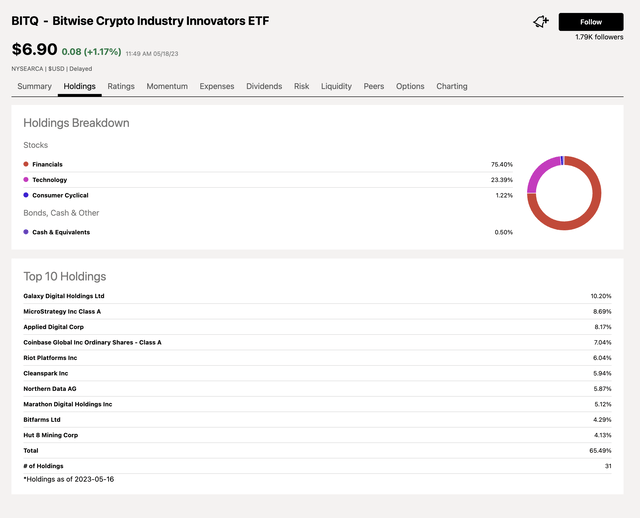

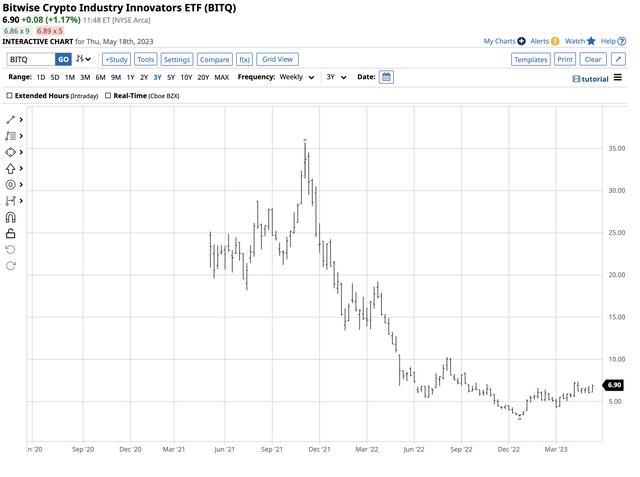

The Bitwise Crypto Industry Innovators ETF (NYSEARCA:BITQ) correlates well with Bitcoin and the asset class’s overall market cap. Since its inception, BITQ has traded as high as $35.68 and as low as $3.20 per share. At the $6.90 level on May 18, BITQ has lots of room to appreciate if cryptos emerge from the current price consolidation on the upside.

The debate over cryptocurrencies continues

Emotional support and opposition surround Bitcoin and the cryptocurrency asset class.

The supporting factors include:

- The declining faith and credit of fiat currencies are bullish for Bitcoin and other cryptocurrencies.

- Technically, Bitcoin and other tokens found significant bottoms and boom-and-bust price action have been the norm over the past years. The November 2021 through November 2022 Bitcoin bust could give way to a boom if the historical patterns repeat.

- Bitcoin and other cryptos have gained more acceptance over the past years as payment and investment assets.

- A prolonged consolidation near the recent high could be a bullish sign for an asset.

On the other side of the debate:

- Governments do not favor independent cryptocurrencies as they threaten the control of the money supply.

- Regulatory bodies have increased supervision and rules contrary to crypto’s ideological thesis.

- Cryptos remain an uber-alternative asset class, and the volatility continues to scare away potential market participants.

- The intrinsic value of crypto tokens is a subject of significant debate.

Value is in the eyes of the beholder, and Bitcoin and cryptos are the subjects of widespread debate. Supporters see cryptos as the technology that changes the financial world, while some opponents, like Charlie Munger, characterize cryptos as “disgusting” and contrary to the civilized world.

A long boom-and-bust history

Volatility is a paradise for traders embracing wild price swings, but wide price variance is a nightmare for passive investors. Action junkies have embraced Bitcoin and cryptos because of their penchant for boom-and-bust price action.

Chart of Bitcoin versus U.S. Dollars Since 2010 (Barchart)

The chart dating back to 2010 highlights a series of significant percentage gains and losses:

- In the first sustained boom period, Bitcoin rose from 5 cents in July 2010 to $1,135.45 in November 2013.

- The following bust took Bitcoin to a $172.45 low in January 2015.

- The next explosive rally took the leading cryptocurrency to $19,862 in December 2017.

- The price imploded to a $3,158.10 low in December 2018.

- Bitcoin recovered to $13,844.30 in June 2019 before falling to $3,925.27 in March 2020.

- In November 2021, Bitcoin reached its all-time peak at $68,906.48.

- Over the next year, it fell to $15,516.53 in November 2022.

At the $27,100 level on May 18, 2023, Bitcoin could be poised for another explosive rally over the coming months and years.

A bullish pattern since the November 2022 lows

Over the past seven months, Bitcoin has settled into a pattern of higher lows and higher highs.

Chart of Bitcoin versus U.S. Dollars since the November 2022 low (Barchart)

The chart highlights Bitcoin’s bullish path. Bull markets rarely move in straight lines, and selloffs are the norm. Meanwhile, the top cryptocurrency with a $525 billion market cap at $27,100 per token is back in boom mode in late May 2023.

BITQ is a diversified crypto ETF

The top holdings of the Bitwise Crypto Industry Innovators ETF include:

Top Holdings of the BITQ ETF Product (Seeking Alpha)

BITQ holds Bitcoin and crypto-related companies, including trading platforms, miners, and other pick-and-shovel cryptocurrency businesses.

At $6.90 per share, BITQ had $72.81 million in assets under management. BITQ trades an average of 79,446 shares daily and charges a 0.85% management fee.

An inexpensive ETF providing exposure

BITQ began trading in May 2021, when Bitcoin was on its way to the November 2021 record high, and the cryptocurrency asset class’s market cap eclipsed the $3 trillion level.

Chart of the BITQ ETF Since Inception (Barchart)

The chart shows BITQ reached a $35.68 peak in November 2021 and fell to a $3.20 low in December 2022, just after Bitcoin found a bottom. Bitcoin fell 77.5% from November 2021 through November 2022, while BITQ plunged 91%. At $27,100 on May 18, Bitcoin recovered 74.7%, while BITQ rallied 116% at $6.90 per share. While Bitcoin experienced boom-and-bust price action, BITQ was more volatile on a percentage basis.

BITQ is an ETF that provides exposure to Bitcoin and the cryptocurrency asset class without the need for crypto wallets or accounts at Coinbase (COIN) or other crypto trading platforms. At under $7 per share, BITQ is an inexpensive product for those looking to dip a toe into the cryptocurrency arena. Like any crypto, only invest funds that you are willing to lose as the risks of loss are commensurate with the significant profit potential.

Read the full article here