BlackRock pushed further into cryptocurrencies on Thursday by filing an application with the US Securities and Exchange Commission to offer a spot bitcoin exchange traded fund.

If the SEC approves the application, the fund would trade on the Nasdaq stock market, making it the first publicly traded spot bitcoin ETF in the US.

The $9tn money manager already runs a private spot bitcoin trust that it launched last year. The ETF marks a further expansion of its partnership with embattled crypto exchange Coinbase, which would be the custodian of the fund’s bitcoin.

The launch of a spot bitcoin ETF by the world’s largest money manager could be a shot in the arm for cryptocurrencies after a run of bad news including the collapse of FTX last year and the SEC’s decision earlier this month to sue both Coinbase and the world’s largest crypto exchange, Binance, alleging securities violations.

But it is not clear that the SEC will approve BlackRock’s application. It has already turned down several earlier proposals from other asset managers on the grounds that the tokens trade on unregulated exchanges with surveillance and manipulation risks.

The watchdog is being sued by Grayscale over its refusal to allow the conversion of what was then the world’s largest crypto investment vehicle into a listed ETF. The lawsuit contends that the SEC’s decision was arbitrary, particularly because it has allowed the launch of ETFs based on bitcoin futures.

BlackRock’s move also comes at a time when the SEC has proposed new custody rules that would place additional responsibilities on asset managers to make sure that customer assets are kept in properly segregated accounts.

The price of bitcoin is down more than 60 per cent from its 2021 peak, but it has also bounced significantly from the lows it hit last year after FTX went bust.

“BlackRock’s increasing engagement shows Bitcoin continues to be an asset of interest for some of the world’s largest financial institutions,” said Sui Chung, CEO of CF Benchmarks, which provides the bitcoin price that BlackRock plans to use.

“An estimated 20 per cent of Americans have now owned bitcoin at some point. BlackRock’s proposed ETF potentially offers the other 80 per cent an option that is altogether more familiar and accessible.”

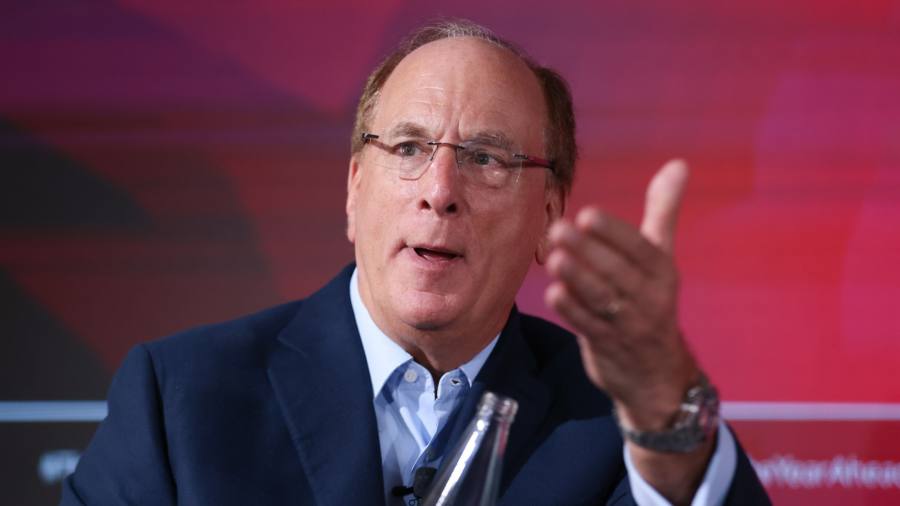

BlackRock declined to comment beyond the filing. But founder Larry Fink, who was once openly sceptical of cryptocurrencies, wrote in his annual letter to investors in March that “very interesting developments are happening in the digital asset space . . . At BlackRock we continue to explore the digital assets ecosystem.”

And during its investor day earlier this week, executives touted the group’s ability to launch new ETFs and offer clients a wide range of asset classes. It currently has more than 1,300 different ETFs.

Read the full article here