Growing one’s income stream is one of the best ways to eating well and sleeping well before and during one’s retirement. That’s because while it seems everyone else is heavily invested in low-yielding index funds and/or chasing capital appreciation, the income investor gets to enjoy real cash that flows into their pocket.

The beauty of the stock market is that one doesn’t have to put all their eggs into one basket, and diversifying one’s holdings into a portfolio of quality REITs, BDCs, and MLPs may help one to achieve long-term income growth and goals, with dividend yields that are many multiples over what the S&P 500 (SPY) offers.

This brings me to Blackstone Mortgage Trust (NYSE:BXMT), which I last covered here back in June. It appears that the market has responded well since then, with the stock giving investors a 12% total return, far surpassing the 1.6% return of the S&P 500 over the same timeframe. In this piece, I provide an update on BXMT’s recent quarterly results and why it remains an appealing high income opportunity, so let’s get started!

Why BXMT?

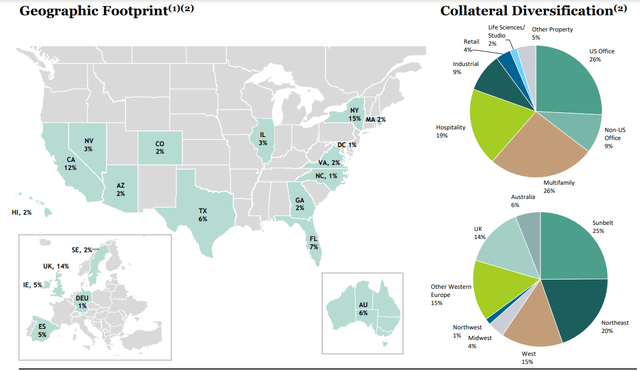

Blackstone Mortgage Trust is a commercial mortgage REIT that’s externally managed by its “big brother” and alternative asset juggernaut Blackstone (BX). BXMT’s access to Blackstone’s global platform gives it valuable insights as it manages a worldwide portfolio across North America, Europe, and Australia.

At present, BXMT manages a $23 billion portfolio that’s secured by institutional quality real estate. The portfolio is protected by senior loans with a safe loan-to-value ratio of 64%, signaling significant equity skin in the game on part of the borrowers.

The portfolio is also diversified by geography and collateral type. A quarter of the portfolio is tied to U.S. office, while the rest of the portfolio is tied to less “headline risk” segments like non-U.S. office, where return to office trends are more robust. For example, Europe has seen on average 80% of office workers returning to the office full-time, higher than 50% for the U.S. In addition, the growing multifamily, hospitality, and industrial segments make 54% of BXMT’s portfolio, as shown below.

Investor Presentation

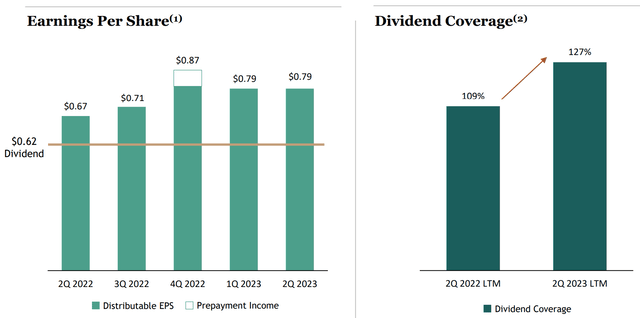

Meanwhile, BXMT continues to benefit from higher interest rates, as it generated $0.79 in distributable EPS during the second quarter, representing 18% YoY growth. This results in a well-covered dividend with a 78% payout ratio. As shown below, BXMT has out-earned its dividend over the past 5 quarters.

Investor Presentation

Out-earning the dividend also contributes to a rising book value. This is reflected by book value per share rising to $26.30, up $0.04 since the start of the year due in part to $30 million of excess Q2 distributable earnings after the dividend. Notably, the rise in book value also bakes in a significant CECL (current expected credit loss) reserve of $380 million, which is up 2.7x from the prior year period. This gives BXMT plenty of capital buffer against potential future losses.

Moreover, 96% of the portfolio is performing and generating robust cash flow, and the weighted average risk rating remains stable at 2.9, which is unchanged from the end of last year, and just 0.1x higher than the prior year period. This includes 8 loans being upgraded (lower risk), including 2 loans from a 4 to 3 rating as a result of both cash flow recovery and significant paydowns from its sponsors, partially offset by 7 loans being downgraded (higher risk) during the same quarter.

Looking ahead, BXMT is well-positioned to capitalize on opportunities, as it reduced leverage by 0.1x sequentially and 0.2x on a YoY basis to 3.4x, giving it $1.8 billion in liquidity. It’s also insulated from near-term interest rate risk, as it has no debt maturities until 2026, and its investments are match-funded with debt, so higher cost of debt would also come with higher investment yields. Importantly, BXMT has retained $120 million of distributable earnings in excess of dividends, giving it plenty of “house money” to play with as it seeks to deploy those proceeds.

Risks to the thesis include BXMT’s pure-play exposure to commercial mortgages, as it doesn’t have physical real estate assets to smooth out its cash flow and serve as an equity buffer. Moreover, it also carries higher leverage than peer Starwood Property Trust (STWD) which has a leverage ratio of 2.4x. Lastly, higher than expected loan losses on the office loan portfolio could negatively impact book value.

Considering all the above, BXMT remains a solid value at the current price of $21.81 with a forward PE of just 7.5. At this valuation, BXMT is priced for a perpetual decline, but that appears to be overly pessimistic, considering its track record of out-earning the dividend with significant capital to deploy, especially in an environment when many regional banks are pulling back.

In the meantime, investors get to collect a very high 11.4% dividend yield, which compares very favorably to the 1.46% yield of the S&P 500. Based on the 6.9% 10-year dividend CAGR of the S&P 500, it would take 40 years for SPY to reach the same yield as what investors get with BXMT today.

Investor Takeaway

For income investors seeking a high dividend yield, Blackstone Mortgage Trust remains an attractive option with a +11% yield. Management has proven adept at managing economic adversity, with BXMT generating robust cash flow to support its dividend over the past several quarters, and it’s sitting on excess distributable earnings that it can use for future growth opportunities.

The 11.4% dividend yield is also well above what the S&P 500 offers, giving investors high income that they can use today. With a low valuation and high yield, BXMT remains an appealing high yield opportunity at the current discounted price.

Read the full article here