Blackstone Mortgage Trust (NYSE:BXMT) is one of the largest mortgage REITs out there, with a loan portfolio of nearly $30 billion. In addition to being the largest, the mREIT is also one of the best managed, with an experienced management team run by Blackstone (BX) itself.

I started coverage on the stock in May with a BUY recommendation at $17.30 per share, and since then the stock has rallied by more than 30%, outperforming the S&P 500 by a factor of four. The company has also released Q2 earnings since then, and so I’m updating my thesis today.

Seeking Alpha

Blackstone Mortgage Trust

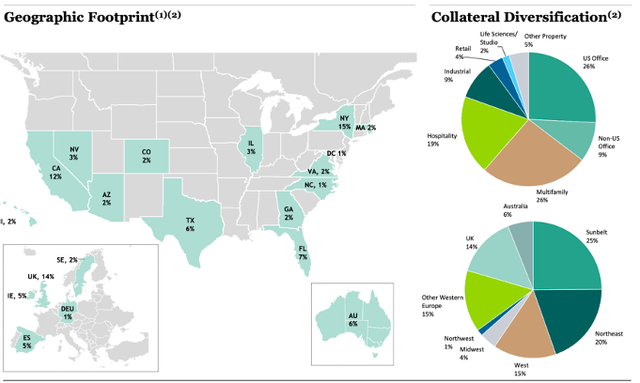

BXMT holds a portfolio that is diversified between the US (65%), Western Europe (15%), UK (14%), and Australia (6%). The portfolio consists of loans to office projects (35%), multifamily (26%), hospitality (19%), and industrial properties (9%).

BXMT

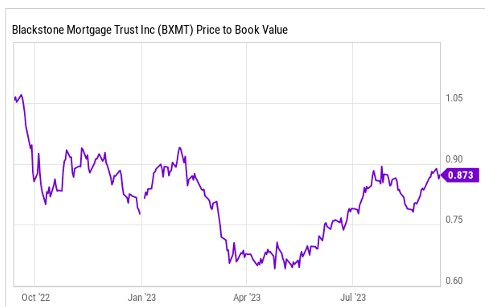

While the stock has rallied recently, at the current price of $23 per share, it still trades below the reported book value of $26 per share. The reason for this is that the market is worried about office loans not performing.

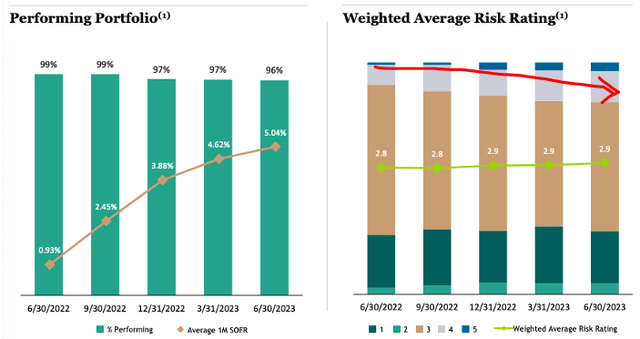

Indeed, the percentage of performing loans has dropped from 99% in Q3 2022 to 96% in the most recent quarter. Over the same period, the average weighted risk of a loan has increased from 2.8 to 2.9 and the number of the riskiest 5-rated loans has increased by a factor of three.

BXMT

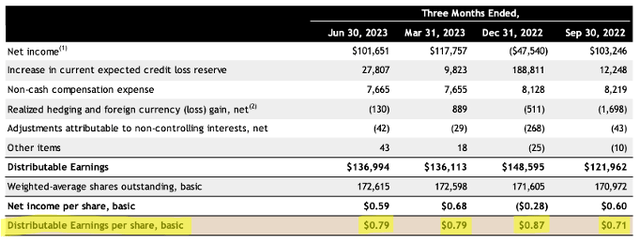

But despite fears of doom and gloom, the second quarter has actually been quite good for BXMT. Results were flat quarter-over-quarter as higher interest rate tailwinds were offset by the loan modification measures and cost recovery accounting. The most important measure for the REIT, distributable earnings, has reached $0.79 during the quarter, which is in line with the last quarter and 20% above expectations.

Notably, because all income received from impaired 5-rated loans is currently being recognized as a reduction in the loan amount, rather than income, there is additional upside above the reported distributable earnings, which will either get recognized when the loans recover or if they default it will reduce future losses. Accounting for this irregularity, earnings have actually increased by about 3% quarter-over-quarter.

BXMT

These earnings have more than supported the $0.62 quarterly dividend with a comfortable payout ratio of 78% and over the last 12 months dividend coverage has reached 127%. That’s pretty good considering that the dividend yields almost 11%. Going forward, unless things get really bad and many office loans default, I see the dividend as largely sustainable, which is great, as an 11% return is already above the average market return.

The good thing is that things appear to be quite stable for now as 8 loans have been upgraded vs. 7 loans being downgraded during the quarter. Moreover, management has only decided to increase their CECL reserve marginally during the quarter, unlike in previous quarters where the increases were in high double-digits. This suggests that they don’t see things getting worse anytime soon, and actually expect some stabilization.

Currently, the reserve stands at $380 million or $2.20 per share and covers 20% of all 5-rated loans. Notably, the two cent per share increase in the CECL reserve during Q2 was more than offset by retained cash flow after dividends, which has had a positive impact on book value.

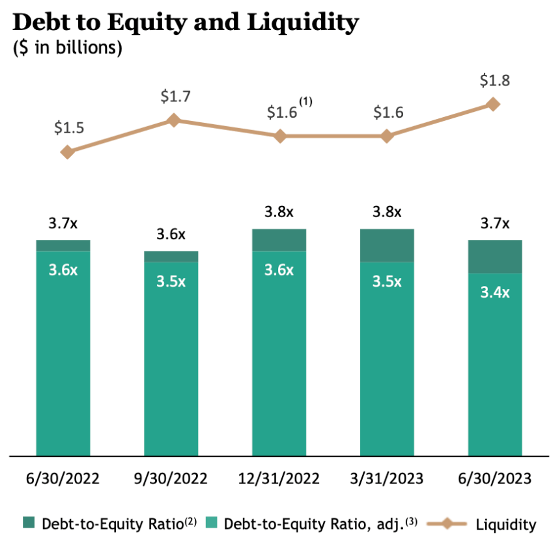

The REIT has also managed to reduce its leverage from 3.8x to 3.7x and has record liquidity of $1.8 billion, which provides a comfortable cushion to weather the rest of this crisis, especially when we consider that there are no corporate debt maturities until 2026 and that the current liquidity is enough to cover all interest payments for the next 5 quarters.

BXMT

Valuation

BXMT is a leveraged company, which means that shareholder returns and losses get magnified. In particular, with liabilities of about $20 billion and equity of $5 billion, leverage stands at 4x. That means that a 1% loss of capital will result in a 4% loss for shareholders.

Since the company is trading at 0.87x its book value, which corresponds to a 13% discount, we can easily calculate just how big a cushion the market is pricing in. Dividing 13% by leverage of 4x yields an implied rate of defaults of 3.25%. That’s actually not a huge cushion if you consider that 5-rated loans account for 4.6% of the portfolio.

YCharts

With that said, I do think that BXMT is roughly fairly priced here. And even if all 5-rated loans default and there is zero recovery (which is unrealistic) the downside from here would only be about 7%. At the same time though, there is little upside as anything above 100% of book value would be considered overvalued, especially at this time.

Consequently, anyone buying here is buying the stock for the dividend alone. But frankly, at 11% that can still generate alpha, which is why I continue to rate the stock a BUY here at $23 per share. I set the price target at today’s price of $23 per share.

Read the full article here