Blackstone Mortgage Trust, Inc. (NYSE:BXMT) slashed its dividend by 24% at the end of last month due to persistent office loan performance problems that led to a substantial increase in the real estate investment trust’s dividend pay-out ratio.

As a consequence, the dividend was not covered by distributable earnings in 2Q24 and an increase in the trust’s credit loss reserve account caused a decline in the trust’s book value as well.

I think that the safest dividend to buy very often is the one that just received a haircut, and I am cautiously optimistic that management carefully evaluated whether or not the new class A common stock dividend of $0.47 per share per quarter will be sustainable.

Furthermore, to cushion the blow from the dividend cut, Blackstone Mortgage Trust announced a $150 million share repurchase.

Since Blackstone Mortgage Trust’s stock is selling at essentially the same big discount to book value as it did before the trust axed its dividend, I think this may be an opportune time to buy the stock.

My Rating History

In my last piece on the mortgage real estate investment trust I explained why I modified my stock classification from Buy to Hold. The risk of a dividend cut for Blackstone Mortgage Trust was obvious to me in 1Q24 as the mortgage trust only covered its dividend with adjusted distributable earnings.

Now that the dividend has been chopped, I think risk-tolerant investors may find the 11% dividend yield quite compelling.

Portfolio Review And CECL Reserve

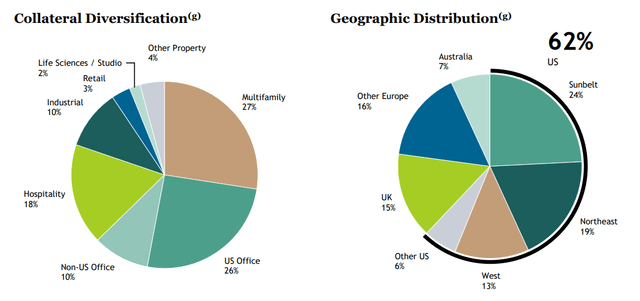

Blackstone Mortgage Trust owned a $20.8 billion portfolio which consisted of 166 senior loans, the majority of which were collateralized by multi-family and office properties. The trust has experienced quality issues in its portfolio which led to a substantial increase in the company’s reserve for expected credit losses in the last quarter.

Portfolio Overview (Blackstone Mortgage Trust)

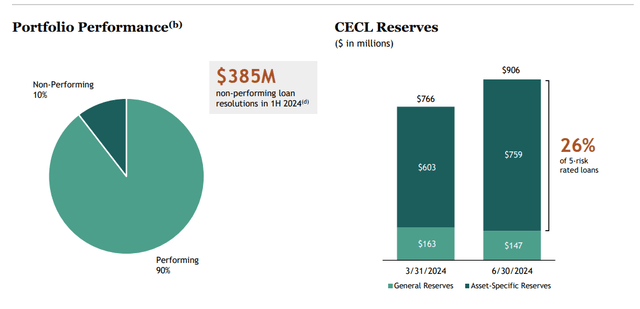

Unfortunately for Blackstone Mortgage Trust, the credit quality situation did not improve in the second quarter. Quite to the contrary: The trust’s CECL reserve continued to rise amid ongoing growth in impaired loans. In 2Q24, the CECL reserve was boosted by $140 million, or 18%, and stood at $906 million as of June 30, 2024.

CECL Reserves (Blackstone Mortgage Trust)

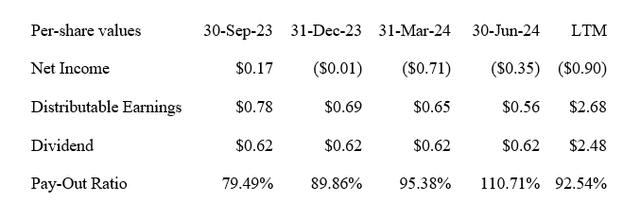

The rise in the CECL reserve combined with a poor distributable earnings performance as of late led the trust to apply a 24% haircut to its dividend. With that, Blackstone Mortgage Trust did not only deal a blow to passive income investors, but also blemished a stable $0.62 per share dividend payment record that lasted for almost nine years.

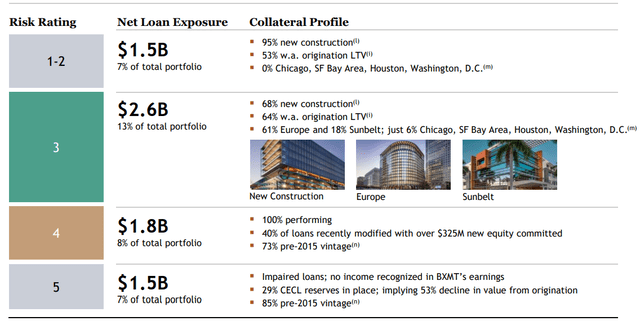

This might not be the last dividend cut, as Blackstone Mortgage Trust continues to have a lot of investments in the office loan segment, but the odds of another dividend cut are lower. About 7% of the trust’s office investments have a risk-rating of 5, meaning there are not producing any income. These investments are either going to get written off or the trust may decide to take a loss and sell them to distressed debt investors.

Risk Rating (Blackstone Mortgage Trust)

The Safest Dividend Is The Dividend That’s Just Been Cut

Blackstone Mortgage Trust did not earn its dividend in the second quarter, thanks to the successive increase in the trust’s credit loss reserve. The dividend pay-out ratio in 2Q24 was 111% so Blackstone Mortgage Trust was not able to cover its dividend which created pressure for a dividend realignment.

This dividend was already threatened in the last quarter when the dividend pay-out ratio rose from 90% to 95% amid the trust’s loan problems. Hence, the logical conclusion for Blackstone Mortgage Trust was to lower its pay-out drastically: The new dividend, which has been reset at $0.47 per share per quarter, will get paid for the first time in the third quarter.

Blackstone Mortgage Trust announced simultaneously that it would repurchase up to $150 million of its class A common stock likely in an attempt to cushion the blow from the dividend realignment.

Dividend (Author Created Table Using Company Supplements)

24% Discount To Book Value

There are two reasons why I am modifying my stock classification from ‘Hold’ to ‘Buy’:

The first is that I truly think that the mortgage real estate investment trust, after it slashed its dividend by 24%, now offers a much safer dividend. The leading dividend pay-out ratio is 84% (based on 2Q24 distributable earnings) which actually incorporates a decent-sized margin of safety.

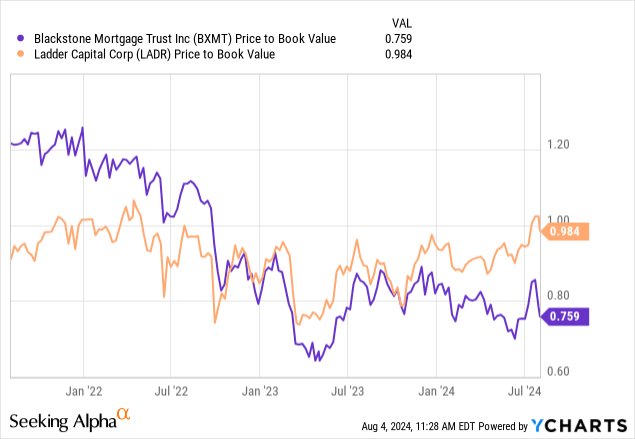

The second reason is that Blackstone Mortgage Trust’s stock is still selling at a rather exaggerated discount to book value, in my view.

Presently, Blackstone Mortgage Trust sells for a 24% discount to book value which as of June 30, 2024 stood at $28.11. This book value, however, included a CECL reserve in the amount of $5.21 per share, leading to a net book value of $22.90 per share. This book value is what I see as Blackstone Mortgage Trust’s long-term intrinsic value estimate.

If Blackstone Mortgage Trust experiences more loan issues and write-offs, then the trust’s stock is set for a potential correction. If the trust can avoid it and sustain its dividend at the new level of $0.47 per share, I would anticipate a rerating to book value over the long-term.

Starwood Property Trust Inc. (STWD) and Ladder Capital Corp (LADR) don’t have such substantial loan issues and thus sell for higher book value multiples. From a rerating angle, I think BXMT is the most compelling, yet risky, investment in the sector. The 11% dividend yield compensates investors for the higher risk, however.

What Could Go Wrong Here?

Blackstone Mortgage Trust was not able to sustain its 62 cent per share dividend any longer which is unfortunate because the mortgage real estate investment trust has paid a stable dividend since October 2015.

Should Blackstone Mortgage Trust’s loan quality continue to deteriorate to such an extent that a second consecutive dividend cut becomes necessary, the stock could tank a lot further and sell for an even higher discount to book value.

My Conclusion

Blackstone Mortgage Trust might be an attractive investment for passive income investors after the mortgage real estate investment just slashed its dividend by 24% amid ongoing loan issues.

I think there is an argument to be made that the safest dividend is the one that’s just been cut, primarily because management obliterated its long and stable dividend record, and likely carefully reset its dividend at a level that it thinks is sustainable.

With Blackstone Mortgage Trust selling at a 24% discount to book value, I think the 11% dividend yield is actually quite interesting for passive income investors, but only for those that have a high risk tolerance.

Read the full article here