Investors in leading alternative asset manager Blackstone Inc. (NYSE:BX) have continued to outperform the S&P 500 (SP500) over the past year, registering a 1Y total return of more than 73%. Despite that, BX remains well below its November 2021 highs at the $150 level, notwithstanding its stellar performance.

BX has also significantly outperformed the SPX since I upgraded it in August 2023, assessing another opportunity to turn more constructive. However, that thesis was tested in October, as BX was also caught in the market downdraft, as the 10Y yield (US10Y) went above the 5% mark, spooking a selloff in BX.

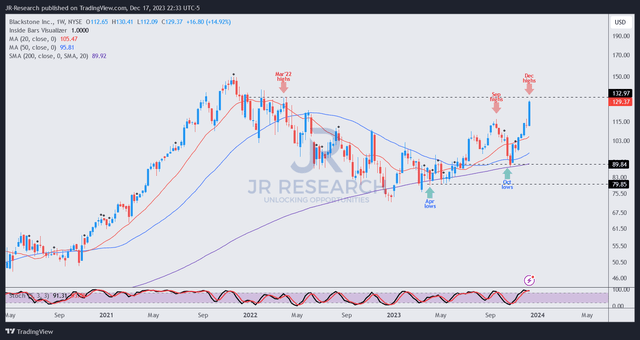

However, it proved to be an astute bear trap or false downside breakdown (see price action glossary), as dip-buyers returned with conviction, seeing relative appeal, as the 10Y also topped out in October. With BX recovering toward its early 2022 highs with the surge in December, I believe it’s timely for me to update investors on whether it’s still apt to add exposure.

Blackstone’s well-diversified alternative assets portfolio remains exposed to interest rate headwinds and tailwinds. The asset manager posted an invested performance eligible AUM of $211.9B in real estate solutions, comprising nearly 42% of the total $504.9B in invested performance eligible AUM in Q3. As a reminder, I highlighted in a recent 2024 outlook discussing the importance of assessing the potential benefits to cap rates in real estate due to possible Fed rate cuts in 2024. As a result, the surge in BX suggests that the market has markedly re-rated its real estate exposure, believing the worst could be over.

At a recent conference, management clarified the impact of cap rates on its portfolio and investor dynamics. Accordingly, Blackstone highlighted that “higher interest rates have recently led to higher cap rates and have affected investor portfolios.” However, given the high-quality plays in Blackstone’s real estate AUM, I believe the Fed headwinds that battered BX from its 2021 highs have reversed into tailwinds but arguably priced in quickly by the market. As a result, investors must anticipate and not wait until the Fed signals rate cuts before returning. If you waited, astute investors have snapped up the most attractive buy levels as BX bottomed out recently in late October 2023 (when the 10Y surged above 5%).

What’s alluring about BX is that the company has continued attracting inflows as its total AUM reached $1.01T in Q3. Of these, fee-earning AUM grew 4.1% over the past year, reaching $734.5B, notwithstanding the market volatility. Blackstone’s perpetual AUM saw a marked increase of 8% to $388.3B in Q3, underscoring the confidence of long-term institutional investors in Blackstone’s strategies. Given Blackstone’s market leadership as the world’s largest alternative assets manager by total AUM, it makes sense to remain vested as BX recovers from its 2022 battering.

Management highlighted several near- and long-term growth catalysts that could drive investor enthusiasm as the Fed headwinds subside. These include new fund launches, helping to bolster its fee-related earnings. In addition, Blackstone highlighted that it has accumulated “over $6 billion of net accrued carry on the balance sheet, which can become a significant earnings driver” as the market normalizes. Furthermore, the asset manager has confidence that the ongoing shift in portfolio reallocation in the market toward alternative assets should underpin the secular growth in BX, lifting its AUM higher and benefiting its earnings accretion.

With the initial re-rating as the market priced in the recent enthusiasm about the Fed rate cut possibility in 2024, investors will likely assess Blackstone’s earnings momentum moving forward. Wall Street analysts have penciled in a relatively high bar for Blackstone to clear over the next two years. Accordingly, Blackstone is expected to deliver a 38% improvement in distributable earnings per share in 2023, recovering from last year’s 24% plunge.

As a result, it suggests that the worst in Blackstone’s headwinds could be over, as the company’s AUM growth engine is expected to regain momentum as the market conditions normalize. In addition, analysts forecast its earnings to grow by another 20% YoY in 2025, reaching a record $6.50 in distributable earnings per share.

As a result, I’m not surprised that BX is assigned an “F” valuation grade by Seeking Alpha’s Quant, suggesting significant optimism at the current levels relative to its sector peers. BX last traded at a forward distributable earnings per share multiple of nearly 27x, well above its 10Y average of 15.5x. In other words, it makes sense to be cautious about BX at the current levels, as its valuation has gotten into the frothy zone. Still, I see no clear sell signals (red flags) suggesting I should cut significant exposure immediately.

BX price chart (weekly) (TradingView)

I assessed that BX remains in a favorable medium-term uptrend, although I would welcome a pullback with the recent surge as seen at its December highs. BX is inching closer to re-testing its March 2022 highs at the $133 level.

Accordingly, BX’s price action demonstrates robust uptrend signals at crucial support levels, forming higher lows and higher highs over the past year. As a result, I have confidence that investors who missed buying BX’s most attractive dips over the past year should capitalize on its next pullback (the steeper, the better) and add exposure as it continues its recovery toward its all-time highs.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here