As one of the few analysts who can claim to have been on the ‘higher for longer’ bandwagon since the beginning of the year, the recent surge in long-term interest rates may seem like an opportunity to take a victory lap. However, I do not feel joy in seeing investors’ hard-earned capital get vaporized after following other analysts who kept saying bonds were a buy. In fact, one regret I have is that my follower-base on Seeking Alpha is not broader, so I was not able to warn more investors against taking excessive duration risk in the face of the Federal Reserve’s stated goal of raising interest rates ‘higher’ and maintaining them for ‘longer’.

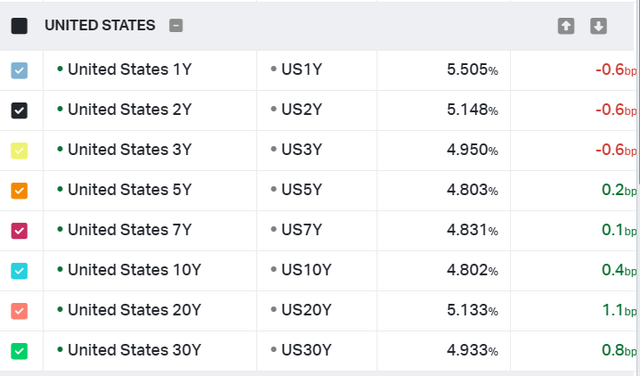

However, with long-term interest rates, as measured by the 10 year treasury yield, recently hitting 4.8% vs. 4.1% when I last published on the Vanguard Long-Term Bond ETF (NYSEARCA:BLV), is now a good time for investors to buy long-term bonds like the BLV ETF and ‘lock-in’ these seemingly high yields (Figure 1)?

Figure 1 – U.S. yield curve (koyfin.com)

Brief Fund Overview

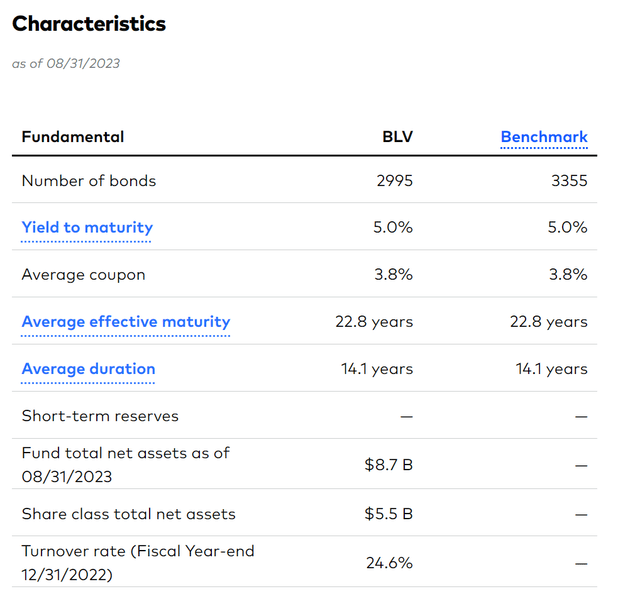

The Vanguard Long-Term Bond ETF provides investors with exposure to long-duration treasuries and corporate bonds. The BLV ETF tracks an index of U.S. government and investment grade (“IG”) corporate bonds with maturity greater than 10 years. In fact, the BLV ETF is the longest duration bond ETF out of the Vanguard family, with a portfolio average duration of 14 years (Figure 2).

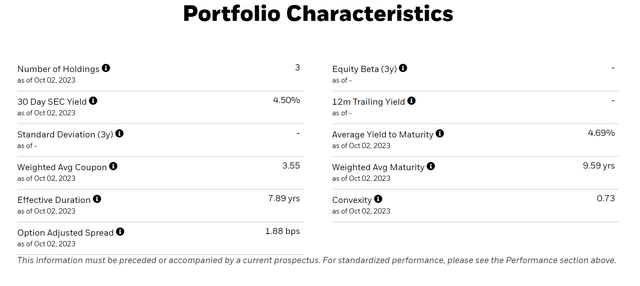

Figure 2 – BLV overview (vanguard.com)

With a 5% yield to maturity, investors buying the BLV ETF today may think they are ‘locking in’ a 5% yield for the next 23 years. However, that line of thinking could be a mistake.

Bond Funds Are Not Bonds

First, investors need to recognize that a bond fund like the BLV ETF is not an actual bond with a fixed maturity that they can ‘earn’ a steady yield on until maturity. In fact, bond funds like the BLV typically maintain their average duration, for example, the BLV ETF has a 14 year duration. As time passes and bonds in BLV’s portfolio gets closer to maturity, the BLV ETF will sell shorter duration bonds and replace them with longer duration bonds to maintain its average 14 year duration. This explains the fund’s 25% annual turnover rate.

This is quite different from buying individual 10 year treasury bonds at 4.8% yield and earning that yield annually until the bond matures in 2033.

In the latter case, as long as investors have the wherewithal to hold the bond until maturity, they will earn 4.8% per annum, irrespective of where interest rates end up in the interim.

However, a fixed duration bond portfolio like the BLV ETF may pass through realized gains and losses to investors as interest rates fluctuate. Furthermore, while BLV’s duration is relatively constant at 14 years, an individual bond’s duration will decrease as time passes. Hence while the BLV ETF may have similar interest rate risk compared to a 14 year bond in year 0, by year 5 or 6, the interest rate sensitivity of the individual bond will be much lower than the ETF.

What Will The Fed Do?

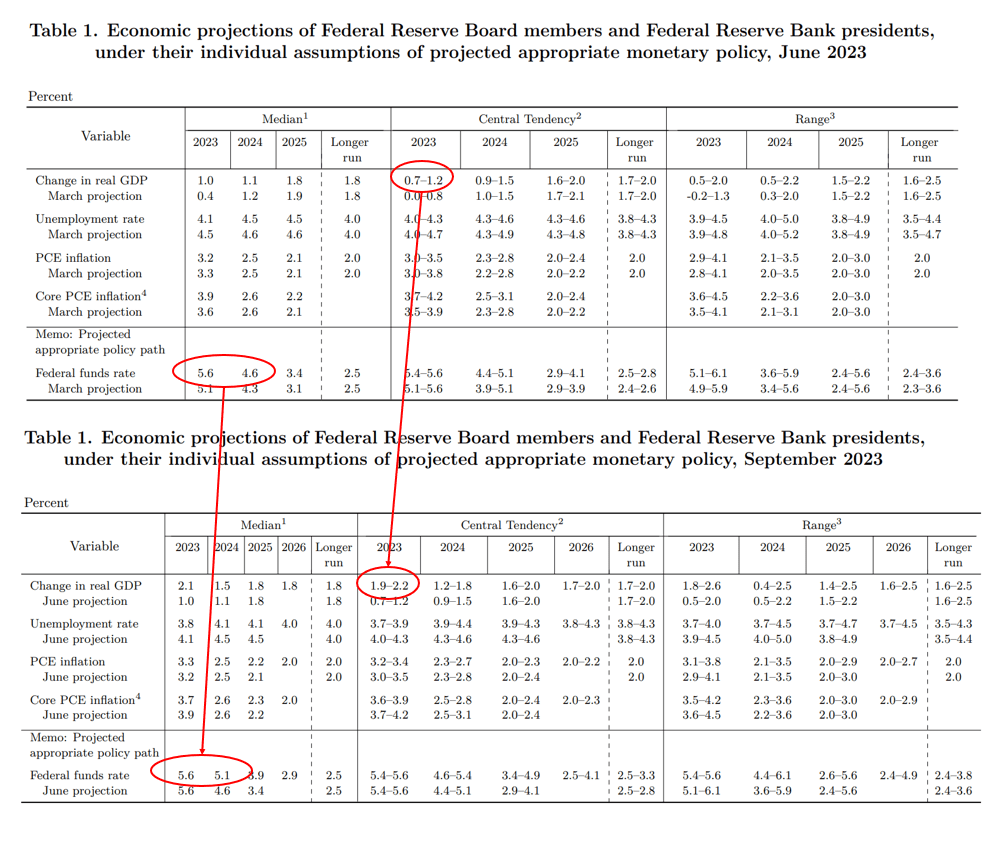

Another important risk to consider is whether the Federal Reserve will continue raising interest rates or hold interest rates steady. If we look at the Federal Reserve’s latest Summary of Economic Projections (“SEP”) compared to the June SEP, the FOMC participants have raised their 2024 Fed Funds rate projection from 4.6% to 5.1%. Their 2023 Fed Funds rate projection remains the same at 5.6% (Figure 3).

Figure 3 – Comparison between June and September SEP (Author created)

This means that based on the Fed’s latest estimates, they may need to raise interest rates one more time, and keep interest rates high for most of 2024.

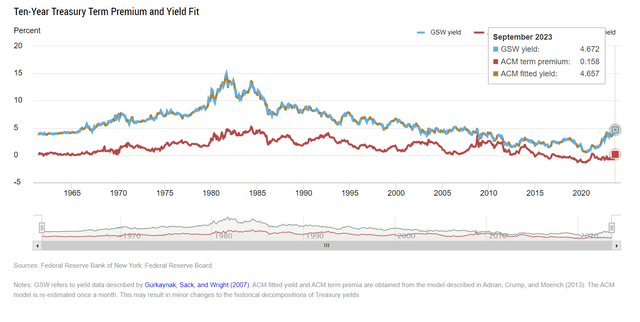

If we take the Fed at their word, this implies 10 year yields will need to rise to above 5%, since the yield of treasury bonds can be considered as composed of short-term treasury yields plus a term premium. Term premium is defined as the compensation that investors require for bearing the risk that interest rates may change over the life of the bond.

Since term premium cannot be observed directly, investors typically use models to estimate term premium over time. According to the New York Fed, the term premium on 10-year treasury securities was historically positive, although it dipped negative from 2016 to recent months (Figure 4).

Figure 4 – New York Fed estimate of 10 year term premium (newyorkfed.org)

So investors ‘locking-in’ treasury bond yields at 4.8% may be a little premature.

Consider iBonds If You Must Lock In Yields

Instead of a fixed-duration bond fund like the BLV ETF, investors who really want to ‘lock-in’ current yields should buy individual bonds, or consider the suite of iBonds from iShares to build their own non-rolling bond ladders. For example, the iShares iBonds Dec 2033 Term Treasury ETF (IBTO) is an inexpensive ETF of treasury bonds with 2033 maturities. Unlike the BLV, the IBTO ETF will more or less perform like a 10 year treasury bond, allowing investors to ‘lock-in’ a 4.7% yield until 2033 (Figure 5).

Figure 5 – IBTO portfolio overview (ishares.com)

The benefit of owning IBTO over a treasury bond is that ETF like the IBTO can offer instant liquidity whereas individual treasury bonds may be harder to sell once they become ‘off the run’.

Risk To My Call

The biggest risk to my cautious call on the BLV ETF is if long-term interest rates decline, then investors may have missed an opportunity to buy a multi-year high in yields. Yields could go lower if the U.S. economy performs worse than expected, requiring the Fed to pivot to an easier monetary stance. Alternatively, higher long-term yields may cause financial assets to ‘break’, like they did in March, sparking a systemic risk event requiring the Fed to step in to buy bonds.

However, so far, although equity prices have corrected ~9% from their July peaks, the S&P 500 is still up 12% YTD so expecting intervention from the Federal Reserve may be premature. Until we get a March-like systemic event with the failure of regional banks, the pressure may continue to build for higher yields.

Conclusion

While investors may be tempted to ‘lock-in’ the current 4.8% treasury yields, the highest in the past decade, I think that thinking may be a little premature. If we take the Fed at their word, 10-year treasury yields may need to go north of 5%, assuming treasury bond yields are composed of short-term yields plus a term premium.

Furthermore, to truly ‘lock-in’ current yields, investors may need to buy individual bonds or term bond funds like the IBTO ETF. The BLV ETF, being a fixed-duration fund, may not deliver the expected returns profile that investors are hoping to ‘lock-in’.

Although we are getting closer, I suspect long-term bond yields may need to widen a bit more before truly reaching a peak. I remain cautious on the BLV ETF in the meantime.

Read the full article here