The Vanguard Total International Bond ETF (NASDAQ:BNDX) is a simple international bond index ETF. BNDX’s 1.9% yield is incredibly low, and much lower than that of its peers. Although dividends have risen these past few months, they remain quite low. Although the fund does provide some diversification, most large bond funds are diversified enough, in my opinion at least. As BNDX provides almost no important benefits for shareholders right now, I would not be investing in the fund at the present time.

BNDX – Quick Overview

BNDX is an international bond index ETF. It provides investors with diversified exposure to said industry segment, with investments in dozens of countries and thousands of bonds. It is a currency-hedged fund. BNDX focuses on developed markets, Europe and Japan.

BNDX

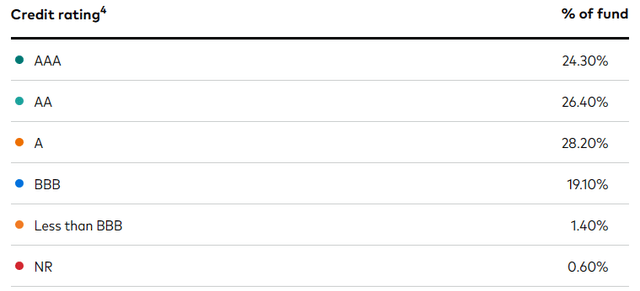

BNDX focuses on investment-grade bonds, with strong credit ratings. It does have some non-investment grade bonds, almost certainly downgraded bonds which should be sold in short order.

BNDX

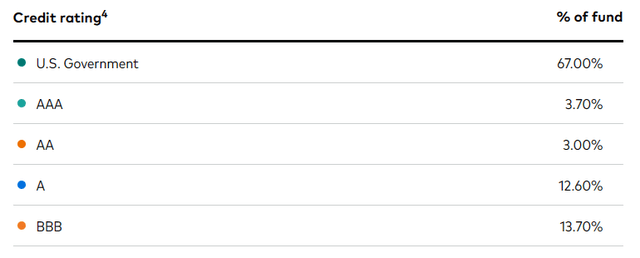

Credit quality seems materially weaker than BND, although as both funds focus on government securities, this is very hard to gauge. Treasuries are generally considered the safest asset of them all, although the U.S. Federal Government does sometimes seem dangerously close to a self-inflicted default. Perhaps international government bonds are safer, although I would personally stick to treasuries.

BND

Besides the above, nothing much else stands out about the fund’s portfolio.

BNDX – Yield Analysis

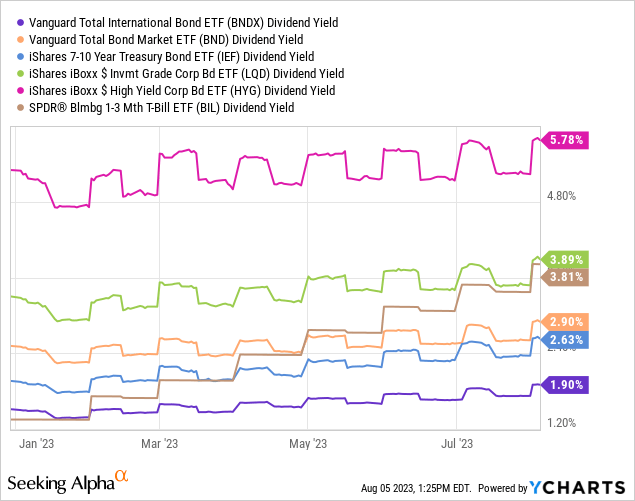

BNDX currently sports a dividend yield of just 1.9%. It is an incredibly low yield on an absolute basis, and much lower than that of most of the fund’s peer, and most major bond sub-asset classes.

Other yield metrics show a similar pattern.

BNDX sports an SEC yield, a standardizes measure of a fund’s underlying generation of income, of just 3.3%. It is a very low SEC yield, and more than one percentage point lower than BND’s 4.5%.

Lots of asset classes yield more than BNDX, including T-bills, with yields of 5.2% – 5.6%, and I bonds, with inflation-protected yields of 4.3%. Several banks offer savings accounts with rates in the 4.5% – 5.0% range, with CD rates a smidge higher.

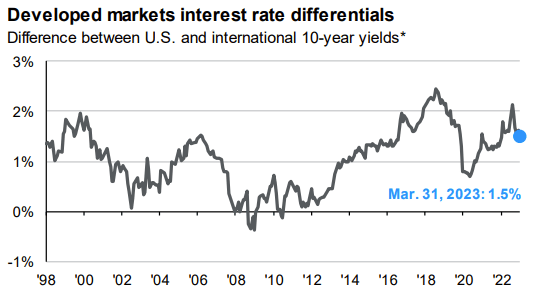

In my opinion, BNDX’s low dividends are partly reflective of underlying economic conditions, and partly a market dislocation. Specifically, U.S. treasuries yield more than comparable international government bonds, so funds focusing on the latter (like BNDX) should yield less than those focusing on local bonds.

JPMorgan Guide to the Markets

There is a catch, however. BNDX uses currency hedges, and these instruments are priced in such a way as to ensure rough interest rate parity between similar securities of different currencies. In simple terms, credit markets are structured in such a way that the risk-adjusted yields on most bonds are as similar as possible. Currency-hedged German or Japanese government bonds are of (roughly) comparable risk to treasuries, and so their yields are (roughly) the same. The percentage point gap in BNDX and BND’s yield seems a bit high, considering these issues.

Notwithstanding the above, in my experience, some small yield differentials do occur. European and Japanese economies tend to sport lower interest rates than the U.S., due to aging populations, and these tend to persist even after currency risk is hedged away. At the same time, Japan explicitly sets long-term bond rates through yield curve control measures, which distorts prices and yields in these markets. All things considered, BNDX should yield less than BND, and that is indeed the case, although the difference in yield seems higher than expected.

BNDX’s comparatively low yield is a significant negative for the fund and its shareholders. It is also, in my opinion, a deal-breaker: the fund simply yields too little for it to be a worthwhile investment. I might be willing to overlook a low yield for a fund with strong potential capital gains, but BNDX is not one such fund.

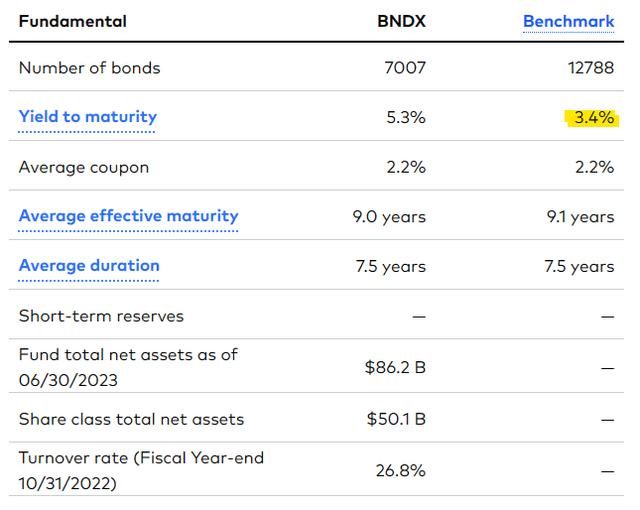

As an aside, and in the interest of full disclosure, Vanguard claims that BNDX sports a yield to maturity of 5.3%, one full percentage point higher than BND’s 4.3% figure. BNDX’s yield to maturity seems implausibly high, and is inconsistent with other fund and industry metric. BNDX’s coupons, SEC yield and dividend yield are all much lower than its yield to maturity. The fund’s own benchmark sports a much lower yield to maturity as well.

BNDX

In my opinion, and considering the above, BNDX’s stated yield to maturity is either a data error, or an accounting issue. It is simply implausible for an index fund to have a yield 2.2% higher than the index it is tracking.

BNDX – Diversification Analysis

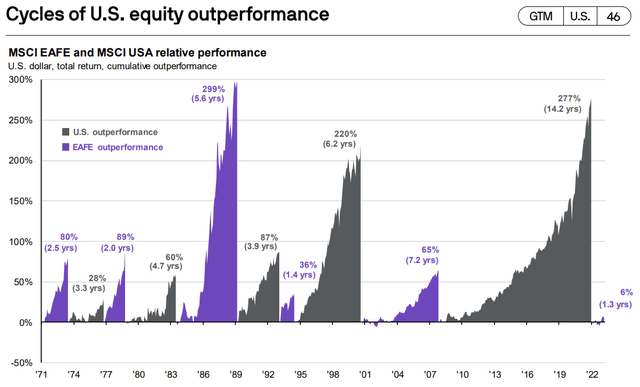

International equities can serve to diversify the equity portfolios of most U.S. investors, reducing risk and boosting risk-adjusted returns. In some cases, international equities can significantly outperform U.S. equities too, as was the case in the 2000s, as the dot-com and housing bubble both led to sizable losses in U.S. equity markets. U.S. equities tend to go through cycles of outperformance and underperformance, and some international equity exposure can serve to ensure strong portfolio returns throughout the entire cycle:

JPMorgan Guide to the Markets

International bonds offer some diversification as well but, in my opinion, the benefits of this are much more limited. Default rates for investment-grade bonds, especially government bonds, are very close to zero, so possible losses are very close to zero too. International diversification would reduce potential losses from the default of any one individual U.S. issuer, but these are incredibly low regardless, so the impact of this is not terribly beneficial.

Correlations between U.S. and international bond prices and yields are very high as well, due to the aforementioned interest rate parity phenomenon, and as central banks policies tend to mirror each other. If the Fed is hiking, then the ECB is most likely hiking as well.

Due to the above, I don’t believe that including international bonds in an investor’s portfolio will meaningfully decrease risk or boost risk-adjusted returns. There will almost certainly be some benefits to international diversification, but these seem too small to matter, to me at least.

Conclusion

BNDX is a simple international bond index ETF. As the fund’s 1.9% dividend yield is incredibly low, I would not be investing in the fund at the present time.

Read the full article here