Introduction

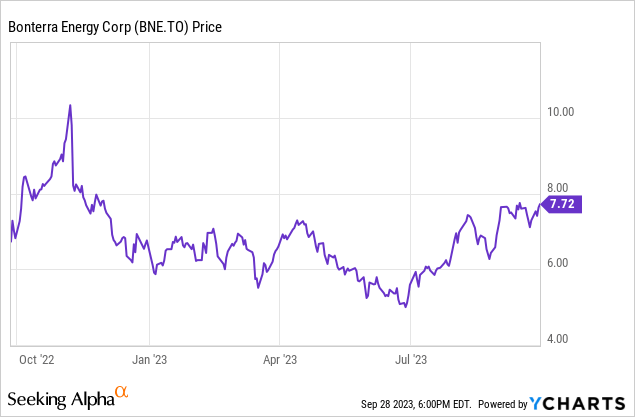

I have been keeping an eye on Bonterra Energy (TSX:BNE:CA) (OTCPK:BNEFF) for quite a while now, as this company provides an excellent torque on the oil price. As the Canadian company still had to work on repairing its balance sheet, the share price remained pretty flat in the first half of the year, but the recent strong oil price means the stock is currently trading about 40% higher than the mid-C$5 level it was trading at when my previous article was published.

A look at the Q2 results, and extrapolating those to Q3

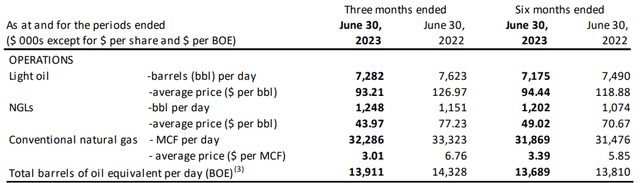

In the second quarter of the year, Bonterra produced a total of just under 14,000 barrels of oil-equivalent per day and just over 50% of the oil-equivalent production consisted of light oil. NGLs represented about 9% while the natural gas production represented approximately 40% of the oil-equivalent production rate.

Bonterra Investor Relations

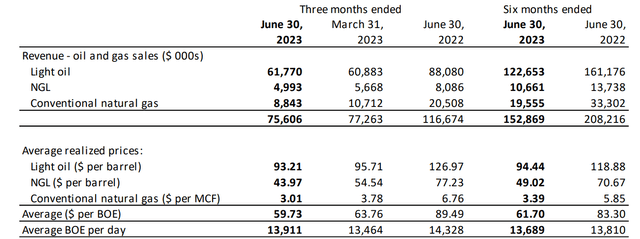

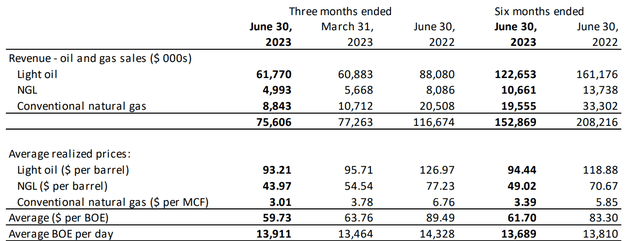

The oil was sold at just over C$93 per barrel, while the NGLs fetched a price of C$44 per barrel. It wasn’t a surprise to see the average realized natural gas price come in substantially lower than in the first quarter of this year and the second quarter of last year. The average realized natural gas price in the second quarter was just C$3.01. And due to that low natural gas price, the total contribution to the revenue from natural gas sales was just under 12% despite representing about 40% of the output.

Bonterra Investor Relations

This means that while the natural gas price could provide a nice booster, Bonterra should still primarily be seen as an oil producer, as this represents about 75% of the total revenue.

Bonterra Investor Relations

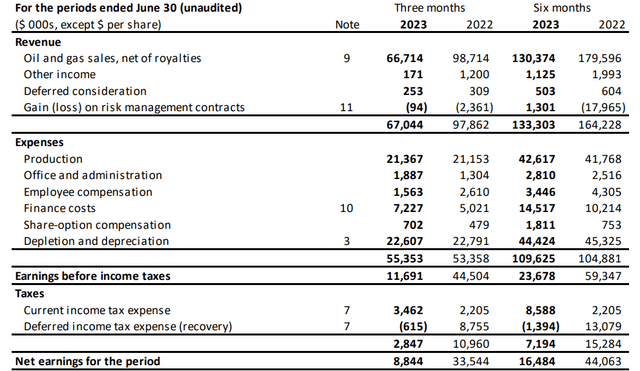

That total revenue came in at C$67M net of royalties, and as the total production costs were still just around C$21.4M (for an average of just C$17 per boe), the company posted a pre-tax income of C$11.7M, including a C$22.6M depreciation and depletion expense.

Bonterra Investor Relations

This indeed meant the company’s bottom line also clearly showed Bonterra Energy was profitable. The total net profit was C$8.8M, or C$0.24 per share. A good result and, as anticipated, the positive free cash flow result helped to further strengthen the balance sheet.

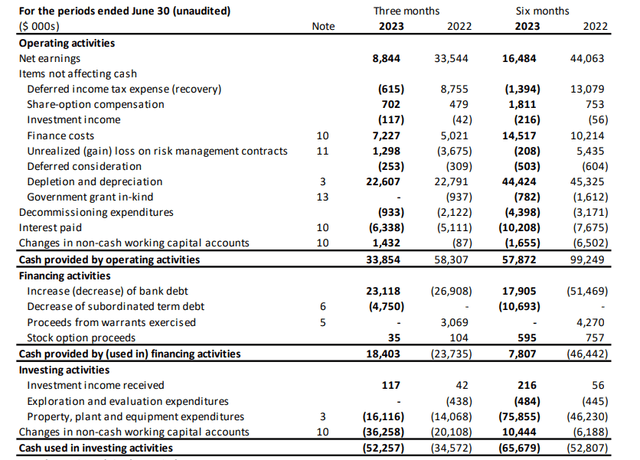

In the second quarter of the year, Bonterra reported a total operating cash flow of C$33.9M and as you can see below, the total capex was just C$16M. This means the underlying cash flow was approximately C$17.8M and approximately C$16.4M excluding the working capital changes.

Bonterra Investor Relations

Keep in mind, the second quarter was very capex-light. As you can see in the image above, the total capex was just a fraction of the C$59M spent in the first quarter. Bonterra has confirmed it expects a full-year capex of C$120-125M, which means the average quarterly capex will likely be around C$30M. This means the company’s underlying free cash flow would be just a few million dollars.

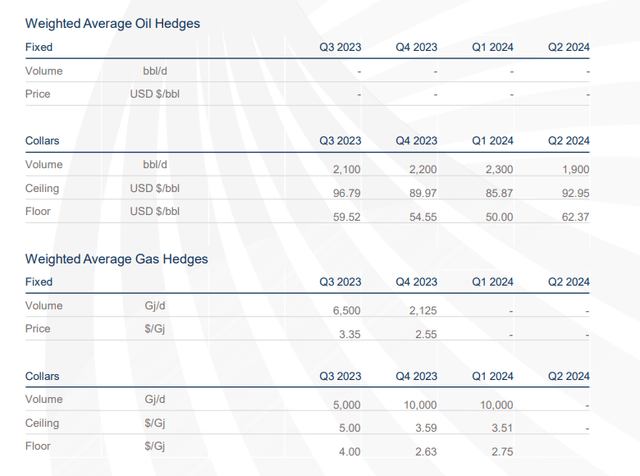

However, the oil price is now trading substantially higher than in the second quarter of this year, and that’s why I thought Bonterra provided an excellent torque on the oil price. As mentioned above, the average received oil price was approximately C$93 per barrel in the second quarter. With the WTI oil price at around US$91/barrel right now, the equivalent price in Canadian Dollar is approximately C$120. The average price was C$99/barrel in July and C$106/barrel in August. This means it is not unthinkable to see an average oil price of C$107-110 per barrel during this quarter. That’s about C$15/barrel higher than in the second quarter of the year and even after deducting the applicable royalties, we can likely expect the operating cash flow to be about C$5-6M higher on a quarterly basis thanks to the higher oil price. There are some hedges in place (see below), but the ceilings are high enough to benefit from the current strong oil price.

Bonterra Investor Relations

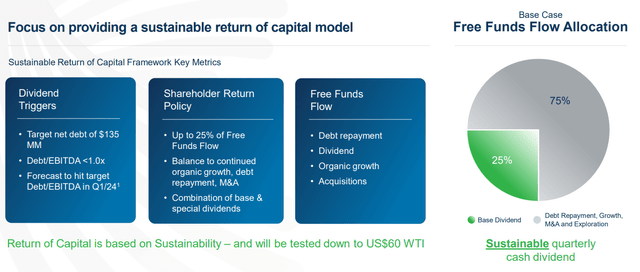

Although the company hasn’t met its debt targets yet, the company announced a rebranding and a renewed focus on shareholder rewards. Once the net debt level decreases to C$135M (a level which it anticipates to reach in the first quarter of 2024), about 25% of the free funds flow will be used to pay dividends.

Bonterra Investor Relations

This means that at the current oil price and a slightly higher production rate in 2024, the company could be on its way to a C$13-15M dividend payment, which would work out to a C$0.35-0.40 dividend per share.

Investment thesis

I currently have a small long position in Bonterra Energy to benefit from the higher oil price. But as this is a small position, I am not sure what I will do with it. While the stock is still attractively priced (and thus a ‘buy’ status is still warranted), I don’t like my portfolio to be too fragmented and in the next few weeks or months I will have to make a decision whether I should sell this position and buy into another oil company, or if I need to further increase my position in Bonterra.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here