Just over a year ago, I wrote on Boot Barn (NYSE:BOOT), noting that significant negativity was already priced into the stock after its ~55% correction and that any pullbacks below $55.00 would provide buying opportunities. Since then, the stock has massively outperformed its small-cap peers in the Retail Sector (XRT), rallying nearly 100% off this buy zone before peaking in early August at $104.00 per share. This impressive share price performance can be attributed to the company’s impressive execution against its long-term goals with exceptional exclusive brand penetration (~$550+ million in FY2023), continued margin expansion on a trailing-five-year period and considerable white space with some of the best unit economics sector-wide (~1.5-year payback on new stores). In this update, we’ll look at the company’s most recent results, how its valuation stacks up after its sharp correction, and whether the stock is offering a margin of safety.

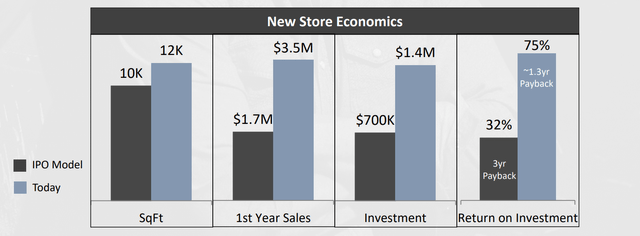

Boot Barn, October 2022 Update – Seeking Alpha Premium/PRO

Recent Results & FY2024 Outlook

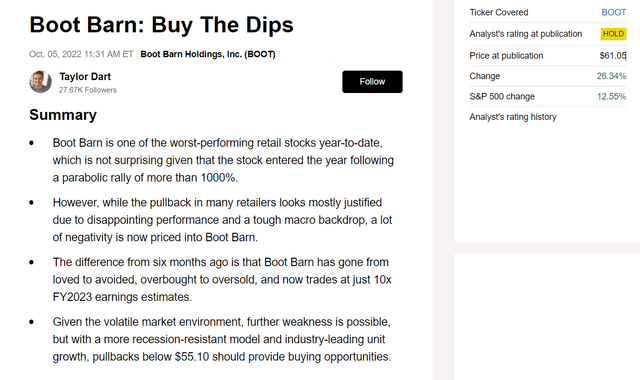

Boot Barn released its fiscal Q1 2024 results in August, reporting quarterly revenue of ~$383.7 million, a 5% increase year-over-year. While this was a sequential decline from the 11% reported in fiscal Q4 2023, it’s important to note that the company was up against some steep comps by lapping fiscal Q1 2023, coming up against 19% growth, translating to a two-year average sales growth rate of 12%. In addition, the macro outlook certainly hasn’t improved for the average consumer even if Boot Barn benefits from having a large chunk of its assortment considered to be ‘functional’, with personal savings rates continuing to trend lower in the United States, landing at 3.9% most recently, down from a peak of 5.2% last year. Plus, these sales figures certainly are better than what we’ve seen from several other retailers, with a two-year stacked comp sales growth of 7.1% easily beating American Eagle (AEO) and Foot Locker’s (FL) negative two-year stacked comp sales growth.

Boot Barn – Quarterly Revenue – Company Filings, Author’s Chart

Digging into the results a little closer, the company noted that its AUR was up in the period which helped with merchandise margin expansion, and the company has continued to grow rapidly as a percentage of sales, up 1600 basis points vs. fiscal Q1 2021 levels to ~38%. And while the company did see some margin pressure due to a deleverage in buying, occupancy, and DC costs, gross margins still came in at a very respectable 37.0%, up nearly 1000 basis points on a 3-year basis. Finally, on development, the company opened 16 new stores, is tracking at ~30% of planned store openings for the year (16/52), and expects to end the year at ~400 stores, giving it one of the highest unit growth rates in the Retail Sector.

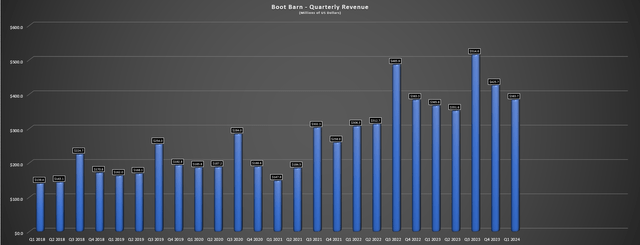

That said, while the results were quite satisfactory and the company’s growth has been nothing short of incredible, Boot Barn is expecting to have a choppier year for sales with an expected same-store sales decline of 4% in FY2024 at the mid-point (previously 4.5%), and with total net sales of ~$1.73 billion (up 2% from previous outlook). Fortunately, this is not going to weigh nearly as much on earnings as some of its peers that have had to be more promotional over the past few years, and annual EPS may be declining vs. its peak in FY2022 ($6.18), but will still be up ~170% from FY2021 levels if the company can meet its guidance midpoint for annual EPS at $5.20. This strong earnings retention can be attributed to continued margin improvement from exclusive brand penetration (1000 basis point better margins vs. third-party brands) and the company is forecasting even further growth in this category this year.

Boot Barn – Exclusive Brand Sales – Company Presentation

Long-Term Potential

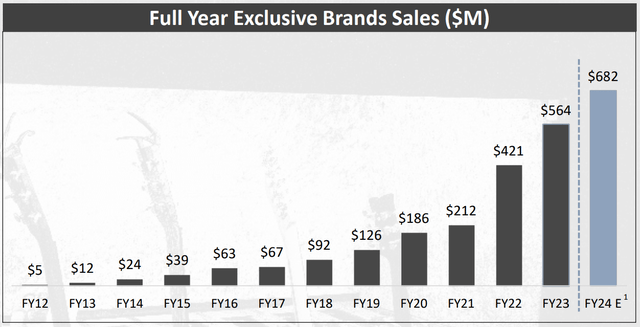

Moving over to the company’s long-term potential, the company believes it has significant room to grow given that it’s the leader in a $40 billion industry and is confident that it can grow to up to 900 stores in the United States (125% growth vs. year-end 2024 store count estimates). Notably, unlike some companies that are growing with mediocre unit economics and 4+ year paybacks, Boot Barn’s rapid growth is supported by consistently improving unit economics, with the company growing square footage from 10,000 to 12,000 since its IPO model concept, but more than doubling 1st-year average sales to ~$1.7 million and improving its return on investment to ~75% (1.3-year payback) vs. 32% previously. These unit economics are incredible, and stack up against some of the best brands in the sector, like Aritzia (OTCPK:ATZAF) which recently cited sub-1-year paybacks at its Tampa location, and Wingstop (WING) with less than two-year paybacks on its stores.

Boot Barn – Store Economics – Company Website

Outside of these exceptional economics, Boot Barn also continues to receive glowing reviews when it comes to awards, ranked as America’s Best Retailer in 2023 and Best Clothing Retailer, with a ~95% score, coming in ahead of other iconic brands like Dior, LEGO, Dooney & Burke, and Von Maur. So, with strong customer satisfaction scores, industry-leading unit growth, and consistent positive same-store sales growth, there’s no reason to believe the company can’t achieve its lofty goals. And assuming the company can continue to consistently grow its store count and benefit from similar or higher exclusive brand penetration, Boot Barn could easily generate $8.00+ in annual EPS long-term. Finally, it’s worth noting that the company has managed to accomplish its growth with low debt, not leveraging up like others to make major acquisitions or borrowing heavily at high rates to fund growth.

That said, this is a market where small caps are detached from fundamentals and most investors are unwilling to pay up for growth as they have in the past. And while Boot Barn has a strong investment thesis, I don’t think it’s ever been more important in the past decade to ensure an adequate margin of safety. Let’s take a look at the valuation below:

Valuation

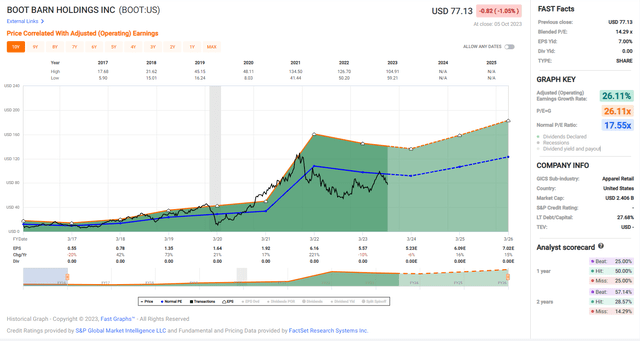

Based on ~30.5 million shares and a share price of $79.00, Boot Barn trades at a market cap of ~$2.41 billion and an enterprise value of ~$2.81 billion. This places it in a similar position to peers in the Retail Sector like American Eagle, Urban Outfitters (URBN), and Nordstrom (JWN) from a capitalization standpoint, but Boot Barn stands out exceptionally well vs. these peers with it managing to 10x annual EPS since 2017, trouncing the relatively low growth rates of this peer group. Not surprisingly, these higher growth rates and phenomenal execution have helped the stock to command a premium multiple vs. its peers, evidenced by its trading at a mid-double digit forward P/E ratio vs. many of its peers trading at an average forward earnings multiple of ~9.0. And as we can see below, Boot Barn has historically traded at ~17.5x earnings, which would normally suggest that the stock is undervalued at current levels (~15.0x forward earnings vs. ~17.5x historically).

Boot Barn – Forward Estimates & Historical Earnings Multiple – FASTGraphs.com

That said, the current environment differs materially from the last decade, and when investors can collect a risk-free ~4.7%, I think it’s best to use a discount to historical multiples to value stocks, unless rates will be cut imminently. Given that this doesn’t appear to be the case, I think a more conservative multiple for Boot Barn is 14.0x forward earnings, a 20% discount to its historical multiple. And while the stock may be ~25% off its highs, the stock is still trading at ~15.0x FY2024 earnings and ~17.2x forward free cash flow on an enterprise value basis, suggesting not nearly enough margin of safety at current levels. Hence, I would argue that a fair value for the stock even if we look forward to FY2025 is $86.00 per share, pointing to only 10% upside from current levels.

Although this points to some upside to its fair value estimate, I prefer to wait for a significant margin of safety when buying small and mid-cap stocks, and when it comes to sub $5.0 billion capitalization names, I am looking for a minimum 25% discount to fair value. If we apply this discount to Boot Barn, this points to an ideal buy zone for the stock of $65.00 or lower, suggesting the stock would need to decline much further to drop into a new low-risk buy zone. Obviously, I could be wrong here and I may be too conservative, with no guarantee that the stock drops back to these levels. However, I prefer to buy companies when they’re hated and trading at a massive discount to fair value, and while this was the case last October for Boot Barn, I don’t see this as the setup today, which in my view makes other names like Pet Valu (PET:CA) that are less sensitive to the macro environment (staples tilt) and far more hated as more compelling reward/risk setups.

Summary

Boot Barn is one of the better-run names in the small-cap Retail Space and the company has done an impressive job of delivering against its targets over the past several years. This is evidenced by a near-tripling of revenue growth from 2016 to 2023 while increasing gross margins by over 500 basis points in the period. However, while the stock was offering a considerable margin of safety last year as it plummeted ~60% from its highs, that same setup isn’t available today, with Boot Barn trading at only a slight discount to its historical multiple and this historical multiple arguably being rich given the interest rate environment we’re in today. So, while I see BOOT as one of the top-10 names in the Retail Space given its ability to over-deliver on promises, I would need to see a pullback below $65.00 to get more interested in the stock from a valuation standpoint.

Read the full article here