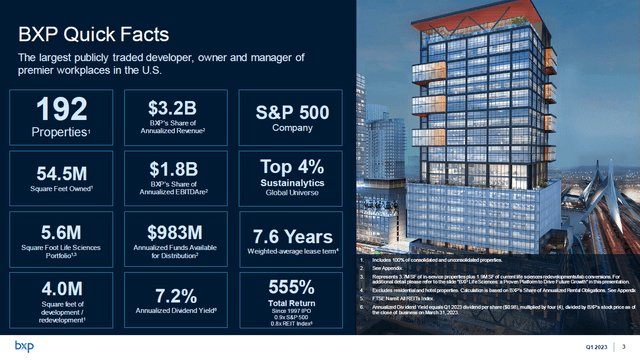

In the post-COVID world, the relevance of commercial office properties is in question as hybrid and remote working arrangements have proliferated and appear to be here to stay. With that in mind, I’m not listening to the doomsayers as it concerns Boston Properties, Inc. (NYSE:BXP) as this REIT is better positioned than most to navigate the new landscape for office properties with its cash flow generating abilities firmly intact. Boston Properties invests in corporate office properties in six key US metropolitan markets including San Francisco, Los Angeles, and Seattle in the West Coast and Washington DC, Boston, and New York in the East Coast. Its portfolio consists of ~190 properties that cater to a diverse tenant base. Shares of Boston Properties are down ~36% on a price-only basis over the past year as of this writing, though more recently BXP has started to perk up a bit as the outlook isn’t as gloomy as some fear, marking a nice entry point for investors.

An overview of Boston Properties. (Boston Properties Inc – 2023 NAREIT REITweek IR Presentation)

Growing Exposure To Life Sciences

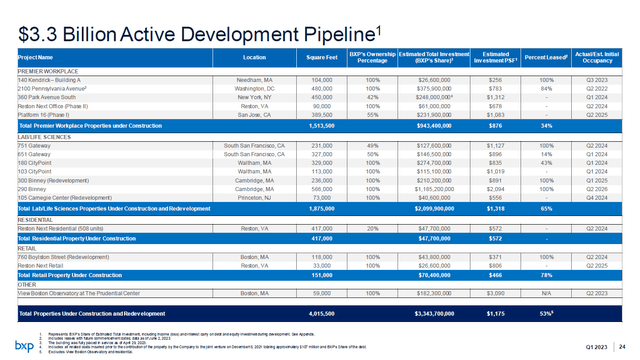

Boston Properties has around 4.0 million cubic feet in development and re-development activity underway worth $3.3 billion. These new and revamped assets are over 50%+ preleased out (excluding the View Boston Observatory at The Prudential Center), and several are completely leased up as you can see in the upcoming graphic down below. Real estate that caters to the life sciences industry is a major growth opportunity for Boston Properties and represents a little under half of the REIT’s development activity in terms of square footage. Entities operating in the life sciences space generally need to go to the office/lab (all of the expensive equipment that’s required to innovate and test new science concepts is located at the lab) and that dynamic is unlikely to ever change, indicating leased rates and thus the cash flows from these types of properties should remain strong over the long haul.

Boston Properties’ development pipeline includes many life sciences real estate projects. (Boston Properties Inc – 2023 NAREIT REITweek IR Presentation)

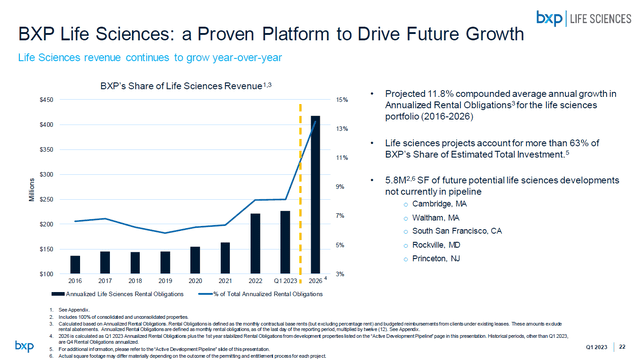

These developments will join Boston Properties’ portfolio that houses around 54.5 million cubic feet of rentable space. Bringing its development pipeline online in a timely manner should help drive the REIT’s cash flows higher over the coming years. By 2026, Boston Properties forecasts that its life sciences property portfolio will represent over 13% of its total annualized rental obligations, up from ~8% currently. Please note that acquisition and divestment activity could impact this trajectory, though the broader trend of the REIT growing its exposure to life sciences will remain.

Boston Properties’ exposure to the life sciences industry is set to grow materially over the coming years. (Boston Properties Inc – 2023 NAREIT REITweek IR Presentation)

Financial Considerations

In the first quarter of 2023, Boston Properties’ GAAP revenues grew by 6% year-over-year to reach $803 million though its non-GAAP funds from operations (‘FFO’) declined by 5% to hit $272 million. The rise in its revenues was driven in part by the leased rate of its company-wide portfolio growing from 89.1% at the end of March 2022 to 91.0% at the end of March 2023, though its FFO took a hit due to rising operating and financing expenses. Its FFO per share came in at $1.73 in the first quarter of 2023, down from $1.82 in the same period last year.

More recently, things have started to look up for the REIT as Boston Properties raised its full-year guidance during its first quarter earnings update. Now it expects to generate $7.14-$7.20 in FFO per share in 2023, up from prior guidance of $7.08-$7.18. While its current 2023 FFO per share guidance is 5% lower than its 2022 result at the midpoint of guidance, it’s still up substantially from the $6.56 in FFO per share the REIT posted in 2021.

The projected decline in its FFO from 2022 to 2023 is primarily due to Boston Properties contending with rising interest expenses (which were up 33% year-over-year in the first quarter of 2023) as a result of the Federal Reserve raising its benchmark rate to combat inflation. As signs are emerging that the cycle of interest rate hikes in the US may be coming to an end, that will go a long way in ensuring Boston Properties’ cash flow growth trajectory will resume in earnest over the coming quarters (depending on when the cycle of interest rate hikes end). Even if the Fed holds its benchmark rate flat, year-over-year growth comparisons will become more favorable for the REIT as Boston Properties’ effective interest rate would likely be broadly flat if such an event were to occur.

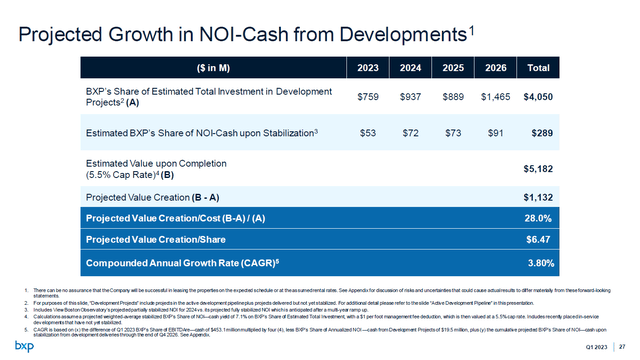

As it concerns Boston Properties’ development portfolio, that is expected to provide a powerful tailwind to its net operating income (‘NOI’) through 2026 while generating $1.1 billion in value for its shareholders (defined as projected value creation upon completion, with a cap rate of 5.5%, less total development costs) as you can see in the upcoming graphic down below. Growing its NOI by turning assets that currently represent cash flow outlays into assets that generate substantial cash flow inlays would help grow Boston Properties FFO and FFO per share metrics.

Bringing its development pipeline online will provide a nice tailwind for Boston Properties’ net operating income. (Boston Properties Inc – 2023 NAREIT REITweek IR Presentation)

During Boston Properties’ first quarter of 2023 earnings call, management noted that the REIT expects its same-store NOI to be broadly flat this year versus 2022 levels (on an accrual basis) though its same-store cash NOI is forecasted grow by 1%-2.5% annually. The main reason why Boston Properties boosted its FFO per share forecast for 2023 during its first quarter earnings update was due to an increase in its property NOI forecast for this year due to a combination of lower-than-expected operating expenses and better-than-expected revenues. Additionally, Boston Properties raised its fee income expectations for 2023 during its first quarter earnings update due to higher-than-expected construction management and development fees.

Things are beginning to stabilize for Boston Properties after the COVID-19 pandemic threw a wrench at its business model, a situation that was later made worse by the rising interest rate environment. Should inflation pressures continue to ease up that will reduce the upward pressure the REIT has been contending with as it concerns its operating expenses while providing room for the Fed to at least keep interest rates broadly flat, though there will likely be another modest hike or two before year-end. In the event inflationary pressures ease and the Fed keeps rates flat, that will help contain Boston Properties interest expenses at a time when new cash flow generating developments are coming online, which in my view will provide a massive boost to its cash flows on a company-wide and per share basis.

Downside Risks

Investors should keep Boston Properties’ downside risks in mind. For starters, the hybrid and remote working arrangements that proliferated during the COVID-19 pandemic are likely here to stay for certain professions, which will make it more difficult to lease up some of its corporate office properties. That will also make pushing through rental rate hikes at those assets more difficult, but not impossible given that Boston Properties operates in incredibly attractive, high growth metropolitan regions in the US. In my view, the REIT is well-positioned to navigate these hurdles, especially as it grows its exposure to the life sciences industry which should experience high occupancy rates throughout the economic cycle.

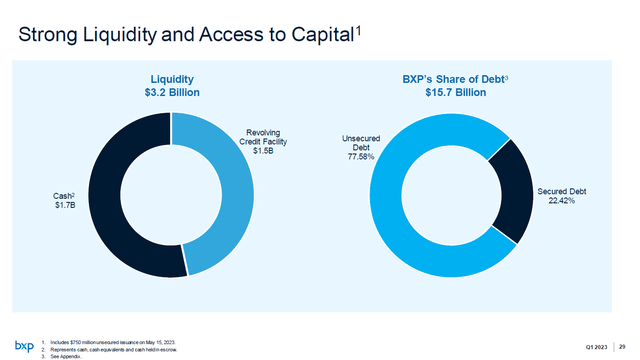

Boston Properties has a large debt load on the books, as do virtually all REITs. Its total debt load (mortgages, term loans, revolving credit lines, senior notes, and finance leases) stood near $15.0 billion at the end of March 2023 which was offset by $1.0 billion in cash and cash equivalents on hand (cash and cash equivalents plus its modest investment in securities position, exclusive of cash held in escrow and investments that would be considered strategic). I’m a big fan of the REIT keeping ample cash on hand as that ensures it has enough liquidity to meet its near-term funding needs. Boston Properties routinely taps debt and equity markets for funds, and its capital market-dependence is another downside risk that investors need to be aware of. S&P Global Inc. (SPGI) placed Boston Properties’ credit rating, which sits at an investment grade BBB+, on downgrade watch in March 2023 which is concerning though recent debt issuance indicates the REIT retains the confidence of investors.

The REIT issued out $750 million in 6.500% senior unsecured notes due 2034 of “green bonds” in May 2023 and expected to receive $741 million in net proceeds from this issuance. Considering its large net debt load and the fact that these are unsecured notes, that’s a reasonably attractive interest rate in this environment. Boston Properties appears to retain access to debt markets at reasonable rates and I expect that should continue going forward, and it has revolving credit facilities at its disposal to further assist in its financing endeavors. The upcoming graphic down below highlights Boston Properties’ financial position as of May 15, 2023.

Boston Properties has ample liquidity and access to liquidity to meet its near-term funding needs, and most of its debt load is unsecured. (Boston Properties Inc – 2023 NAREIT REITweek IR Presentation)

As a large chunk of Boston Properties’ outstanding debt is unsecured, concerns over falling commercial real estate prices and how that would impact its financial standing are overblown, in my view. The firm is not as dependent on secured debt as many of its office property REIT peers and that’s a good thing.

Concluding Thoughts

Boston Properties’ annualized yield sits at $3.92 per share, a level that’s been held flat since 2020. Using its FFO per share forecast for 2023, its payout ratio (dividend per share divided by FFO per share) should come in around 55% this year at the midpoint of guidance, well below the 80% threshold that’s considered healthy for a REIT. This is so Boston Properties has the funds to complete its major development buildout while staying on top of its debt load, payout obligations, and other financing needs. I’m a big fan of Boston Properties as a high-yielding income generation vehicle with shares of BXP yielding a nice ~6.7% as of this writing.

A combination of macro factors (reduced inflationary pressures and related increases in its operating expenses, the potential for the cycle of interest rate hikes at the Fed to end) and internal factors (boosting its leased rate, bringing new attractive real estate assets online, potential rental rate hikes) should drive Boston Properties’ cash flows (and FFO per share) much higher over the medium-term. Shares of BXP have picked up of late as the worst is already priced into the name though the REIT is now turning a corner and there’s room for these shares to run higher. However, I’m primarily interested in Boston Properties as a high-yielding income generation vehicle.

Read the full article here