One thing you have to get used to about investing is the reality of sometimes buying of stock that underperforms for an extended period of time before it works out for you. One really good example of this that I could point to involves Bowlero (NYSE:BOWL), an enterprise that owns, leases, and operates, bowling entertainment centers. Despite achieving rapid growth on its top line and attractive cash flows, the company does incur larger net losses year over year. But even with this, shares of the enterprise look cheap and management continues to make investments to set the company up for long term financial success. So even though the company may be lagging the markets right now, I would make the case that it is an attractive prospect for those who are value oriented and who have the patience to see this game to its end.

A bad frame

The first and only article that I ever wrote about Bowlero was published in December of last year. In that article, I called Bowlero an interesting prospect, particularly for those who like bowling. Due in large part to the COVID-19 pandemic, the prior few years for the company had been rather rocky. But management was finally showing meaningful signs of improvement. This improvement, combined with investments that set the company up for long-term growth, and combined with attractive cash flows, led me to rate the company a ‘buy’ to reflect my view at the time that shares should outperform the broader market for the foreseeable future. Since then, things have not gone as I hoped they would. While the S&P 500 is up 12.2%, shares of Bowlero have increased by only 0.6%.

Author – SEC EDGAR Data

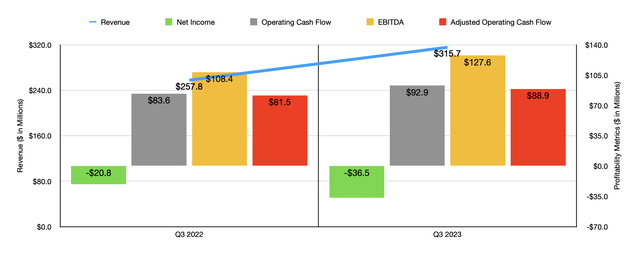

Given this return disparity, it’s not a stretch of the imagination to think that perhaps the financial condition of the company was deteriorating. But that is not the case. Consider how the company performed during the third quarter of its 2023 fiscal year. During that time, revenue came in at $315.7 million. That’s 22.5% above the $257.8 million that the company reported one year earlier. This increase has been driven by a couple of different factors. Most notably, the firm experienced a 17.1% surge in same store sales. Unfortunately, management did not provide a breakdown of how much of this increase was driven by higher prices and how much was driven by greater traffic or games. But they did say it was a combination of these factors. Another big driver was an increase in the number of locations that the company has in operation. This rose from 317 to 327 over this window of time.

On the bottom line, the picture was definitely more mixed. On the negative side, we have net profits turning from a loss of $20.8 million to an even larger loss of $36.5 million. This came about even as the gross profit margin for the company expanded modestly. A rise in interest expense, combined with a significant increase in the fair value of an earn-out liability, negatively affected the firm’s bottom line. Fortunately, other profitability metrics held up far better. Operating cash flow, as an example, went from $83.6 million to $92.9 million. Even if we adjust for changes in working capital, we would have seen this improve from $81.5 million to $88.9 million. Meanwhile, EBITDA for the company expanded from $108.4 million to $88.9 million.

Author – SEC EDGAR Data

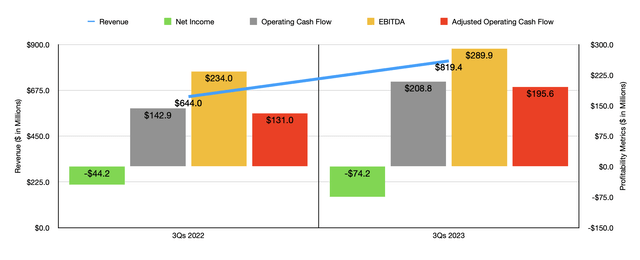

As you can see in the chart above, results experienced during the third quarter of the year were not a one-time thing. Rather, they were indicative of a larger trend for the business. For the first nine months of the 2023 fiscal year, revenue and all cash flow metrics improved compared to what they were one year earlier. But net profits worsened. Just as was the case with the third quarter of the year, the big driver for the company during the first nine months when it came to revenue was same store sales growth. This totaled an impressive 20.8%, indicating that demand for the company’s services and its supplier power are definitely in a positive spot.

As I mentioned earlier in this article, Bowlero is a company that’s dedicated to growing. Since the end of the third quarter, management has continued to make acquisitions. According to my estimate, if we include purchases that have not closed yet, the company has around 345 locations in operation today. It also has leases for six new builds, with two of them under construction. This should further fuel growth in the long run, even if it does come at a cost today. This has not stopped management, however, from making some other interesting moves. Prior to the end of the third quarter, management repurchased $5 million worth of Series A Preferred Stock. And after the end of the quarter, the firm repurchased another $58.6 million worth. That subsequent purchase cost shareholders about $74 million. That’s rather lofty, but it does remove some stock that carried a 5.5% annual yield on it. In the long run, that will improve cash flows.

Author – SEC EDGAR Data

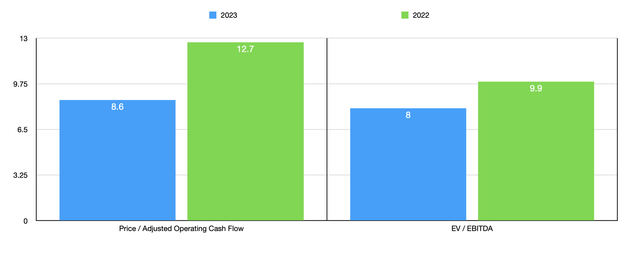

We don’t really know what to expect for the final quarter of the fiscal year. But if we annualize the results experienced so far, we would expect adjusted operating cash flow of $261.4 million and EBITDA of $392 million. Based on these figures, as you can see above, shares of the company are quite cheap on a forward basis. But even if we were to use data from 2022, the stock does not look all that pricey at all. In fact, it might still be somewhat undervalued. Given that Bowlero is a one-of-a-kind firm, finding comparable firms to look at is a challenge. But as you can see in the table below, I compared it to five other entertainment / lifestyle oriented businesses. When it comes to the price to operating cash flow multiple, two of the five companies ended up being cheaper than our prospect. And when it comes to the EV to EBITDA approach, only one of the five ended up being cheaper.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Bowlero | 8.6 | 8.0 |

| Cedar Fair (FUN) | 6.1 | 7.6 |

| Six Flags Entertainment (SIX) | 8.2 | 11.3 |

| Topgolf Callaway Brands (MODG) | 59.6 | 12.1 |

| Xponential Fitness (XPOF) | 15.7 | 23.8 |

| Vail Resorts (MTN) | 14.5 | 13.7 |

Takeaway

Financially speaking, Bowlero is still in really solid shape. I don’t like that the company continues to generate net losses. But cash flows are significant. Strong same store sales growth, combined with the impact of acquisitions, is excellent to see. And shares of the company are cheap, both on an absolute basis and relative to similar firms. Given the totality of this picture, this all leads me to feel comfortable in rating the company a ‘buy’ even though it has underperformed the broader market so far.

Read the full article here