Thesis

In my last article on Bowlero (NYSE:BOWL), I recommended to go long as management has certainly executed as I expected, and I did not see any slowing down moving forward. The business itself is a straightforward firm with incredible unit economics. The end result was an increase of share price from ~12+ to $17.45. The recent fall in BOWL share price after the 3Q23 earnings, in which management commented on the slowing sales trend into 4Q23, presents a great buying opportunity in my opinion. BOWL has benefited greatly from the COVID lockdowns as can be seen from FY22 strong growth. This has eventually led to the current situation of BOWL comps against a strong 4Q22. This is not surprising as it is unlikely for BOWL to continue growing 30+% given the nature of its business. The mismatch in expectations has drawn BOWL to trade down to 8.6x EBITDA, the lowest it has ever been, which I think is compelling and I reiterate my buy rating.

Financials

BOWL’s financial performance has been very strong, despite the share price reflecting this, with revenue growing 22.5%, up 54% from 2Q22. The most effective method for evaluating BOWL growth is via 2 or 3 year stack, which takes into account a longer time period than just one year, thereby avoiding the illusion of business slowdown when comp against a tough year. To reiterate, BOWL business has done exceptionally well over the past three years, and the “slowdown” is a normal phenomenon to occur as the tailwinds from COVID fade. To that end, I would urge investors not to pick apart the business because the total revenue growth in the 4Q so far is still tracking at more than 50% compared to pre-COVID.

Pricing

I expect management to continue its price increase strategy to take advantage of the current spending environment where consumers are likely to seek cheaper alternatives, and I see BOWL as a cheaper alternative to other entertainment such as travel and theme parks. Management mentioned that 2.5% price increase has been the historical benchmark, which I take it as at least 2.5% given the current inflationary environment. Instead of organic price hike, I believe the right strategy it to mask price increase behind bundles so that consumers do not feel the pinch. Various pricing measures can also be used to maximise unit economics by improving traffic during non-peak hours (I think value bundles during off-peak hours is a good strategy). Given the fixed cost in place, increase in utilization will carry very high incremental margins.

Improving gross margin

Gross margins improvement is apparent in BOWL financials, with reported an adjusted margin of 40.4% in 3Q, up ~16pts vs 3Q21. This clearly demonstrates the high incremental margin that BOWL business possesses, and I anticipate margins to improve further as management continues to drive increased utilization/pricing across the units. One reason the company’s margin has improved steadily over the years, in my opinion, is because of the attention and active management of margin by management. One example is that management is already thinking ahead and making preparations for the worst-case scenario, as evidenced by the existence of a recession contingency plan.

In general, I anticipate that the company’s strong revenue growth will lead to significant improvement in operating margins, considering its fixed cost structure. This will be achieved through the execution of BOWL’s unit growth strategy, which aims to expand the customer base and enhance brand recognition. Additionally, the continuous investment in technology will further contribute to the growth of margins by driving operational efficiencies across both new and existing centers.

Pipeline

The current climate has not slowed the BOWL pipeline of new centers. Management has stated that between 25 and 30 new centers, comprised of both acquisitions and new builds, are scheduled to open in the near future. Even in a downturn, I anticipate a healthy pipeline because sellers’ expectations tend to be reset lower during downturns, leading to an increase in the supply of assets on the market at more attractive prices.

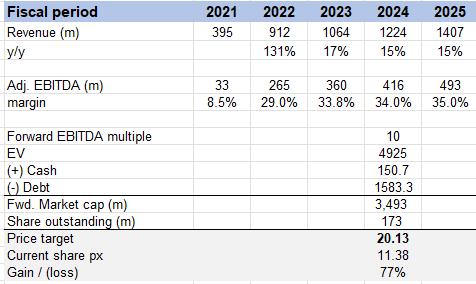

Valuation

BOWL’s upside is much more appealing now that valuation is much lower. Despite the fact that the company is larger and has a better margin profile, the share price has returned to where it was when I first started covering it. I still expect the same mid-teens growth rate for BOWL, but with the FY23 results so far, I expect a higher margin profile. Multiples should return to their historical average (10x forward EBITDA) once the market digests and understands that BOWL growth is still healthy and that the slowdown is due to a difficult comparison last year.

Author’s model

Risks

The industry in which BOWL operates is extremely cutthroat and diverse. Theatrical performances, sporting events, amusement parks, and restaurants are just some of the many alternatives to “free time” that BOWL must contend with. The comparison between movies and other forms of entertainment (Netflix, mobile games, etc.) is also applicable here.

Another risk is a mass lockdown again. BOWL may be subject to more rules than other outdoor recreational activities if COVID-19 and similar scenarios become more widespread. Profitability in 1Q22 was significantly impacted by COVID, and its effects were visible again during the Omicron wave.

Conclusion

In conclusion, despite the recent market reaction to BOWL slowing sales trend and challenging comparisons, I believe it presents an excellent buying opportunity. The company has shown strong financial performance, with revenue growth exceeding pre-COVID levels. Management’s price increase strategy and focus on improving margins through increased utilization and pricing are promising. Additionally, the pipeline of new centers remains healthy, and the company’s valuation is attractive, with upside potential.

Read the full article here