Introduction

I have been fairly critical of BP, (NYSE:BP) in recent articles over the past couple of years. With titles like, Junk In The Hole, it’s fair to say that at times I’ve been a little snarky and sarcastic. I stand by all of that – they deserved it, and aren’t all the way out of the woods with me thanks to this Landmine, that dropped last week. Non-government funded offshore wind farms are a discussion for another day. It is with some pleasure that I bring news of a positive sort with the TravelCenters of America acquisition. This deal makes sense to me and, with other things the company is doing, strengthens the investment case for BP.

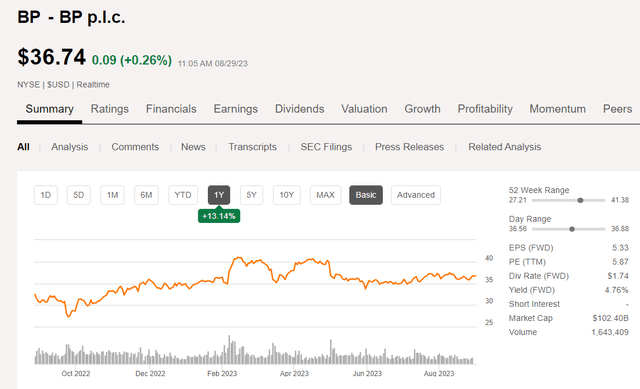

BP Price chart (Seeking Alpha)

BP is trading at an attractive PE valuation, and has recently toned down its former psycho-babble about cutting fossil fuels production by ~40% by 2030, to save the planet. That is welcome news as these sources remain their primary revenue sources, and are likely to remain so through that 2030 threshold to which they so firmly cling.

Analysts are mixed on BP at current prices with an Overweight rating. Forecast price ranges run from $37 on the low side, to $76 on the high side. That’s quite a range. The median is $44 which still represents a respectable upside, and makes the stock worth a look.

The thesis for BP with TravelCenters

Roads are how we get around in this country, and even in their current, somewhat dilapidated state, they are pretty darned good. With the misery that air travel has become, combined with the robber baron prices now being charged by the airlines, is any at surprise that more and more people are choosing a road trip instead? We will discuss.

It was the decision I made last spring when I drove to Michigan from Central Mississippi. Having my own car and being able to stop where and when I wanted, sealed the deal as opposed to concerns I had about being stranded in an airline terminal. Call me a worry-wart, but I’ve been stranded various places around the world and it is one of my deepest traveler anxieties. Getting to Michigan was six days of travel for me – to and fro, but heck, I am retired and I have Lifetime Diamond status with Hilton. (These days that gets me a bottle of water in the room when I check in, and free internet.)

Families are an even better case in point. Can you imagine going to the airport with three kids-all under six, getting through security-with your therapy dog, running to the gate… only to find your flight has been canceled? This is happening to families thanks to our decrepit air transport system. You’ve seen them on TV, blank stares of fatigue or tears on their faces as they stand in lines, desperately seeking information. How much would you pay… how much time would you take, not to be in that throng? And, to top it all off, it’s getting worse.

Highway travel centers by comparison will not poke or prod you or abruptly cancel your journey, rendering useless further reservations at resorts, cruise ship embarkation points, or national parks. They will not require that you take off your shoes and empty out all your pockets, or put your laptop in a bin, or randomly subject you to “further” inspection. Nor will you get sniffed by a drug or bomb sniffing dog, as the armed handler firmly tells you not to pet the curious canine. Travel centers will not require that you park in another “state,” and walk to a pick up spot where a gigantic bus-already crammed with exhausted travelers, pauses briefly to take on a few extra passengers – (do bus drivers get paid by the pound?), who will then struggle to retain their balance as the bus lurches off… Ok, I am done. Does any of that sound like fun to you? Would you gladly drive a thousand miles to avoid these indignities? How much misery are you willing to undergo for your “safety?” Un-huh. I’ve made my point here.

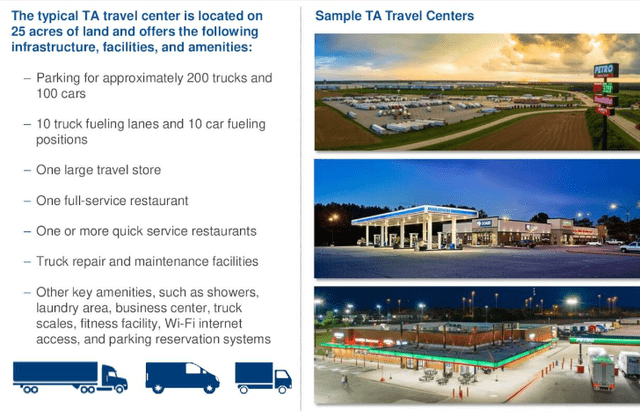

Colloquially known as “truck stops,” Travel Centers are a little bit of heaven on a long journey, and they are not just for truckers anymore. On the subject of truckers though, the fact that 76.2% of all the freight is delivered by road-truck in this country, puts a large, dedicated market into BP’s domain, daily.

So we have established the road travel mode has legs and all of these travelers will need relief, sustenance, and fuel (gas or electric recharge) along the way. And, that makes the TA an accretive and logical acquisition for BP.

BP and convenience

Convenience is one of the 5-pillars of the new BP. If you’ve done much interstate travel, chances are you’ve taken refuge temporarily in one of these easy-off, easy-on mega-centers. You can use the facilities, grab a giant sugary beverage to go with the mustard/onion/relish/jalapeno topped hotdog that you will inhale while you are pumping your gas. Eating with one hand, using the other to hold the nozzle in the tank, or swat at the Yellowjackets that want some that sweet relish on your dog, you’re in and out and back on the road in 10 minutes. Fifteen tops. Good times!

And, you’ve probably dropped, counting gas anywhere from a $80-$100 bucks, and the dog and drink are high margin items that pump EBITDA to the moon. And, 300 miles later you’ve probably got the location of that next TA center programmed into Google Maps. What a racket. It finds me for the first time in ages saying to Bernard, “Well done, laddie, well done!”

TA Travel Centers (TA now BP)

CEO Looney comments on how the TA centers advantage other BP growth platforms:

This is bp’s strategy in action. We are doing exactly what we said we would, leaning into our transition growth engines. This deal will grow our convenience and mobility footprint across the US and grow earnings with attractive returns. Over time, it will allow us to advance four of our five strategic transition growth engines. By enabling growth in EV charging, biofuels and RNG and later hydrogen, we can help our customers decarbonize their fleets. It’s a compelling combination.

A head to head comparison in convenience

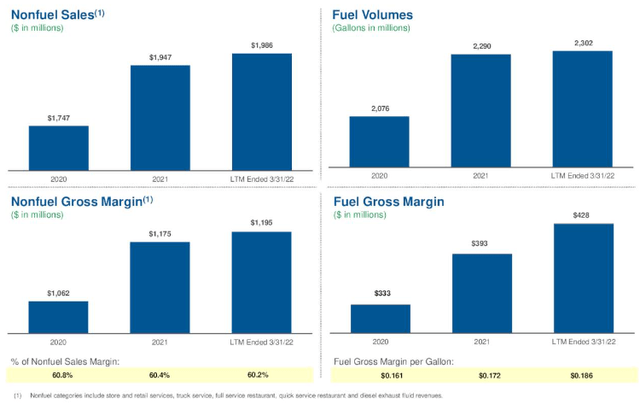

Hopefully BP will recognize the retail value they are getting from TA. The first slide below notes directionally the trend for TA as a standalone entity. Non-Fuel margins are at 60.2% for Q-1, 2023, down fractionally as a percentage due to increased sales.

TA operating margins (TA now BP)

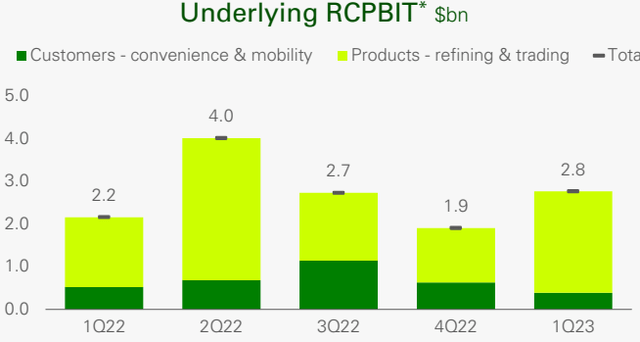

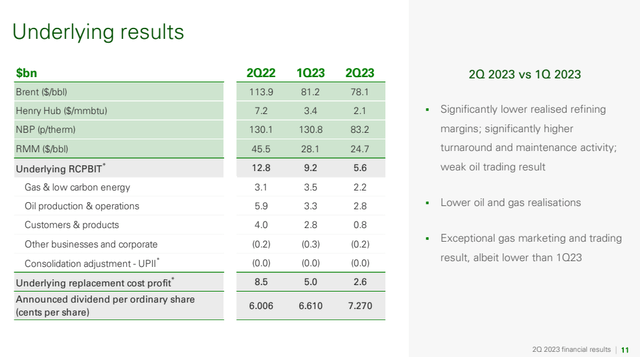

BP does not (though Q-1, starting with Q-2 they are much more transparent) disclose as much as TA, but if you look at the Replacement Cost Profit Before Interest and Taxes-RCPBIT, you see the trend is not their friend. In their press release on the TA acquisition, BP acknowledged this disparity,

Around 70% of TA’s total gross margin is generated by its convenience services business, almost double bp’s global convenience gross margin.

BP RCPBIT (BP)

Summing it up: TA had the deal. Now BP has the deal, and if the current TA management is allowed to continue to deploy their obvious expertise at maximizing the consumer experience, BP’s Convenience segment should return significant growth in coming years.

In the press release, Dave Lawler, chairman and president of bp America looked to address the concern I raised above about keeping current TA management:

Subject to approvals, we look forward to welcoming the TA team to bp. TA’s amazing nationwide network of on-highway locations combined with bp’s more than 8,000 off-highway locations have the potential to offer travelers and professional drivers a seamless experience for decades to come.

Some details about the transaction:

- BP has plans to invest $1bn in EV charging across the US by 2030.

- As part of the transaction, TA will enter into amended lease agreements with Service Properties Trust (SVC), establishing long-term real estate access.

- The acquisition price of $1.3 billion, or $86 per share, represents a multiple of around 6 times based on last twelve months’ TA EBITDA (4Q21 to 3Q22). It is expected to add EBITDA for bp immediately, growing to around $800 million in 2025.

- It supports delivery of bp’s convenience and EV charging growth engine target of more than $1.5bn EBITDA in 2025 and aim for more than $4bn in 2030. bp expects the acquisition to be accretive to free cash flow per share from 2024 and to deliver a return of over 15%.

BP’s 2nd quarter and guidance

BP rose after raising its dividend by 10% Q/Q and saying it will buy back another $1.5B of shares, even as Q2 earnings and revenues fell by more than expected. Q2 net profit plunged 80% Y/Y to $1.79B from $9.26B in the same quarter last year while underlying replacement cost profit tumbled to $2.59B from $8.45B in the year-earlier quarter and well below analyst consensus of $3.5B.

The sharp drop was driven by lower refining margins, weak oil trading results and lower oil and gas realizations, as oil producers suffer from tough Y/Y comparables from a year ago when Russia’s invasion of Ukraine caused a spike in commodity prices.

Q2 operating cash flow fell to $6.29B from $10.86B a year ago, and net debt widened to $23.66B from $22.82B.

Q2 production rose 7.5% Q/Q to 1.37M boe/day, and the company expects Q3 reported upstream production to be broadly flat compared to Q2.

BP Underlying results-Q-2, 2023 (BP)

Source

Risks for BP

You don’t have to search very far to find the harsh criticism I have levied in past article about BP’s obsession with wind, specifically offshore wind. I think it’s a boondoggle that is wasting investors cash and may come back to haunt them in years to come. BP has thrown billions into offshore wind that it made selling oil and gas, and the offshore wind model is coming under question. We will table that for now, and surely return to it in future articles.

BP carries a substantial amount to debt-$47 bn. A figure that’s declined in recent quarters as cash flow rose with oil prices. An RBC Capital analyst noted this in his quarterly review of the company in commenting on the dividend increase and the share buyback:

“BP has higher leverage than all of its supermajor peers, more fundamentally, we would have preferred to see the company focus on net debt reduction, with a dividend increase deferred to later in the year,” Borkhataria said.

I think Borkhataria’s concerns are appropriate. BP’s interests costs have risen to $800 mm as of Q-2. At some point debt matters. On the subject of that well received dividend increase, it should be noted that it is not covered by cash flow at present, if you count the $2 bn share buyback in Q-2. OCF-$6,393-Capex-$3,453-Share buyback-$2,073, Dividend-$1,153 =(-386 mm in the hole for the quarter.)

Your takeaway

BP is trading at a substantial discount to its larger peers, Exxon Mobil (XOM), and Chevron (CVX) at 2.88X EV/EBITDA, and might be attractive to some investors on that basis. For reference XOM trades at 4.9X EV/EBITDA, and CVX trades at 6.16X EV/EBITDA.

Analysts are lukewarm on the stock at current levels with an Overweight rating.

While I am enthused about the direction taken by the company with the TA merger, it’s not enough of a near term impact to get me to put a buy on the stock. On a fundamentals basis, I am raising them to a hold, and might put that to a buy on weakness below $35.00. A scenario that may not come to pass if rising oil prices do in fact come to see us and remain for a while.

Bottomline, I think better opportunities for income and growth are out there; don’t go chasing BP at current levels. The dividend yield is not especially attractive, and with 18.2 bn shares (9.1 bn in ADR’s) outstanding, a $1.5 bn share buyback-~40.8 mm doesn’t move the needle. I move BP to a hold at current levels.

Read the full article here