Following our recent publication of Compagnie Générale des Établissements Michelin (OTCPK:MGDDF)(OTCPK:MGDDY) with a positive view on the latest acquisition and a clear growth path Around & Beyond the tire segment, today we decided to comment on the Japanese tire company Bridgestone Corporation (OTCPK:BRDCY). Before going into the details, it is important to emphasize that Warren Buffett visited Japan in May and started to invest in companies in the Asian country. As a result, the Nikkei index reached a 33-year-high, and looking at the evolution, this performance was recorded only once in the late 1980s. All this was also supported by multiple favorable MACRO factors such as yen weakness, ultra-accommodative monetary policy, and fiscal stimulus from the Bank of Japan. In addition, Japan’s post-COVID-19 reopening pushed the economy with a GDP of 2.7% in Q1 2023. There is also another positive news in the country. Indeed, many investors usually see Japanese companies as a value trap. Still, the Tokyo Stock Exchange plans a new reform in which companies trading below 1x their respective book value should develop capital improvements. How? Thanks to higher shareholders’ remuneration (buyback and dividend). Here at the Lab, we believe that this MACRO environment favored Bridgestone, but at a MICRO level, we think the company valuation looks full.

Bridgestone vs Michelin

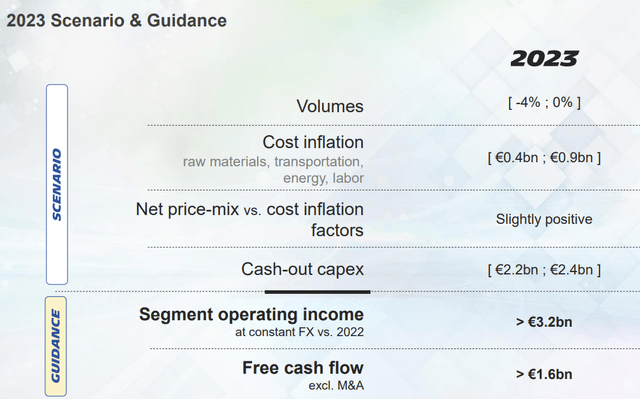

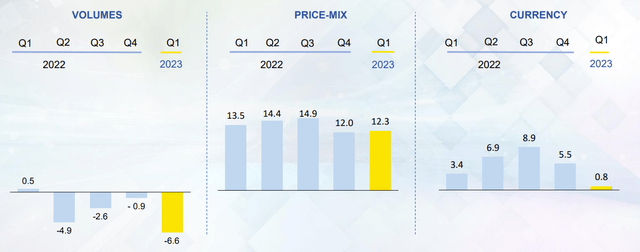

- Very briefly, going into Bridgestone Q1 numbers, we see volume risks in the following quarters after a positive sales development thanks to an ongoing cost pass-through. Indeed, the sales outlook was not upgraded, and leaving the guidance unchanged, Bridgestone might indicate a steep decline in volumes at the lower end of the anticipated minus 4% to 0% range. Michelin is also guiding the same negative range (Fig 1); however, in Q1, the tire volume declined by only 6.6% (Fig 2);

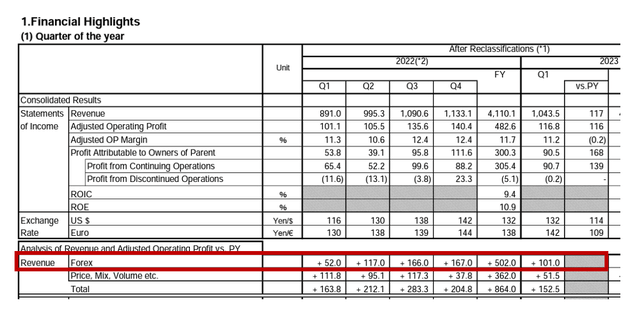

- Bridgestone Q1 volume was already down by 9% in passenger vehicle products, and the positive top-line sales evolution was mainly due to favorable FX (Fig 3) and higher selling prices. A very similar performance was also recorded in commercial vehicle products, with volume down by 13%;

- Bridgestone sales in the Americas and Europe area are still subdued due to inventories that are at high levels. In addition, specialty tire results have been relatively firm, with a 5% growth in the ultra-large category. Bridgestone anticipates a recovery in H2; however, year-end assumptions were left unchanged;

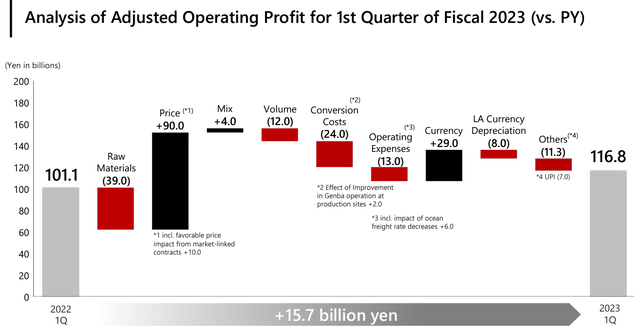

- As a result, Bridgestone adjusted operating profit reached ¥116.8 billion. This was supported by a good price mix evolution which remained solid and continued to be in the 10% range on a yearly basis; however, as we can see in Fig 2, Michelin’s price mix is well above 12% over the last five quarters and outperformed the Japanese player;

- A Bridgestone early recovery seems unlikely, and excluding the positive FX evolution, the company is already behind target on “Its New 2030 Plan“. Again, Michelin was positively favored by FX. Still, it was a minor one-off in Q1 2023 (Fig 2), while Bridgestone positively benefited from sales evolution (Fig 3) and lower cost basis (Fig 4 – EBIT bridge).

Michelin 2023 guidance

Source: Michelin’s latest investor presentation (Morgan Stanley) – Fig 1

Michelin volume, price MIX and FX evolution

Fig 2

Bridgestone FX impact

Source: Consolidated Statement results – Fig 3

Bridgestone EBIT bridge

Source: Bridgestone Q1 results presentation – Fig 4

Conclusion and Valuation

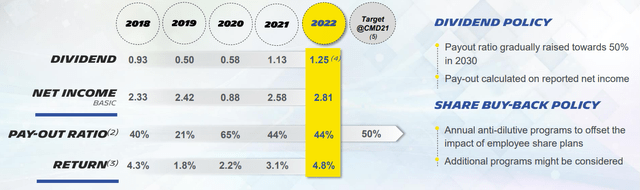

Before concluding, I would like to emphasize how Michelin is moving on beyond tire sales. This is supported by a clear M&A strategy with significant improvement in the EV race (and hydrogen race, thanks to Symbio investments). In the meantime, we feel that Bridgestone is far behind in the Electric Vehicle tires development, with no major updates in the Q1 results. As already reported in our initiation of coverage, Bridgestone is targeting a payout ratio of 50% over the long term, in line with Michelin’s payout policy. However, the French company offers a higher dividend yield (5% compared to 3.3%) supported by a 2023 FCF yield of 9%.

Bridgestone payout evolution

Source: Bridgestone 2030 Long-term Strategic Aspiration Plan

Michelin payout evolution

Looking at the valuation and continuing to compare the two companies, Bridgestone is currently trading at an EV/EBITDA of 5.7x, while Michelin is at 4.56x. The French company is at a 20% discount compared to its historical average at EV revenue, EBITDA, and price earning. Michelin’s PE is at 8.97x, while Bridgestone has almost reached 12x. Bridgestone’s valuation is higher than its historical average and looks full. Tire volume fell short compared to our initial expectations, and the major boosts were due to forex, superior tire performance, and price. Bridgestone full-year outlook was not revised. With numbers unchanged, we continue to value the entity with an EV/EBITDA of 5x and an EBITDA 2023 estimate of ¥775 billion. Applying the multiple, we derive a twelve-month target price of ¥5.000 ($18 in ADR). Therefore, we moved Bridgestone’s rating to sell from neutral.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here