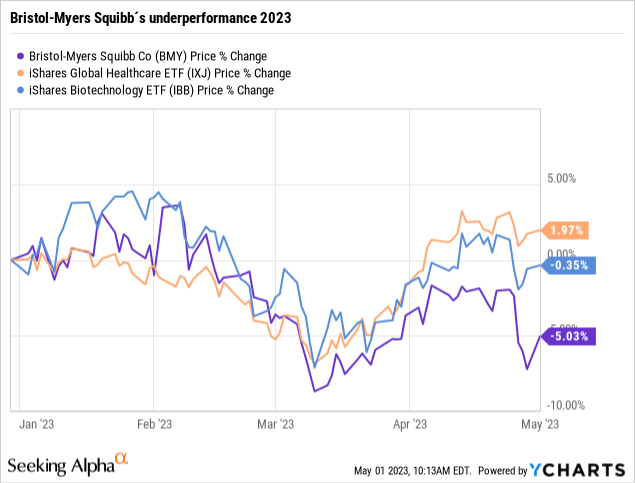

While 2023 has been a fairly positive year so far for stocks in general, Bristol-Myers Squibb’s (NYSE:BMY) stock has tended to weaken in recent months. While this is partly due to some weakness in the healthcare sector, as you can see in the chart below, Bristol-Myers Squibb has underperformed in both the Nasdaq Biotechnology (IBB) and Global Healthcare ETFs (IXJ).

Yet the company is doing a lot right operationally at the moment, even though its first-quarter financials were a bit weak in terms of sales. The already quite favorable valuation has come down even further in recent weeks. Together with the fact that the new product portfolio finally seems to be building momentum, I think Bristol-Myers Squibb is very much worth buying at the current level.

The quarterly figures at a glance

In the first quarter, the company posted revenue of $11.377 billion, down 3% year-over-year. Adjusted for currency effects, sales would have been roughly flat. Analysts had expected just under 300 million more here, which is not insignificantly more and was probably the reason for the restrained market reaction regardless of the strong earnings per share of $1.07 (prior year $0.59) on a GAAP basis and $2.05 on a non-GAAP basis, which beat market expectations by $0.08. I’m usually skeptical of non-GAAP numbers, but here the focus makes sense since there were one-time effects this year from write-downs due to an acquisition. So EPS was up 4.5% year-over-year after all, despite the sales decline, which is a sign of strength, to begin with. The non-GAAP net margin thus climbed to 38%. Another positive is that a good $1.5 billion in short-term debt was repaid in the first quarter without a cash drop.

The miss on sales was primarily due to the sharp decline in Revlimid, whose product sales plunged 37% worldwide, which was faster than analysts had hoped. However, important for me is the fact that Bristol-Myers did not lower its 2023 outlook – neither for Revlimid nor for total sales. From there, the next few quarters should be quite strong.

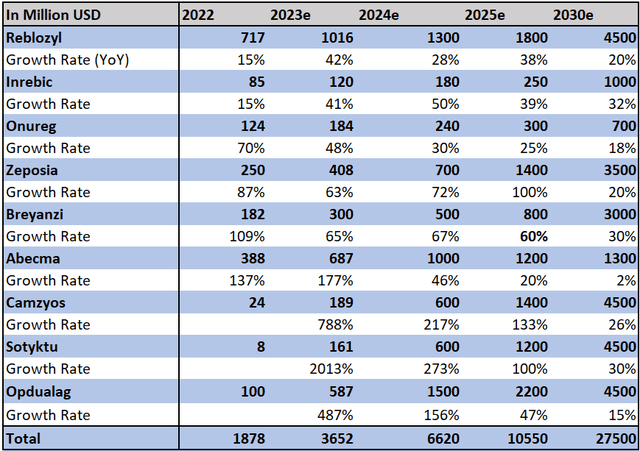

On a standalone basis, Opdivo in particular stood out positively with a 15% increase in sales, while the rest of the established market products performed acceptably in what experience has shown to be a weak first quarter. A positive surprise for me, however, was the performance of the new product portfolio. In my last analysis, I criticized the lack of dynamic growth of the new products, as these are essential for BMS to meet its long-term targets. In detail, the growth rates were as follows:

- Reblozyl: 32%

- Inrebic: 39%

- Onureg: 48%

- Zeposia: 117%

- Breyanzi: 61%

- Abecma: 119%

- Camzyos: 81% sequentially

- Sotyktu: 128% sequentially

- Opdualag: 12.5% sequentially

Most products thus significantly accelerated their growth compared with the previous quarters. The new products thus totaled 723 million, a good doubling of the previous year’s figure. Yes, that’s still just 6.4% of total sales, but if growth rates continue over the next few quarters, Revlimid should be able to break even in about two years. That brings me to the investment case for Bristol-Myers Squibb.

The bullish mid-term case for Bristol-Myers

The thesis is simple: It is believed that the new product portfolio and pipeline are strong enough to offset the sales of Revlimid and Pomalyst in the medium term, and also to generate some growth with high profitability. If the company succeeds in delivering 2% annual sales growth through 2030, it would be very attractively valued at an adjusted P/E of 8.4 and a P/FCF of 12.6.

I always find it difficult with pharmaceutical companies to make the investment contingent on the success of future products, however, Bristol-Myers has already received nine major approvals for potential compounds with blockbuster potential. In addition, key milestones have already been reached for these in regulatory extensions, allowing the products to reach their full potential. The number of drugs also means that Bristol-Myers Squibb is diversified into many different fields of medicine and is therefore not as dependent on the success of individual products as was previously the case with Revlimid, for example.

By 2025, management already expects $10-13 billion in sales from these new products alone, and still more than $25 billion by 2030. In detailed planning, it could look like this:

Bristol-Myers New Product Portfolio Forecast (Author´s calculations)

The numbers are quite rough estimates, of course, but they show that in 2025, product sales from the new portfolio would completely replace Revlimid’s 2022, for example. With this outlook, the company seems to be very well positioned for the medium term, with no dependence on further research successes to meet the projections. A small bonus is the dividend yield of 3.35%, which has increased by as much as 7% per year over the past five years and, with a payout ratio of less than 30%, would have the potential for further increases even with stagnant cash flows.

The uncertain long-term case for Bristol-Myers

I see no reason not to be bullish on the company until 2025. After that, however, the future becomes a bit more uncertain as various patents expire. In 2026, the patent for Eliquis in the US and EU expires, which should generate approximately 14 billion in annual sales by then. So comparable to the magnitude of Revlimid. In a similar period, the Yervoy patent (2 billion annually) will also expire.

Just two years later, Opdivo (12 billion expected peak sales) is threatened with the same fate in the USA, and again a year later Zeposia (4.5 billion expected peak sales). The new product portfolio alone will not be able to compensate for this. New blockbusters are needed from the pipeline, which looks very promising with 28 ongoing phase 3 studies and 36 phase 2 studies. The track record in recent years also gives reason to hope for some breakthrough successes, but a certain degree of uncertainty remains as to business development after 2026.

Valuation

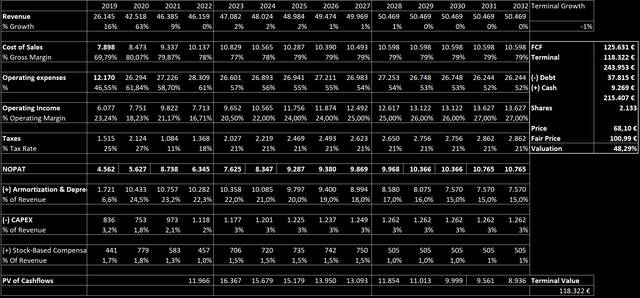

For a classification of these findings, I update my Discounted cash flow analysis.

I have made the following assumptions:

– Revenue growth of 2% annually from 2023-2025, slowing to 1% in 2026-2028 and 0% by 2031

– Gross margin will gradually increase to 79%.

– Operating expenses slowly decrease to 52% of sales by 2031

– Tax rate 21

– Depreciation and amortization to decrease to 15% of sales

– CAPEX 2.5% of sales

– Stoch-based compensation remains between 1-1.5% of sales

– Terminal growth rate -1% to factor in long-term risk

– WACC 7%

Discounted Cashflow Model (Author’s calculation)

With these assumptions, the upside potential is almost 50%, which is very attractive for a rather defensive single stock. A forward P/FCF of 8.9 is how low Bristol-Myers Squibb is already valued in the immediate future. Even if one were to assume constant 0% growth for the next few years, the price potential would still be 35%.

Bottom Line

After the weak start to the year, Bristol-Myers Squibb shares are once again a clear buy candidate for me. In the short term, the sharp decline in sales of Revlimid is a burden, but the outlook has not been lowered, so I do not see any danger here. Instead, the new product portfolio is finally showing an important sign of life.

This should allow for low sales growth over the next few years. The long-term horizon is still a bit cloudy and difficult to assess, but the stock is currently trading so cheaply that a lot can go wrong here and the stock would still be attractive.

Read the full article here