Well folks, we are in the middle of a seasonally weak period for stocks, and the AI market has taken a breather of late as investors question whether the technology will truly reaccelerate these companies’ growth prospects. Some believe that investors may have gotten too excited about AI, while others believe that the market is simply taking a natural pause. We have had conversations with followers and members that have suggested the AI craze and subsequent rally is over. Folks, nothing is over. We tend to believe we are in the midst of a breather that could last a few months, while some air is let out of the AI-related bubble. But we do not see a massive pop that results in catastrophic dotcom like bubbles.

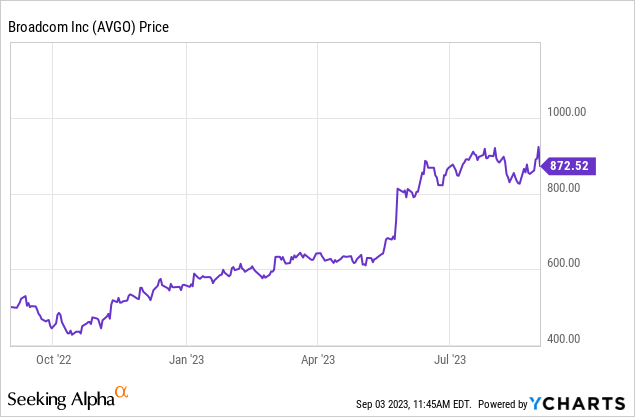

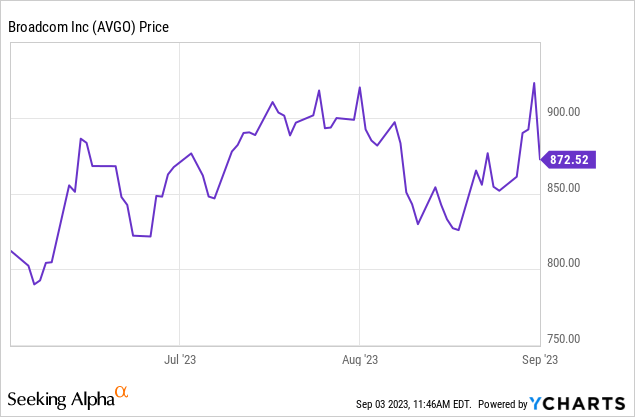

Since the start of August, shares of semiconductor companies such as Broadcom (AVGO) and NVIDIA (NVDA) have fallen. In terms of AI dominance, it is the latter company that has near-term cornered the market, it is theirs to lose. To be sure, the minor correction that took place in August has been indiscriminate, with pretty much all stocks in the subsector seeing their share prices drop, regardless of their intrinsic value, prospects, or valuations. Valuations have become a bit stretched in many of these stocks, while others, like Broadcom, are relatively still attractive. We believe investors should be trading this dip, especially following Q3 earnings which we will discuss. Take a look at the chart:

Make no mistake, the one-year chart of AVGO is in a very clear uptrend, but on the short-term chart, shares have taken a breather. We see shares as a buy from here down to $800 for trading entry.

While this stalling in the share price may be concerning for some investors, it is important to remember that stocks cannot only go up nonstop. Even if a company has excellent prospects or is undervalued, its stock price can and usually will still decline at times, especially if the sector. This is simply the nature of the market. It is actually healthier for the market to take a slight pullback from time to time, rather than getting too overheated. This can help to prevent a more dramatic crash in the future, and for quality companies like Broadcom, can offer a chance for new money to enter the stock.

The play

Target entry 1: $865-$870 (25% of position)

Target entry 2: $835-$840 (35% of position)

Target entry 3: $790-$800 (40% of position)

Target exit for traders: $950

Long-term price target: $1100

Stop loss for traders: $700

Investors should look to actually double down below $700 provided we see ongoing operational strength.

Options consideration: There are several plays to consider using both call and put strategies; however, those ideas are reserved for our investing group. Investors with the coin for 100 shares can easily consider a buy-write approach.

Our near-term targets rest on the technical uptrend, while our longer-term target rests on valuation, and the growth. We believe that with the growth on display, the valuation is becoming more attractive. With that in mind, investors should focus on the long-term prospects of AI companies generally, and we see AVGO having tremendous runway. Let us discuss the operational results which we believe lend evidence to our buy call.

Discussion

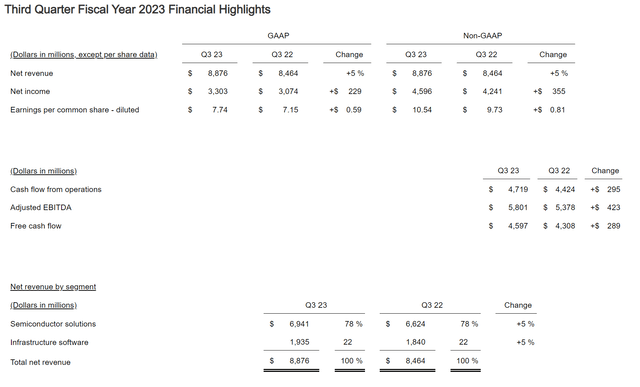

The company delivered a top and bottom line beat in the just announced Q3 results.

Broadcom website Q3 press release

As you can see the revenue for the third quarter grew 5% year-over-year to $8.87 billion and adjusted EBITDA increased 8% year-over-year to 65% of revenue. The revenue figure surpassed consensus by $20 million.

Adjusted gross margins expanded from the sequential Q1, but on a percentage basis took a slight dip. Still they were a strong 75.1% of revenues. Solid margins, but down slightly from 75.9% a year ago. Interestingly, adjusted operating expenses were down from last year, and that led to strong earnings performance.

Net income strength is on display here year-over-year. Net income grew to $3.30 billion from $3.07 billion a year ago. On an adjusted basis, net income rose to $4.60 billion from $4.24 billion. This translated to GAAP EPS of $7.74, up from $7.15 a year ago, while adjusted EPS grew to $10.54 from $9.71. This was a $0.11 beat.

So why is the stock not rallying hard on these genuinely positive results? Sure, this is not NVDA like growth, but AVGO does stand to gain from AI demand. The outlook was pretty much in line, but this was met with some disappointment. Take advantage of that disappointment, especially if September is weak.

The outlook is strong in our opinion. For the fiscal Q4 outlook the company sees revenue of approximately $9.27 billion. It further sees adjusted EBITDA of approximately 65% of projected revenue. On an EPS basis we see $10.90-$11.00 as likely. This would also translate to $42.09 to $42.19 for the year, suggesting a near-term FWD EPS p/e of 20.6X. The stock is also attractive at 16X-17X free cash flow.

This year so far the company has generated $12.9 billion in free cash flow, and should hit about $17.5 billion for the year, at least. Attractive as this is about 20X, with next year’s free cash flow likely to grow to well over $20 billion. As shares pull back, it provides the opportunity to buy the stock at mid-teens free cash flow multiples.

We also like the shareholder friendly nature of the company. The company has a strong buyback in place. In fact the company in Q3 alone repurchased and retired 2.9 million shares for $2.17 billion. And the company continues to pay a quarterly dividend. While the yield is not impressive as share prices have grown, the dividend of $4.60 that will be paid is 2.1% annualized. Keep in mind this company has been a serial dividend raiser, so you get an extra bonus to be a shareholder in this quality company.

Final thoughts

We think you let the market take the stock down a bit to consolidate it, allowing for new money to enter at better prices. Nothing is over here, the AI rally is simply taking a breather. The company is shareholder friendly, is reasonably valued, and is growing sales, earnings, and cash flows. The AI opportunity here is a story that will play out more as time moves on, and Broadcom, as well as competitors, stand to take market share from the current leader in the space. We rate shares a buy.

Read the full article here