I must admit that Broadcom Inc. (NASDAQ:AVGO) stock’s performance was so dominant in 2023 that I have failed to participate in its upside since AVGO bottomed out in October 2022. Accordingly, AVGO staged a rebound of nearly 178% through its recent December 2023 highs. As a result, AVGO has continued to outperform its semiconductor peers (SOXX) (SMH) since its COVID lows.

I gleaned that AVGO’s upward momentum has stalled since it topped out in mid-December. However, that shouldn’t be surprising as dip buyers reallocate after such a remarkable outperformance. Moreover, Broadcom insider sales have also accelerated from December 2023 to the present (as of January 12). Accordingly, Broadcom insiders executed share sales of nearly $58B during this period. This figure is much higher than the $32B in insider sales between January and November 2023.

There’s little doubt that Broadcom is a high-quality semiconductor company with a wide economic moat. I presented in my previous update that the company is considered a bellwether, given its exposure across the semi-value chain. As a result, the company has significant clout over its customers and suppliers, leading to industry-leading profitability margins. The closure of the VMware acquisition has given it the ability to cross-sell a world-class enterprise software stack to its customers while leveraging on subscription-based revenue streams.

Broadcom’s fiscal fourth-quarter earnings release in early December demonstrated the company’s considerable exposure to the AI hype cycle. Capitalizing on its position as the leader in networking solutions, Broadcom’s well-diversified market leadership allows it to benefit significantly from the secular AI growth drivers. As a result, while Broadcom felt the impact of slower momentum in the enterprise, telco, and industrial space, it could still benefit from the hyperscaler and cloud computing exposure. Consequently, I’m not surprised that Broadcom sees a doubling in AI infrastructure sales in FY24, accounting for an estimated 17% of its total revenue base.

Broadcom’s profitability moat (assigned “A+” by Seeking Alpha Quant) is so impressive that even potential near-term dilution attributed to VMware didn’t markedly affect investor sentiments. Management guided for an FY24 adjusted EBITDA margin of 60%, discernibly below its FY23 metric of 64.8%. However, Broadcom is confident of continuing to gain operating leverage as it offloads the non-core businesses. Management anticipates free cash flow or FCF of $29B (estimated FCF margin: 54%) by FY25, way above its FY23 metric of $17.6B (FCF margin: 49%). In other words, Broadcom’s reputation as a serial acquirer and FCF machine has gained more credibility with the market, as suggested by its continued outperformance.

Furthermore, AVGO isn’t considered too expensive relative to its peers. Seeking Alpha Quant assigned AVGO with a “D+” valuation grade. Its forward EBITDA multiple of 18.5x remains reasonable compared to its peers’ median of 16.1x (according to S&P Cap IQ data). I’ve also not assessed red flags in AVGO’s price action, suggesting investors should consider taking significant exposure off. Therefore, while I admit I’ve missed AVGO’s incredible performance, I’m ready to sit out at the current levels, as it isn’t considered undervalued.

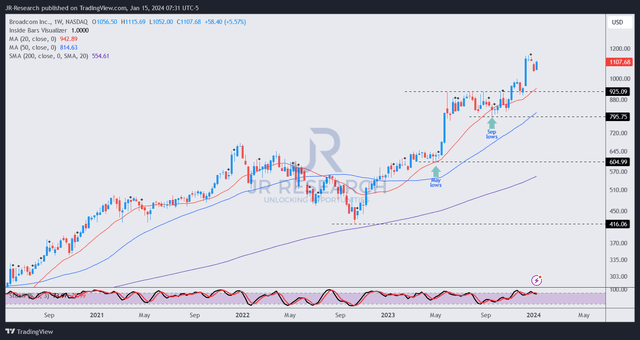

AVGO price chart (weekly) (TradingView)

AVGO’s price action suggests that the $925 level has become a potential support zone, as buyers decisively shrugged it off at the previous consolidation zone.

As seen above, AVGO traded sideways in a consolidation zone between the $800 and $925 levels from May to early November 2023. As a result, buyers had started the breakout even before Broadcom reported its FQ4 earnings release in December.

However, the momentum spike in December has led to profit-taking, as seen above, with AVGO buyers likely assessing another consolidation zone. I gleaned that AVGO’s valuation has likely captured much of its FY24 guidance, suggesting investors must anticipate even more robust growth momentum in FY25. With AVGO not assessed to be undervalued, I’m ready to continue biding my time, as I don’t assess its continued outperformance to be sustainable at the current levels.

It’s still too early for me to assess its subsequent consolidation zone. However, AVGO doesn’t seem to have clear sell signals, even though near-term volatility shouldn’t be ruled out. Unless I determine a more constructive base over the next three to four months, I’m not in a hurry to join the recent surge and go into FOMO right now.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here