Introduction

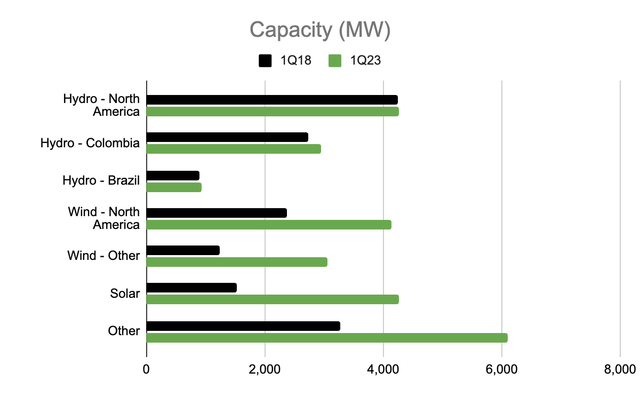

My thesis is that Brookfield Renewable (NYSE:BEP) (NYSE:BEPC) continues doing their part to help the world limit the use of fossil fuels. They’ve always been a proponent of hydro power but in the last 5 years they’ve also expanded significantly into wind and solar as the economics for these alternatives continue to improve. Per my October article, utility solar and onshore wind made up 43% and 27%, respectively, of Brookfield Renewable’s trailing twelve month (“TTM”) investments through September 2022 but capacity in these areas has increased even more since that time. The last quarterly supplement available at the time of my October article was 2Q22 which showed wind and solar capacity in megawatts (“MW”) as 5,853 and 2,845, respectively. The 1Q23 supplemental shows these increased to 7,188 and 4,266, respectively.

The Numbers

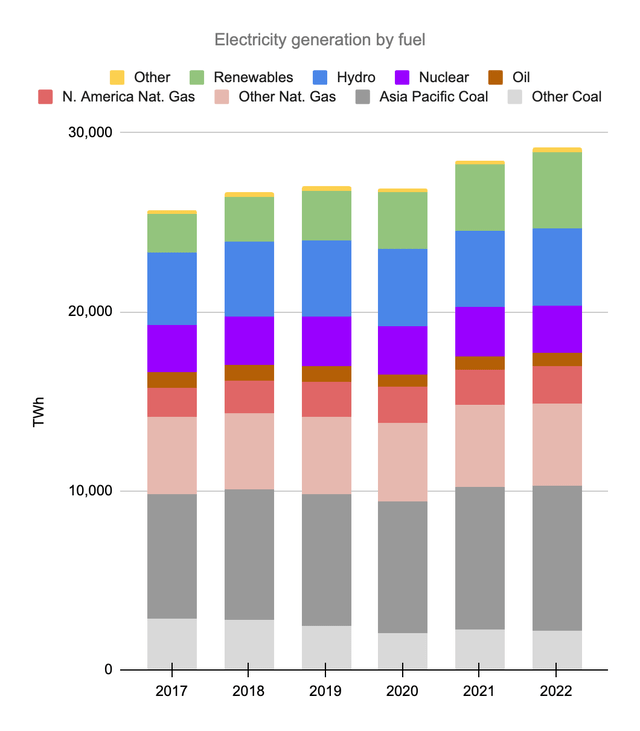

The Statistical Review of World Energy for 2022 and earlier years comes from BP (BP) whereas the Statistical Review of World Energy 2023 comes from the Energy Institute. Charting the numbers in these reviews, we see global electricity generation has gone up over the years and renewables have helped meet the increased demand. However, we still generate too much electricity from coal in Asia Pacific and from natural gas in North America. Companies like Brookfield Renewable are well positioned to help move us away from coal and natural gas as battery storage technology improves:

Electricity generation (Author’s spreadsheet)

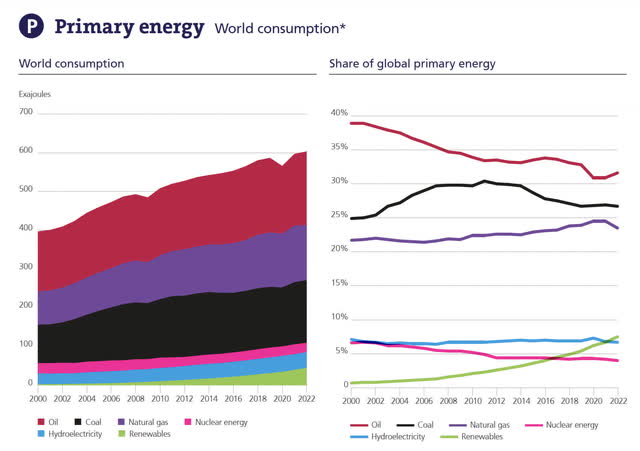

Similar to what we see with electricity generation, we use too much coal for energy consumption in Asia Pacific and too much natural gas for energy consumption in North America. Again, Brookfield Renewable is well positioned to move us away from these fossil fuels in the years ahead:

Energy consumption (Energy Institute)

Looking at capacity for 1Q23 versus the 1Q18 period from 5 years ago, we see hydro has held steady while other segments have increased prodigiously:

Brookfield Renewable Capacity (Author’s spreadsheet)

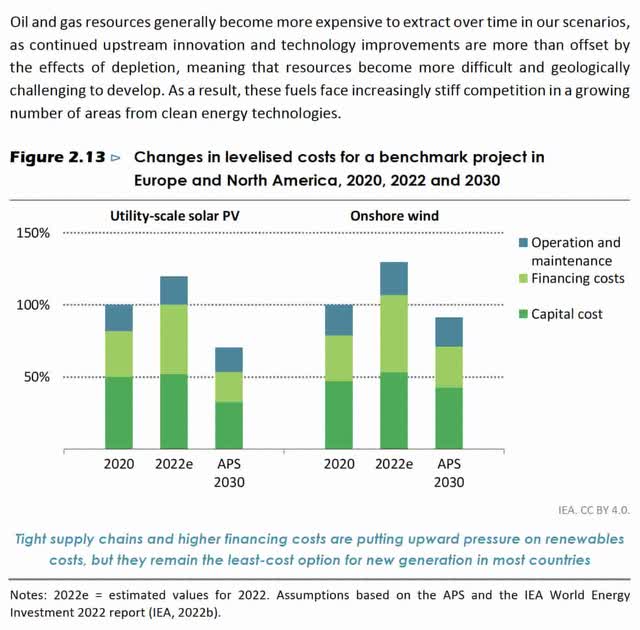

The IEA World Energy Outlook 2022 shows utility-scale solar PV should be significantly less expensive in 2030 relative to 2020 under Announced Pledges Scenario (“APS”) assumptions. As such, I expect Brookfield to continue their expansion of solar investments:

Solar and Wind Costs (IEA World Energy Outlook 2022)

I’m especially excited about Brookfield continuing to give us alternatives to natural gas in the US. CEO

Connor Teskey emphasized the importance of the US market in the 2Q22 call:

No doubt the vast majority of our activity in the last 12 months has been in the United States. There has been a concentration there in the last 6 months. But I would say our general rule of thumb of, call it, 75% of our business being in developed countries, primarily in North America and Europe, that largely holds. And that’s because we don’t necessarily do more deals in those geographies, but that certainly tends to be where we do the largest transactions.

CEO Teskey’s 4Q22 letter to unitholders described continuous expansion in the US:

We invested in three large renewable development businesses in the U.S. – Urban Grid, Standard Solar, and Scout Clean Energy. With these investments, we continue to expand our presence in the U.S., and it continues to be our largest market with approximately 74,000 megawatts in operations and development. On the back of the Inflation Reduction Act and strong corporate demand, we are actively pulling forward development projects in the U.S., which is increasing the growth prospects of these businesses beyond our original underwriting.

Closing Thoughts

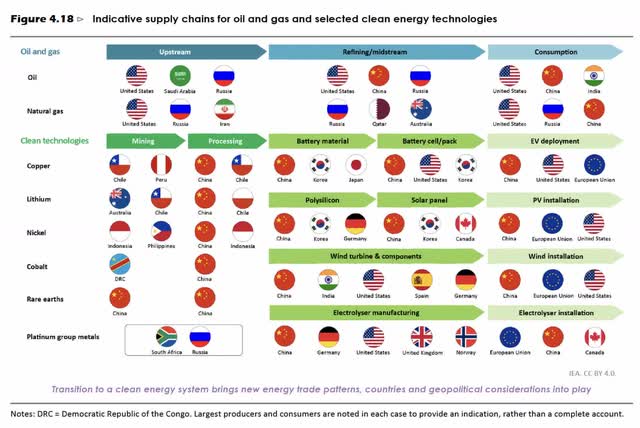

One valuation risk for clean tech companies like Brookfield is supply chain disruption:

Clean Tech Supply Chain (IEA World Energy Outlook 2022)

Despite supply chain risks for renewable energy, I’m more than comfortable owning BEP indirectly through my Brookfield Corporation (BN) investment.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Read the full article here