(Note: all ‘$’ figures are CAD, not USD, unless stated otherwise.)

Investment Thesis

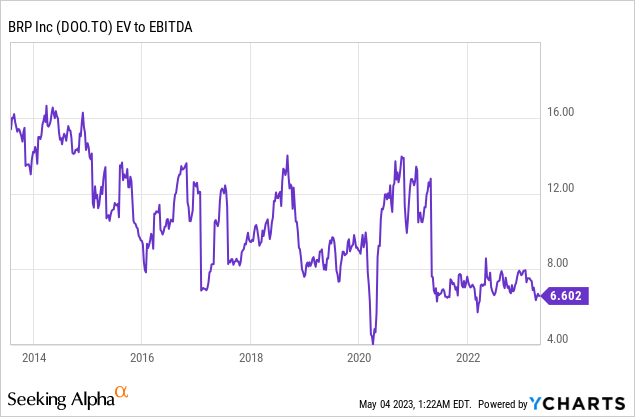

BRP Inc. (NASDAQ:DOOO) (TSX:DOO:CA) manufactures recreational vehicles in the powersports industry. With a leading product portfolio and dominant market position, the company has been stealing market share from competitors that has propelled their growth despite a small industry decline last quarter. BRP has a history of strong revenue growth and profitability and has rewarded shareholders through dividends and share repurchases, buying back nearly a third of its float in the last few years. With strong pricing power and a focus on developing new and innovative products for the powersports market, I believe BRP is a high-quality company. With shares well below their five-year historical multiple at 6.6x EV/EBITDA, I believe shares of BRP look attractive.

Company Overview

BRP was created as a stand-alone company two decades ago as a spin-off from Bombardier. The company manufactures and sells snowmobiles, personal watercraft, side-by-side vehicles, all-terrain vehicles, and roadsters. Its portfolio of brands are well-known in the industry and include the likes of Ski-Doo, Lynx, Sea-Doo, Can-Am, and Rotax. The company is also involved in the production of marine propulsion systems through its Evinrude brand where it sells outboard engines and jet propulsion systems.

Investment Attributes

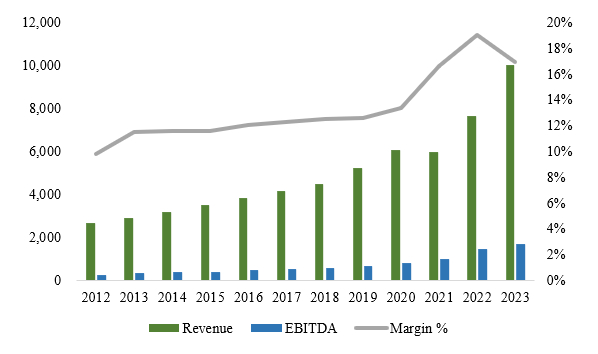

One of the first things that drew me to BRP was its impressive revenue growth and margin expansion. Since 2012, revenues and EBITDA have compounded at 13.4% and 18.3%, respectively, with margins expanding from 9.8% to 16.9%.

Author, based on data from S&P Capital IQ

A key part of BRP’s success has been driven by their innovative product portfolio that have allowed them to gain a loyal following. Associated with quality and innovation, their brands are well-known in the industry and the company’s diverse product offering has allowed them to weather seasonal fluctuations in demand for any one product category.

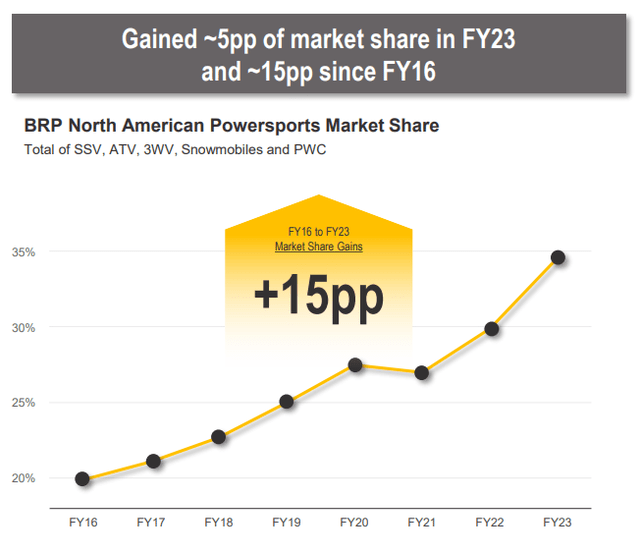

The powersports industry itself has been growing in the low single digits with the despite BRP outperforming in all product lines and key markets with double digit growth of ~20%. Much of their growth can be attributed to market share gains, as seen below.

Investor Presentation

Over the years, BRP’s market leadership in several of its product categories, such as snowmobiles and personal watercraft have led it to become a market leader in the industry. In my view, this market leading position gives the company a competitive advantage, enabling it to leverage economies of scale and pricing power. With a reputation for innovation and the company investing heavily in research and development, I believe the company’s consistent introduction of new and improved products to the market is what is helping to drive sales and grow market share.

Another key factor driving BRP’s success has been its strategic positioning of where it sells its products. As a global company, BRP locates its manufacturing facilities close to demand (e.g. personal watercraft in Mexico). With strategic priorities focused on market share growth, lean operations, and a focus on meeting evolving customer needs, I view BRP’s strategic positioning as integral.

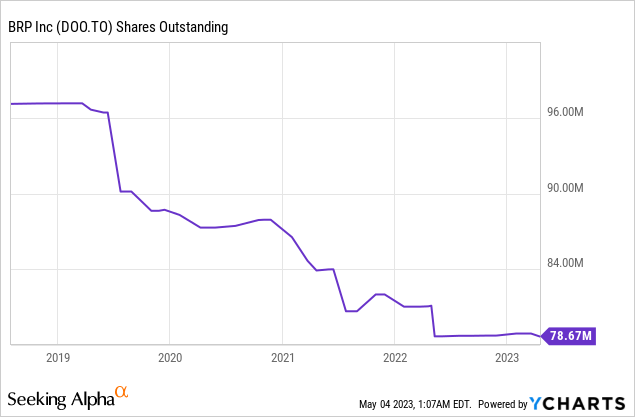

Finally, BRP has been aggressive in buying back shares on the open market. Over the last few years, it has reduced its share count by almost a third, deploying $300 million towards this effort and its share count declining 6.2% per year. With 3.5 million shares available under the company’s NCIB, the company expects to be aggressive in its share buybacks going forward.

In my view, these share repurchases are another important investment attribute of BRP. By reducing the number of outstanding shares, the company is able to increase the earnings per share for its shareholders, all else equal. This can make the stock more attractive to investors and potentially drive share price appreciation. Moreover, BRP’s commitment to share buybacks also signals management’s confidence in the company’s future growth prospects and its ability to generate cash flows. By allocating capital towards share buybacks, I believe the company is demonstrating its belief that investing in its own shares is one of the most attractive uses of capital.

Recent Quarter

In its recent Q4 earnings release, BRP reported its strongest quarter ever with record sales, EBITDA and EPS. With revenue of $1.4 billion in the quarter, up 47%, driven by strong shipments across all product lines and across all geographies, BRP is showing no signs of slowing down. Despite a low single digit industry decline, North American retail sales for BRP were up 19%, EMEA up 36%, Latin America up 32%, and Asia-Pacific up 16%. In my view, this shows that while the industry may be suffering near term, BRP is seeing strong market share gains while competitors suffer. While other companies struggle with excess inventory, BRP had to increase overall network inventory 130%, which is still below their optimal level. I view this as a strong indication that demand is strong and that as supply chain improves, the company will be able to significantly outpace the industry in the quarters going forward. I recently covered Patrick Industries where I discussed how the company still looks attractive despite industry headwinds in the RV industry. Even with a small decrease in the powersports industry this year, I don’t see growth slowing for BRP this year.

Valuation

Based on the 9 analysts with one year target prices for BRP, the average price target is $141.57, with a high estimate of $154.67 and a low estimate of $115.65. From the average target price, this implies about 38.4% upside from the current price.

BRP currently trades at 6.6x EV/EBITDA and 9.6x P/E. At 6.6x EV/EBITDA, the company is trading below its 5-year historical average of 8.5x EV/EBITDA. Even using the P/E multiple, its 9.6x P/E sits well below its historical 5-year average P/E of 15.8x. When we consider that the forward multiples on both valuation metrics are lower than their current metrics, this suggests that analysts are expecting earnings to increase next year. Considering how BRP is showing no signs of slowing down despite industry headwinds, I believe its current valuation is unjustified sitting well below its historical average multiples.

Conclusion

In summary, BRP is a market leader in the powersports industry that is stealing market share despite short-term headwinds in the industry. With a track record of balanced capital allocation through investments, dividends, and share repurchases, the company has proven it can deliver strong results for shareholders over the long-term. At 6.6x EV/EBITDA, shares of BRP are well below their 5-year multiple despite further growth expected for next year. With a compelling valuation for this high-quality compounder, I believe shares of BRP are a buy today.

Read the full article here