For trust not him that hath once broken faith”― William Shakespeare

Today, we put a Canadian based REIT in the spotlight for the first time. Inflation and higher interest rates have been challenging headwinds for this owner of multi-family properties. The shares now yield just north of four percent. Is the REIT in the ‘Buy Zone’ yet? An analysis follows below.

Seeking Alpha

Company Overview:

BSR Real Estate Investment Trust (OTCPK:BSRTF) is a Toronto, Canada domiciled REIT focused on the operation of 8,666 multi-family residential rental units, primarily Class B properties in the Texas markets of Dallas, Austin, and Houston (a.k.a. the ‘Texas Triangle’). It owns 24 properties in these geographies, as well as three in Little Rock, Arkansas and four in Oklahoma City. They are typically two-to-three story apartment complexes, each with 200–300 units. BSR was formed in 1956 as Bailey Properties, began focusing on multi-family properties in 1991, merged with Summit Housing Partners to form BSR in 2008, and went public in 2018, raising gross proceeds of $135 million (US) at $10 per unit. BSTRTF trades at just under $13 per unit, translating to an approximate market cap of $730 million.

The REIT is ‘capitalized’ by two classes of units. The 36.4 million publicly traded Class A units confer economic interest and voting rights, whereas the 20.5 million privately held Class B units bestow economic interest and exchangeability into Class A units (or cash) but no voting rights. As such, Class B units, which are owned primarily by Vice Chairman John Bailey, Trustee (and Summit founder) W. Daniel Hughes Jr., and their families, are listed on the balance sheet as a liability. The market cap calculations treats the Class B units as equity. The Class A units are thinly traded on both the Toronto Stock Exchange (under the symbol HOM.U:CA) and on the Pink Sheets in the U.S.

Operating History

When BSR went public, it boasted 9,879 units on 48 properties in five states but has recycled capital to concentrate on larger markets, foregoing Shreveport and Baton Rouge, Louisiana in favor of the Texas Triangle and Oklahoma City, as per its plan. Specifically, since its IPO, it has added 22 properties (6,966 units) in its core markets at a total price of ~$1.3 billion with a weighted average age of six years. Over the same period, it has disposed of 39 properties for a total price of $760.5 million, with a weighted average age of 31 years. Net operating income (NOI) from its core markets has increased from 52% of total at the time of its IPO to 97% currently. That said, BSR did not bring one unit on or offline in FY22 or to date in FY23.

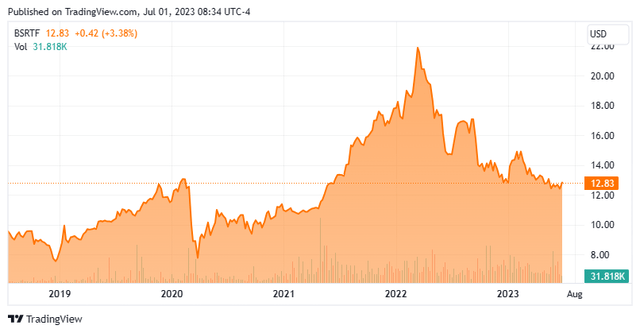

However, its cap rate (NOI / property cost) took a hit as the transition meant the sale of higher-cap-rate small market apartments and the acquisition of lower-cap-rate large market real estate. As such, Adj. funds from operations (AFFO) fell from $0.64 in FY19 to $0.56 in FY20 and $0.59 in FY21, but the move began to pay off in FY22. With average rents in its portfolio rising 36% from $1,088 at 4Q20 to $1,482 in 4Q22 while weighted average occupancy increased from 93.8% in FY21 to 96.0% in FY22, BSR delivered AFFO of $0.80 in FY22. BSRTF units responded in anticipation of these tailwinds, rallying 142% from September 2020 to an all-time intraday high of $22.70 in March 2022.

The Texas Market

Obviously, its decision to concentrate on the Texas Triangle was aided by the pandemic, with an exodus out of the urban areas of the Northeast and California into many markets in the Sunbelt. It was also driven by Millennials – who comprise 25% of the population in BSR’s core markets – and their propensity to rent. Real estate developers have been entrenched in the Texas Triangle for some time, but building reached record levels in 2022, with Dallas (2nd), Austin (4th), and Houston (5th) all landing in the top 5 cities for apartment construction last year. This dynamic and inflation, which eats into the real return provided by distribution-paying REITs, resulted in a protracted price reversal, with units of BSRTF currently down 44% from their March 2022 high.

That said, rent as a percentage of median household income in its core markets is anywhere from 17% (Oklahoma City) to 27% (Dallas) as compared to the national average of 35%. Furthermore, the Texas Triangle is expected to add 1.3 million residents between 2022 and 2027, with Austin (1st), Houston (2nd), and Dallas (5th) representing three of the five fastest projected growth rates of the top 50 metropolitan statistical areas (MSAs) over that period, according to Oxford Economics.

1Q23 Financials & FY23 Outlook

With potential headwinds meeting potential tailwinds, BSR reported its 1Q23 financials on May 10, 2023, posting FFO of $0.23 per unit and AFFO of $0.22 per unit on revenue of $41.6 million versus FFO of $0.21 per unit and AFFO of $0.20 per unit on revenue of $37.6 million in 1Q22, representing 10%, 10%, and 11% increases, respectively. Total portfolio NOI increased 16% to $41.6 million. Weighted average rent rose 10% year-over-year and 0.5% sequentially to $1,489, while weighted average occupancy improved 140 basis points year-over-year to 95.9%.

Management maintained FY23 guidance, projecting AFFO of $0.86 per unit (7.5% growth) and NOI growth of 7% on same community revenue growth of 6%, based on range midpoints. That guidance was obviously suggestive of a slowdown over the balance of the year and did not generate any positive momentum REIT’s units, which have maintained a $12 handle since the report.

Balance Sheet & Analyst Commentary:

To finance the deficit created by its capital recycling, BSR onboarded additional debt and has raised net proceeds of $228.5 million in three secondary offerings since FY19. As of March 31, 2023, the REIT held debt of $741.1 million, consisting of mortgage notes totaling $498.6 million at an effective rate of 3.4% (97% fixed or hedged) with a weighted average maturity of 4.9 years and the balance on a credit facility at an effective rate of 6.4%. Approximately $160 million of the debt matures in 2024, followed by $295.9 million in 2025. BSR held cash and equivalents of $4.3 million with $169.7 million of liquidity available on its credit facility, which can be further expanded through the collateralization of unencumbered properties. At the close of 1Q23, its net asset value was $21.36 per unit.

With its units trading at a 41% discount to NAV, BSR is deploying capital towards buying back those units, where management believes it is receiving a cap rate of ~6.5% versus ~4.5% for current opportunities in its core markets. As such, it has purchased ~1.2 million units between FY22 and the first stanza of 2023. Other capital is earmarked for property upgrades, such as smart home technology and washer/dryers. That said, no dispositions are planned.

The REIT pays a monthly distribution of $0.0433 a unit or $0.52 annually, for a current yield of 4.1%. It is safe (and could be increased) with a payout ratio in 1Q23 of 59% versus 63% in the prior year period. It should be noted that the distribution is a return of capital for tax purposes, meaning that the unitholder does not initially incur a tax liability from said distribution. However, it does lower the unitholder’s cost basis.

The very thinly traded units, be it on Toronto or the Pink Sheets, are not widely followed by the Street – at least in the U.S. – with only Raymond James covering the company stateside. The firm downgraded BSR from a buy to an outperform in March 2023 and maintained a $17 price objective.

Verdict:

Higher rates make the residential REIT’s relatively low 4.1% yield less attractive. However, higher mortgage rates decrease housing affordability and thus keep would-be first-time homebuyers in the renter category. They have also gummed up the pace of transactions in the multi-family space with potential sellers, who are likely sitting on mortgages with a 3% handle not in a rush to recycle into a mortgage with a six to seven percent handle. With BSR actively in the market repurchasing units, there is limited downside. However, BSR currently trades at 14.9 times FY23E AFFO, which is fair in the current inflation environment.

BSR is stable. It finds deals in its core markets unattractive and is not in any rush to deploy additional capital. The upside potential trumps the downside risk, but not by a mile. Is a 4.1% yield that appealing when short term treasuries yield over 5%? The verdict is no.

Trust is always a good idea. For someone else.”― Sherrilyn Kenyon

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here