Co-authored with “Hidden Opportunities”

Las Vegas is a fun place. The city welcomes almost 42 million tourists annually and has a lot going on there, making it a must-visit destination; fine hotels, excellent food, vibrant nightlife, highly entertaining shows, and most importantly, the casinos.

As a business, casinos deal with these tokens or chips instead of cash because they are easier to stack, store and count. While these tokens are interchangeable with money at the casino (and perhaps a few businesses in “gambling towns” may honor them informally), make no mistake – these tokens have no practical value. When the old casino closes down and a new one moves in, those old chips are interesting art.

Similarly, the financial markets have a wide range of highly speculative instruments that tempt the average investor to “get in on it.” It is understandable. After all, the urge to participate in something that looks like easy money is a basic human instinct.

“A rising price does create more buyers and people think ‘I’ve gotta get in on this’ and it’s better if they don’t understand it. If you don’t understand it you get much more excited than if you understand it.” – Warren Buffett in 2018

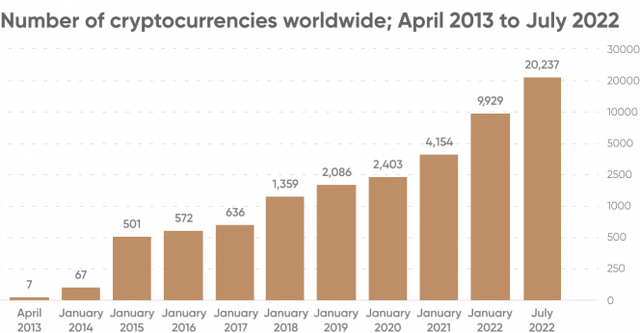

The funny thing about the crypto market is that the instruments aren’t perfect, even in the theory of being the technology to support decentralized finance. Because Bitcoin is fundamentally flawed, we have Ethereum. And Ethereum has scalability issues, so we have Cardano. You often hear about the founder of one crypto starting another, claiming improvements in known challenges of the former. Today, there are almost 23,000 cryptocurrencies with a market cap of +$1 trillion. They are filled with “pie in the sky” potential described in ways beyond the understanding of the average individual with a “shut up and take my money” attitude. Source

CoinMarketCap

The Oracle of Omaha, who also happens to be a notable disciple of Ben Graham, the father of value investing, sees no value in Bitcoin. Despite its rising price, the Berkshire Hathaway CEO sympathizes with cryptocurrency speculators and doesn’t shy away from calling it a “get rich quick scheme.”

While Mr. Buffett buys hidden value and lets time unlock the true potential of his purchases, our objectives deviate a bit. We don’t invest in anything from the financial markets unless it pays us for our time (and money).

Preferred Securities Offer Reliability In Current Markets

Benjamin Graham noted that due to the irrationality of investors (including factors such as the inability to predict the future and the fluctuations of the stock market), buying undervalued or out-of-favor securities is sure to provide a margin of safety for the investor.

In a market where prices of stocks and bonds have fallen in concert due to the so-called “interest rate risk,” preferred equity combines the best of both worlds for risk-averse investors.

Unlike bonds, most preferred stocks have no maturity date at which the principal must be repaid. Companies issuing the preferred can redeem it anytime after the “call date” for the issue. Until this time, you can collect regular dividend payments.

Preferred securities are quite the opposite of speculative plays – they provide a reliable and predictable income stream and can be redeemed at a set par value (typically $25). As long as the underlying company continues to execute its business objectives, we get paid for our patience. Eventually, as the company improves its credit ratings and can borrow at lower costs, callable preferreds get redeemed at par value, and if we purchased below par we collect a capital upside.

As interest rates have risen, many preferreds are trading well below their par values, and we are boosting our stake in this asset class. At High Dividend Opportunities, we are maintaining a 40% fixed-income allocation. Our preferred portfolio has positions in 45+ individual preferreds and baby bonds, targeting an average yield of 8-9%. As Wall Street runs away from fixed income in this rising rate environment, we buy with both hands for our long-term income needs.

Here are two deeply discounted high-yield preferreds we are loading up in this sale.

Pick #1: SiriusPoint Preferreds – Yield 8.7%

SiriusPoint Ltd. (SPNT) is an insurer with licenses to write Property & Casualty and Accident & Health insurance and reinsurance globally. SPNT has $2.9 billion in total capital, and its operating subsidiaries have a financial strength rating of A- from AM Best, S&P, and Fitch.

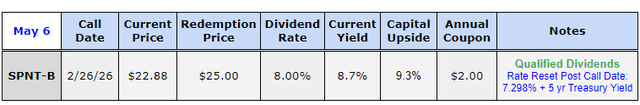

With discussions of SPNT being taken private by ~9% shareholder Dan Loeb gaining airtime, holders of its 8% Resettable Fixed Rate Preference Shares (SPNT.PB) are concerned about the abandonment of the securities.

If unredeemed after its call date (February 2026), SPNT-B‘s coupon switches to a floating rate at the 5-year U.S. Treasury Rate plus 7.298%, resetting every five years. Considering the coupon is most likely going to be higher than today’s levels, (and that the subsequent call opportunity won’t be until 2031) there is a higher probability of redemption of the preferred in three years.

Author’s Calculations

Since SPNT-B was issued to appease major institutional investors as part of a definitive agreement that led to the formation of SPNT, it enjoys a generous 8% coupon; it has several structural protections and features that make it quite a unique investment. 8.7% qualified yield and 9% upside to par from this preferred with a rate-reset clause that almost guarantees redemption upon the call date.

Pick #2: Necessity Retail REIT Preferreds – Yield Up To 9.3%

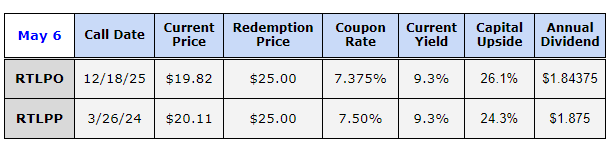

The Necessity Retail REIT (RTL) also calls itself the place “Where America Shops.” This REIT has a recession-resistant portfolio of primarily necessity-based tenants like discount retailers, auto repair stores, gas stations, and convenience stores. RTL maintains high occupancy rates and a healthy balance sheet, providing adequate coverage to the preferred dividends.

RTL has two classes of preferreds sporting an attractive 9.3% yield and offering up to 25% upside to par value. The growing common dividend is a boon for the investors of these cumulative preferreds.

- 7.375% Series C Cumulative Redeemable Perpetual Preferred (RTLPO)

- 7.50% Series A Cumulative Redeemable Perpetual Preferred Stock (RTLPP)

Author’s Calculations

Being perpetual preferreds, the company does not have an obligation to redeem these securities after the call date. Given RTL’s financial position and the interest rate climate, we don’t expect RTL preferreds to be called anytime soon, making them excellent buys for our long-term income needs.

Conclusion

As a spectator of decades of investor sentiment, Mr. Buffett has for decades seen several financial instruments disguised as “assets” with big promises, drawing anxious people to “get in” on the upside. With Bitcoin, The Oracle of Omaha simply likens them to the gambling he has seen throughout his life.

“Cryptocurrencies basically have no value, and they don’t produce anything. They don’t reproduce, they can’t mail you a check, they can’t do anything, and what you hope is that somebody else comes along and pays you more money for them later on, but then that person’s got the problem. In terms of value: zero.” – Warren Buffett in 2020

Don’t gamble away your financial future with the promises that highly speculative investments offer. Your neighbor may have made bank with Bitcoin or other cryptocurrencies, but you could lose everything when the bubble bursts into nothing.

We love dividend stocks, and these two picks are part of our Preferred Stock portfolio which constitutes +45 different solid investments. Thanks to the Hawkish Fed, there are much safer asset classes at deeply discounted prices. We believe that interest rates have peaked, and dividend stocks, in general, are at their very lows today. As income investors, we are loading up on preferred securities and will patiently wait for the upside as the interest cycle shifts. Retire in safety with up to 9.3% yields from two well-protected preferreds. Now is the time to load up on dividend stocks!

Read the full article here