On May 3rd, Dallas-based Builders FirstSource (NYSE:BLDR) experienced a rise of approximately 12.9% following the release of its 1Q results, which surpassed the consensus estimates. Moreover, the stock claimed the top spot among industrial gainers (with a market capitalization greater than $2 billion) for that week, rising 17.4%. The year-to-date and long-term returns on the stock have been similarly impressive, with BLDR’s stock significantly outperforming the benchmarks. In this article, I will discuss the reasons for such outperformance and explain my bullish stance on the stock, even after this recent run-up.

Recent performance and reason for the outperformance

BLDR’s performance, along with that of the entire home-building sector, has been phenomenal since the onset of the pandemic. This was further bolstered by the BMC merger and several other tuck-in acquisitions. From a topline standpoint, the company delivered exceptional growth, with revenue growing more than three times in just three years. While M&A, particularly the BMC merger, played a significant role in this growth, favorable commodity prices and strong demand from the single-family housing market also contributed to the company’s success.

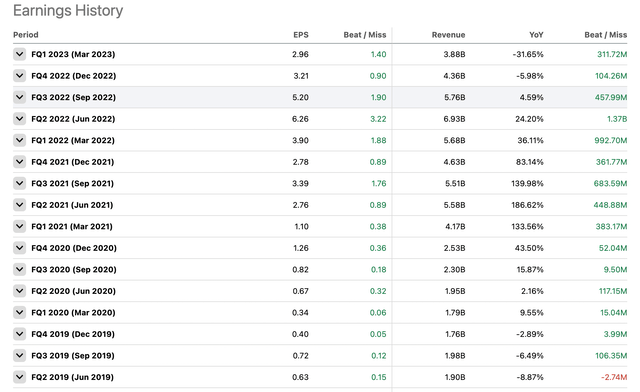

From a bottom-line perspective, things are even better, as operating leverage came into play, coupled with synergy benefits. Prior to 2019, BLDR had an EPS of less than $2, which increased to $16.8 in FY22 or roughly nine times the pre-Covid levels.

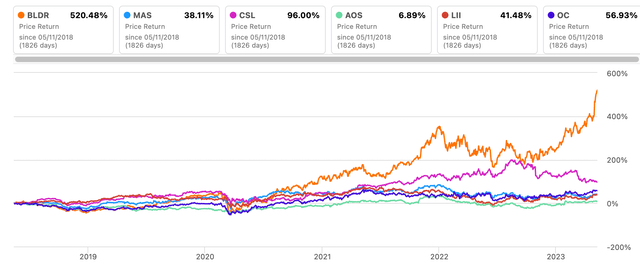

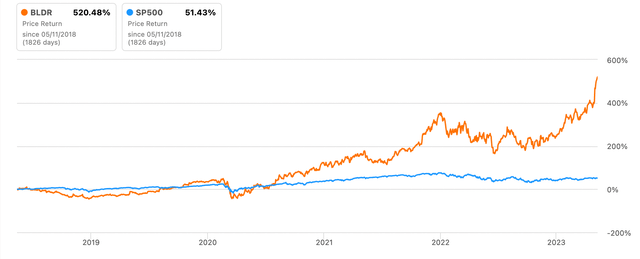

Therefore, the robust growth in the last few years has been rightfully reflected in the stock price, with BLDR’s stock outperforming all of its peers and the S&P 500 benchmark index.

Seeking Alpha Seeking Alpha

The performance of BLDR’s stock was impressive until the start of 2022, when concerns about persistent and higher inflation became more prominent. As a result, the stock pulled back slightly from its all-time highs. However, BLDR continued to post good results, and when interest rates and mortgage rates stabilized, the stock resumed its rise. More recently, the stock gained momentum as the company reported impressive results, surpassing the consensus estimates on both the top and bottom line fronts.

What’s Next?

For FY23, analysts are expecting a significant decline in both revenue and EPS for BLDR, with a projected 28.8% year-over-year revenue decline and a 49.2% year-over-year EPS decline. At first glance, FY23 appears to be a challenging year for BLDR. However, this is primarily due to the exceptional growth the company experienced over the past couple of years, which is now normalizing due to the swift rise in mortgage rates.

Despite the expected pullback in growth figures, I believe that the demand and supply dynamics of the single-family home market, which remains undersupplied, indicate that this is a temporary setback for BLDR. As a result, I expect the company to resume growth from FY24, albeit at a slower pace than in previous years.

Industry consolidator

I am drawn to companies that operate in highly fragmented industries and have the potential to consolidate market share. These companies are well-positioned for margin expansion and revenue growth, as they can continuously acquire smaller competitors and leverage their larger size for better bargaining power while deriving synergies from acquisitions. Since its merger with BMC, BLDR has become one such company in the building materials industry. In addition, BLDR has been utilizing the recent housing boom to acquire many smaller players in the industry, as it generates significant cash.

I recently covered WSO, which operates in a similar industry dynamic, and its returns are comparable to BLDR. Similar to WSO, I believe that BLDR’s core margins, which strip out the volatility of lumber prices, and revenue should increase over time.

BLDR’s digitization efforts

Furthermore, I would like to emphasize BLDR’s efforts to digitize the homebuilding industry. A study by the McKinsey Global Institute found that the construction industry is the second-least digitized industry, following only agriculture and hunting, leading to stagnant productivity over the last four decades. However, BLDR is taking steps to address this issue. Recently, the company launched an end-to-end web portal called mybldr.com, which allows small and medium-sized homebuilders to virtually design and manage their homebuilding process. The management aims to generate an additional $1 billion in revenue per year from this platform.

Is BLDR a buy now?

Despite the recent increase in BLDR’s stock, I still find it to be attractively priced. BLDR’s stock is currently trading 12.2x its FY23 EPS estimate, which is ~25% lower than the sector median. Additionally, I believe that the consensus EPS estimate for FY23 should be revised upwards as I think the management has given conservative guidance for the year. This guidance has been factored into many sell-side analysts’ models when calculating their EPS estimates. BLDR’s management has a track record of under-promising and over-delivering, as evidenced by its consistent beats the consensus estimates for every quarter in recent years.

Seeking Alpha

I believe this time is no different and BLDR should surprise the market in the coming quarter with sell-side analysts revising the EPS estimate upward resulting in even lower forward PE.

Risk

Similar to other home building and building material stocks, BLDR’s stock is highly influenced by the overall homebuilding industry demand situation. Although there are fundamental demand drivers for the industry, such as underbuilding in the last decade, demand could remain suppressed for longer than expected if inflation remains persistent and the Fed further tightens interest rates.

Conclusion

BLDR’s stock has recently seen significant gains, and I believe it has even more potential for growth due to the strong fundamentals of the homebuilding industry and BLDR’s leading position within it. Furthermore, valuations appear to be reasonable, which reinforces my bullish stance on the stock even after its recent rise. Therefore, I recommend a buy rating for BLDR.

Read the full article here