Investment action

Based on my current outlook and analysis of Burlington Stores (NYSE:BURL) 2Q23 earnings, I recommend a hold rating. I expect the stock price to be rangebound in the near term, as I do not see any positive catalysts that will drive the valuation multiple upwards. BURL needs to show the market that it is performing in line with peers (or better) over the next few quarters.

Basic recap

BURL is an American national off-price department store retailer. They primarily sell goods that are deemed as value buys for consumers. BURL primarily serves the US market, with some presence in Puerto Rico. The company is one of the few largest off-price department store retailers, competing against TJX (TJX) and Ross Stores (ROST).

Review

The increase in retail sales for 2Q23 was 9.4%, which was slightly higher than the consensus estimate of 9.2% and was driven by comp growth of 4.0%. EBIT margin increased by around 100 basis points to 3.1%, which was higher than the consensus estimate of 2.4%, and gross margin came in at 41.7%, which was better than the expected 40.4%. As a result of robust comps growth and gross margins. EPS for BURL were $0.60, beating expectations of $0.44. Although the results were satisfactory on their own, they lagged behind peers. The most notable difference is that ROST and TJX both showed stronger sequential comp improvements in 2Q23, while BURL’s comps growth remained flattish from the previous quarter. Similarly, while most of BURL’s competitors increased their 2H23 guidance, BURL lowered theirs. When asked about their future plans, BURL maintained their cautious stance toward their core customer, the middle- and lower-class individuals who are still feeling the effects of the ongoing economic downturn. To make things worse, FY23 trade-down traffic benefits have lagged behind both management’s expectations and consumers’ past behavior. As such, management revised their comp guidance for 2H23 and the FY23 to 2-4% and 3-4%, respectively, from 3-6% and 3-5% previously, reflecting the slower YTD trend and macro pressures on the consumer.

While I am aware of these relative headwinds, I believe the market is ignoring the fact that BURL execution is improving. The high merchandise margin achieved in 2Q23 is indicative of this improvement in purchasing and availability of desirable name-brand goods. The increase in BURL’s quarterly gross margin of 275 basis points was driven partially by the 150 basis points increase in merchandise margin. Specifically, management mentioned increases in merchandise margin due to a favorable off-price purchasing climate, as well as decreases in markdowns and shortage costs. This demonstrates BURL’s methodical implementation of enhanced merchandising tools, which, if successful, should boost the company’s ability to provide value to its customers. BURL also has a clearer view of upcoming store openings, as they are optimistic about the store expansion as a whole, citing the purchase of 62 formerly leased Bed Bath & Beyond locations as an example of the strengthening pipeline of new store growth. In my opinion, the new leases are a net positive, as they provide greater clarity regarding future store expansion and should increase investors’ optimism regarding BURL’s potential for increased revenue and earnings per share.

That said, I do acknowledge that the headline comparison certainly does not work well for the stock. Any investors or capital looking to take advantage of the trade-down situation are likely to place their bets in TJX or ROST given the performance so far. In the current situation, even though I am bullish on BURL’s operating performance, it is sad to say that the stock is likely to be rangebound until it shows the market (over a couple of quarters) that 2Q23’s weak performance was a blip.

Valuation

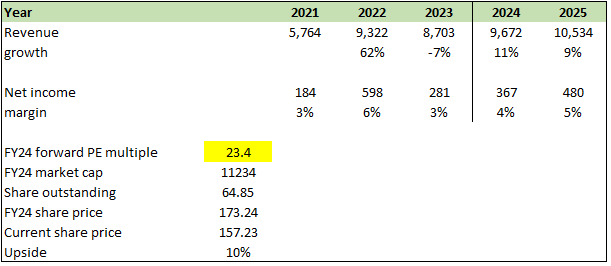

Author’s work

I believe BURL can grow as management guides it in FY24 and continue to grow similarly to how it has done so historically. My positive view is mainly driven by the improved execution and store expansion plans. I do not see any structural change in the industry; in fact, the current macro situation is in favor of BURL’s industry. Based on my model, investors can still get a 10% return if multiples stay at the current level, which I expect they will, as I do not see any catalyst to drive them up. Depending on each investor’s investment requirements, for me, 10% is good enough, but because of the bearish reasons I stated above, I am recommending a hold rating until BURL shows that it is at least performing in line with peers.

Risk and final thoughts

I believe the risk with investing in BURL today is that the comparative underperformance vs. peers might worsen in the near term, which will further solidify the bearish narrative that BURL is losing market share. This will not be great for the stock, especially with BURL trading at the same valuation multiple.

In conclusion, my recommendation for BURL is a hold due to uncertainties in near-term growth and performance relative to peers. Despite achieving a higher merchandise margin, BURL’s comps growth remained flat from the previous quarter, and the company lowered its guidance for the rest of the year due to ongoing macro pressures on consumers. While my model suggests potential for a 10% return at current multiples, I recommend holding off until BURL shows performance on par with its peers, as its relative underperformance could hinder market perception.

Read the full article here