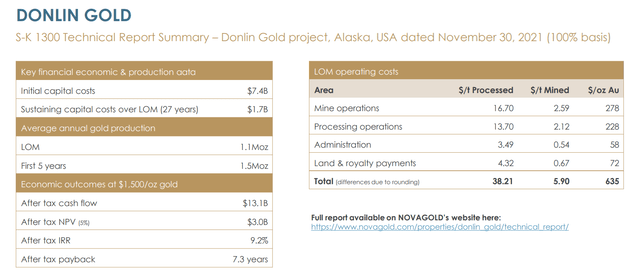

NovaGold Resources (NYSE:NG) is a resource exploration company I have mentioned several times over the years as a way to ride rising gold prices. It’s main asset is 50/50 owned with Barrick Gold (GOLD) in Alaska, the Donlin project. The company is now working on a new development plan, with the last 2020-21 version envisioning between $8 and $10 billion in upfront costs to build a mine, quite high by any mining industry standard.

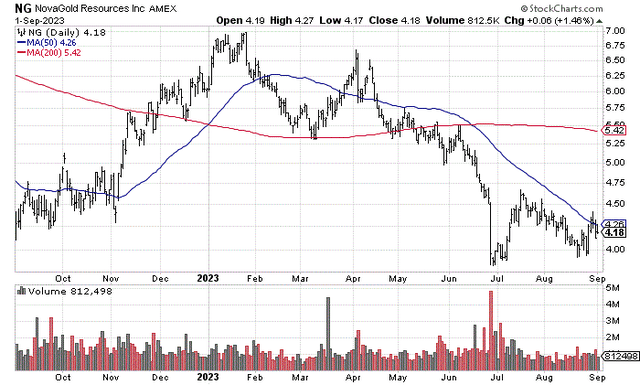

Barrick’s CEO Mark Bristow also stated last year that the project did not quite meet the company’s criteria to move forward with full approval to build Donlin. As a consequence of this letdown for investors, and a gold price that has not been able to rise at all the last six months, NovaGold’s share quote has declined from a peak near $7 to roughly $4 since January.

StockCharts.com – NovaGold, 12 Months of Daily Price & Volume Changes

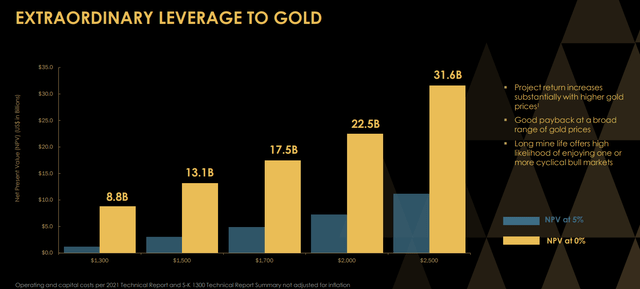

While NovaGold’s main project will likely not be built for a number of years, a much higher gold price would make putting off a decision to build equally difficult to fathom. If you will, I now consider Donlin the “premier” blue-chip idea in the riskier gold exploration sector. Why? It’s all a function of my increasingly bullish outlook for gold prices. US$3000 an ounce gold would make the underlying economics incredibly attractive vs. only limited excitement at $1900 gold in the summer of 2023.

Company Summary

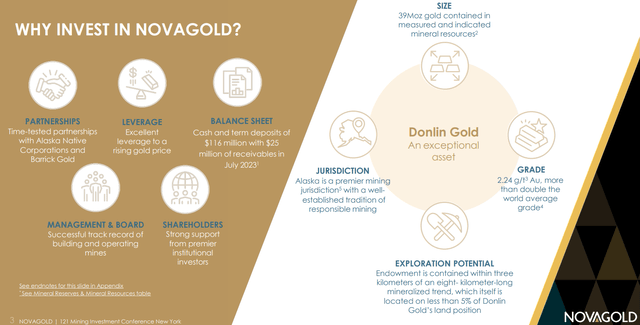

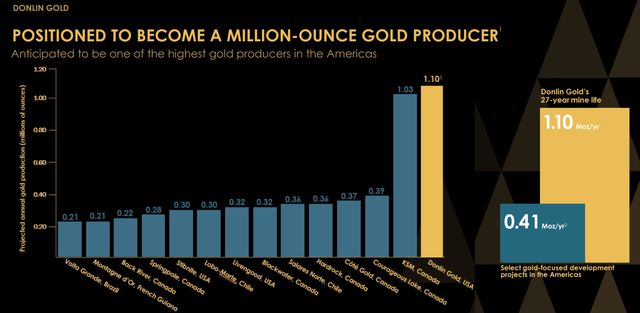

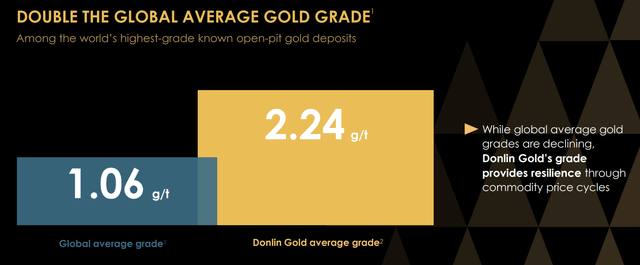

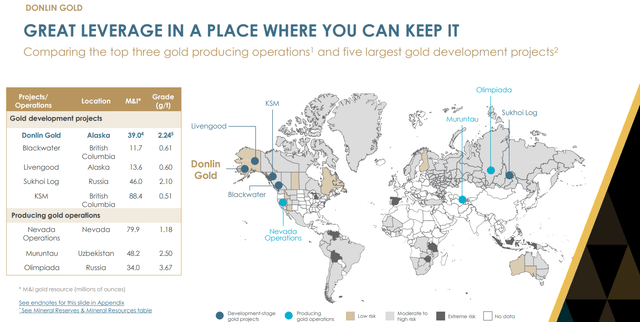

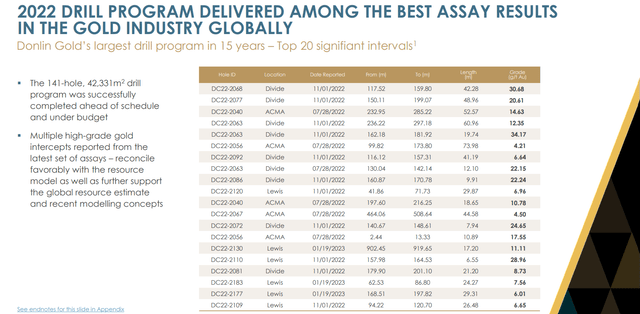

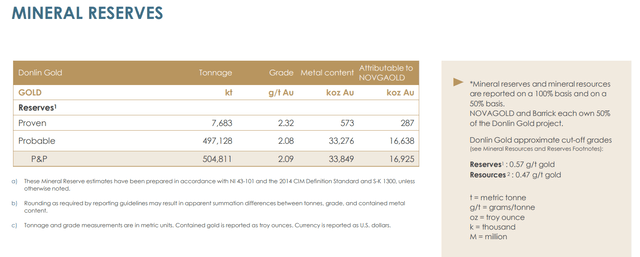

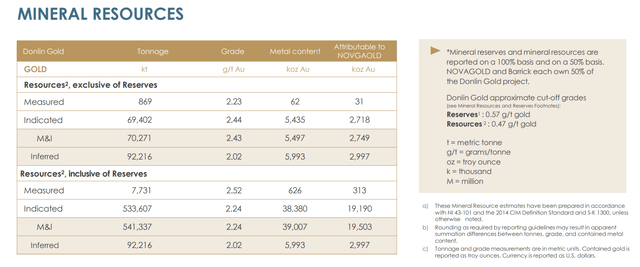

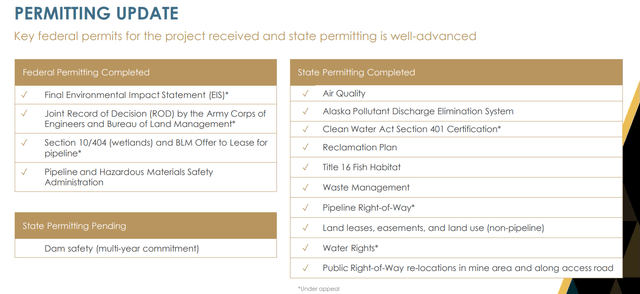

You can review more data on the Donlin Gold resource in NovaGold’s June investor presentation below. A combination of attractive factors like exceptionally high gold ore grades (vs. existing open-pit designs around the world), a super-safe mining jurisdiction (Alaska, USA), a land package only 5% explored, one of the largest drilled resources in the world for size discovered (39 million ounces), with a major mining partner onboard (Barrick), well down the road to permitting, is an A+ asset setup to own.

NovaGold – June Investor Presentation NovaGold – June Investor Presentation NovaGold – June Investor Presentation NovaGold – June Investor Presentation NovaGold – June Investor Presentation NovaGold – June Investor Presentation NovaGold – June Investor Presentation NovaGold – June Investor Presentation NovaGold – June Investor Presentation NovaGold – June Investor Presentation NovaGold – June Investor Presentation

The current equity market cap of $1.4 billion (with a balance sheet holding cash and current assets greater than total liabilities) for NovaGold’s half of Donlin should explode in value on sharply higher precious metal quotes. 5% net-present-value (NPV) calculations for its 50% ownership would jump from numbers closer $2-3 billion at $1800-$2000 gold to numbers above $10 billion at $3000+ selling prices per ounce. That’s the basic upside gold leverage argument to own this exploration outfit.

Gold Bull Market Beginning?

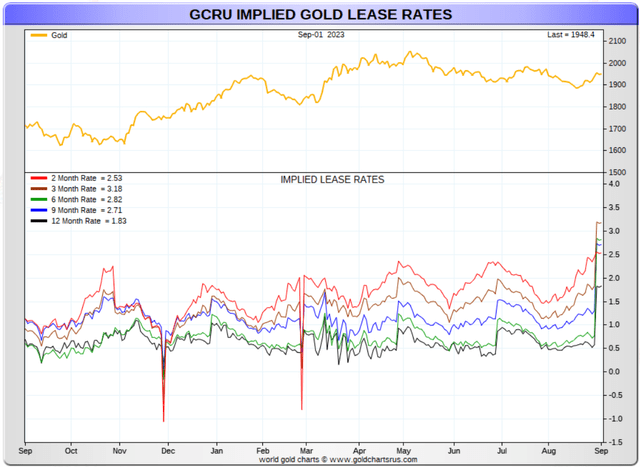

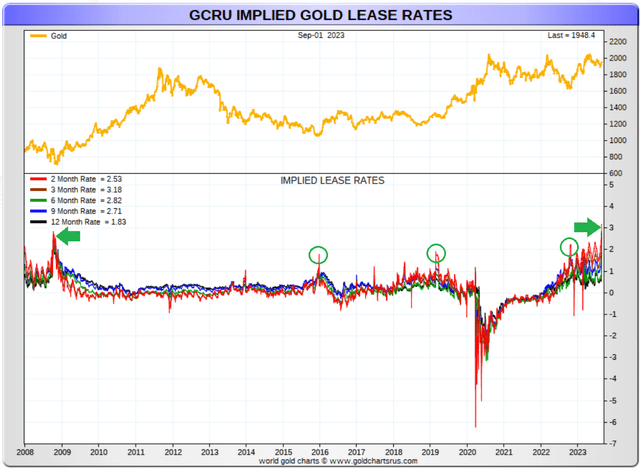

With an unusual and important gold buy signal flashed by spiking “lease rates” last week, we could be on the cusp of a bull market in metals that allows Donlin to finally be built. You can read more on the lease rate idea in my VanEck Gold Miners ETF (GDX) story posted several days ago here.

GoldChartsRUS.com – Gold Lease Rate Picture, 1 Year GoldChartsRUS.com – Gold, Lease Rate Picture, 15 Years, Author Reference Points

My view, after trading gold miners for nearly 36 years, is a rare opportunity in terms of timing a buy in NovaGold may be on the table today. Previous instances of gold lease rates spiking like the late August to early September situation include October-November 2008 after Lehman Brothers was allowed to fail (green arrow on chart), then again at the important long-term price bottoms around $270 an ounce for gold in 1999 and 2001 (not pictured). Smaller lease rate increases are circled in green, including late 2015, early 2019, and about 12 months ago (which I highlighted in my bullish gold articles during each period). All four instances proved a great time to buy gold assets, including exploration and resource owners.

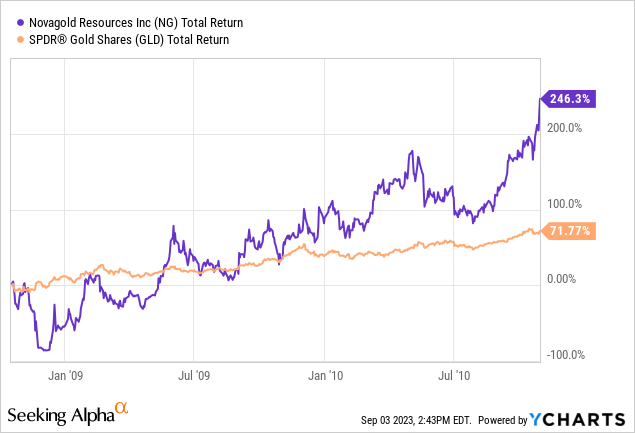

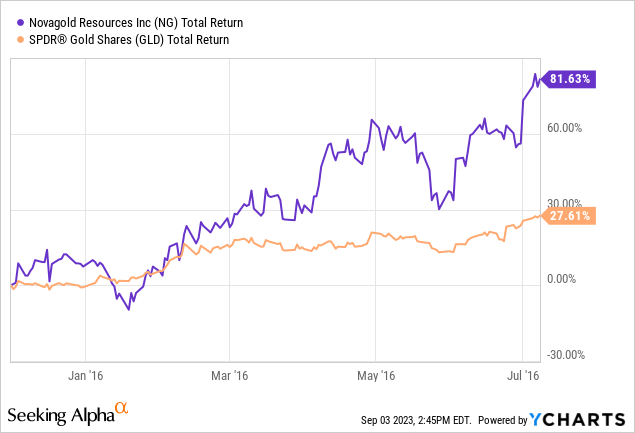

I have charted the last four periods of spiking lease rates below. You can review for yourself how both gold bullion and NovaGold reacted over the following months/years.

Late 2008 – September 2010

YCharts – NovaGold vs. Gold Bullion Price, Oct 2008 – Sept 2010

December 2015 – July 2016

YCharts – NovaGold vs. Gold Bullion Price, Dec 2015 – July 2016

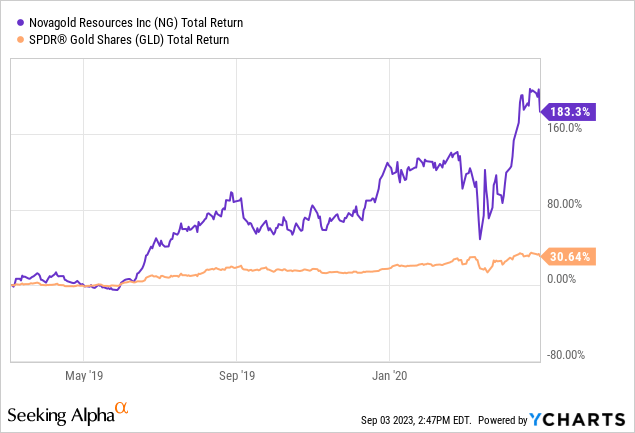

March 2019 – May 2020

YCharts – NovaGold vs. Gold Bullion Price, March 2019 – May 2020

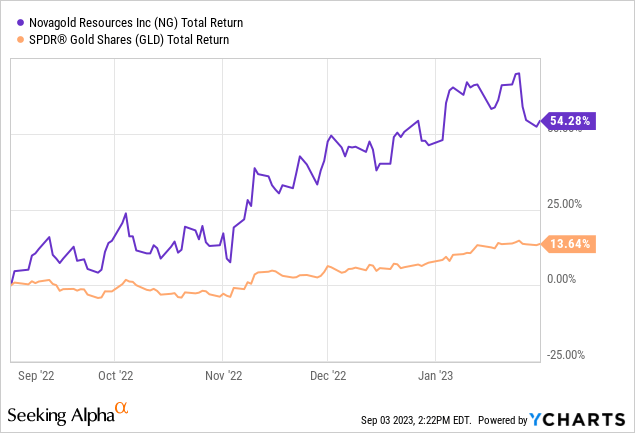

September 2022 – January 2023

YCharts – NovaGold vs. Gold Bullion Price, Sept 2022 – Jan 2023

A couple of notes. While the final quarter of 2008 was rotten for NG, it was able to recover to new highs into 2009, and jump even faster into 2010. In addition, this year’s NG selloff from January may prove a temporary blip on long-term charts, if the renewed lease rate spike – buy argument of September is signaling a shortage of physical gold supplies the rest of 2023.

Final Thoughts

So, if NovaGold is unloved and under-owned currently (which it is), with the potential to become a multi-bagger in price appreciation during the next big bull run for physical gold prices, now could be a terrific moment to consider adding shares to your portfolio.

Amazingly, higher gold, silver and copper metals pricing over the last 12 months has not been able to generate much of an advance in related miners. To me, this is a clue underlying value could be rising fast. Without doubt, investors and analysts are a long way from being overexcited about the prospects for mining companies.

According to Seeking Alpha’s Quant Rank, NovaGold is one of the worst trending gold miners to consider, from one of the weakest industries to own for performance over the last 6-12 months. Who wants a piece of that?

Seeking Alpha – NovaGold Quant Ranking, September 2nd, 2023

SA analyst Taylor Dart does a brilliant job of covering the gold mining sector. His latest writeup on NovaGold includes a better review of the nuts and bolts of Donlin’s exact mining/resource setup. You can read his effort from May here. Mr. Dart projected a price decline back to $4 for NG, absent a meaningful gold upmove, and that’s exactly what played out.

The difference in my bullish rating today is largely dependent on a clear outlook for strong gold prices in the not-too-distant future. I tend to be something of a big-picture investor.

For sure, if gold spikes in price faster than most anyone thinks possible today, pressure will be put on Barrick to acquire NovaGold’s half-share of Donlin before another major miner does, think Newmont (NEM) or Agnico Eagle (AEM). Barrick’s management has been playing a waiting game before developing Donlin, hoping to acquire NG’s 50% ownership on the cheap. That window is now closing rapidly.

My view is Donlin is one of the most valuable gold resources on the planet, waiting to be built when bullion prices rise into a more realistic area. Without higher precious metals pricing, very few new “Tier 1” mines are capable of getting construction approval. The whole gold mining industry has found it difficult to replace depleting ore reserves of late, as little in the way of operating profits is available at $1900 gold. I figure an honest ongoing cost of production and reserve replacement average for the global mining industry is at least $1500 an ounce today. Historically, waves of new mine development come to fruition when the price of the world’s main monetary metal rises to a number at least TWICE the industry cost of production, which has not happened since the 2008-12 period.

If we are about to experience a climb to $3000 an ounce gold in 2024 or 2025, NovaGold could be ready for $10-15 per share as a new price level (my estimate using company NPV projections). At $4000 gold, NG is likely worth $20-25 per share.

Don’t say it cannot happen. We live in age where world wars and pandemics do not mix well with record debt levels. The appearance of additional black swan events that push the financial system into chaos (Russia vs. NATO, China vs. Taiwan, outlier trouble in the oil-rich Middle East, etc.) will surely be met by another round of RECORD money printing from central bankers globally. At that point, $3000 gold will be a foregone conclusion.

Why not purchase NG before rotten things happen in life, and prepare your portfolio for trouble with one of the top gold resource hedges available? Today may be the perfect time to purchase NovaGold. I am upgrading my rating to Strong Buy.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here