Campbell Soup Company (NYSE:CPB) sells ready-to-serve soups among other food products. The company is looking to acquire Sovos Brands to freshen the company’s offering and to improve Campbell’s top-line growth. Although the company doesn’t have a high amount of growth, I believe the stock is worthy of having on a watchlist for investors who look for low-risk investments – the company has very steady operations. As the stock seems undervalued according to my DCF model estimates, I have a buy rating for the stock.

The Company & Stock

Campbell owns a portfolio of brands that focuses largely on meals such as canned soups and other ready-to-serve products, beverages, and snacks:

Campbell’s Brands (campbellsoupcompany.com)

Of the portfolio, the Campbell brand seems to be the company’s most recognizable brand. The Campbell brand sells canned soups in the well-known red-and-white metal can.

The stock has performed poorly in 2023 – at the time of writing, Campbell’s year-to-date return is -30%:

YTD Stock Chart (Seeking Alpha)

Acquisition of Sovos

Announced in August, Campbell is looking to acquire Sovos Brands (SOVO) for $2.7 billion. The acquisition is quite large for Campbell – currently, Campbell’s market capitalization is $11.7 billion. The acquisition was made to achieve cost and sales synergies between the companies and to fuel Campbell’s top line growth.

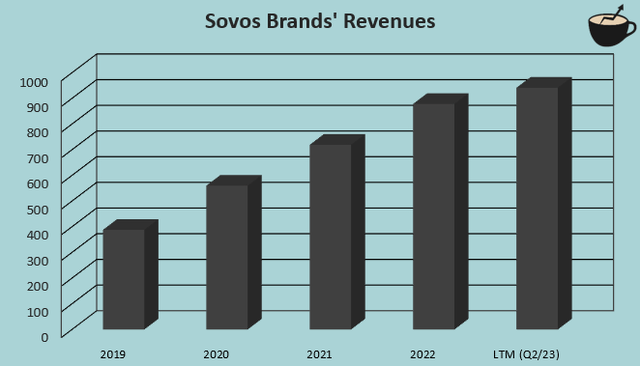

Sovos Brands is a publicly traded company. The company operates three brands – Rao’s Homemade which sells pasta sauce, Noosa Yoghurt, and Michael Angelo’s which sells Italian-style frozen meals. Sovos has been able to grow its revenue successfully, as the company’s top line grew by 22.1% in 2022:

Author’s Calculation Using Seeking Alpha Data

The growth has been profitable, as Sovos’ current trailing EBIT margin stands at 13.9% – Sovos’ financials seem very solid.

The acquisition didn’t come without a price tag, though. The acquisition value of $2.7 billion represents an EV/EBIT ratio of around 20.6 – compared to Campbell’s own trailing EV/EBIT of 11.7, the acquisition seems expensive. An important notation is the targeted synergies – Campbell and Sovos expect annualized synergies of $50 million:

Sovos Acquisition Presentation

In summary, the acquisition seems very interesting. Campbell could have the organizational power to grow Sovos’ brands further, and the targeted synergies represent an opportunity to expand Campbell’s bottom line significantly. Although the acquisition came at a seemingly high price, the growing revenues and good-quality brands of Sovos could prove themselves as worthy of the price.

Financials

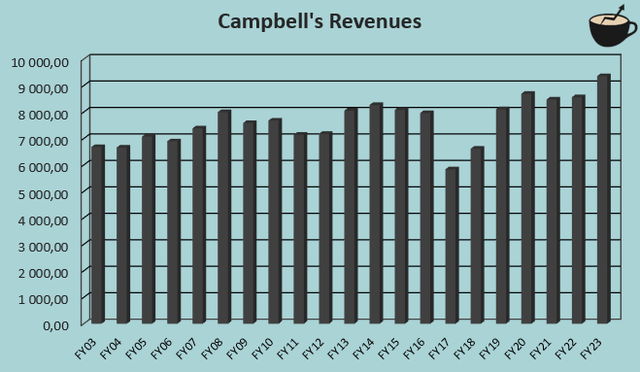

Campbell’s financials can be described as incredibly stable – excluding a revenue slump in FY2017 caused by a differentiating revenue accounting method in FY2017 and FY2018, the company’s revenues have stayed quite stable with a compounded annual growth rate of 1.7% from FY2003 to FY2023:

Author’s Calculation Using TIKR Data

The growth has been quite mediocre – the growth of 1.7% includes some acquisitions in the period, that exceed the amount gained from divestitures: Campbell’s organic growth has historically been below the figure of 1.7%. The acquisition of Sovos could improve the top line growth, though – as explained, the acquired company has a significant amount of growth, improving Campbell’s revenue trajectory.

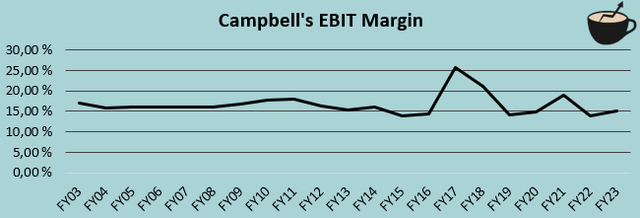

Campbell has had a mostly stable margin in the company’s history – from FY2003 to FY2023, the company has had an average EBIT margin of 16.6%, slightly above the current trailing figure of 15.1%.

Author’s Calculation Using TIKR Data

As Sovos has a similar EBIT margin to Campbell, I don’t see the margin having significant pressures in either direction. The synergies between the two companies could slightly grow the margin, though, and as Sovos grows its revenues, it could realize slight operating leverage as the company has historically achieved.

Campbell has a significant amount of debt – currently, the company has $4.5 billion in long-term debt and around $0.2 billion in short-term borrowings on the company’s balance sheet. The capital structure is to be leveraged further with the acquisition of Sovos – the acquisition valued at an EV of $2.7 billion is planned to be paid with cash that Campbell draws as a loan. The combined debt balance after the acquisition adds up to around $7.4 billion – compared to Campbell’s market capitalization of $11.7 billion, the debt seems quite excessive.

Valuation

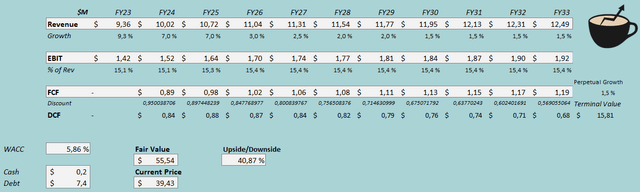

To analyse the stock’s valuation, I constructed a discounted cash flow model – in my opinion, looking at the company’s current forward P/E ratio of 12.9 doesn’t give enough context because of the acquisition. In the model, I model the acquisition into the estimates – as the acquisition should happen around the half point of FY2024, I estimate a growth of 7% for both FY2024 and FY2025 – combined, the revenues grow by $1.36 billion in the two years, factoring in slight growth organically in the period.

After FY2025, I estimate a growth of 3% as Sovos should be able to keep up some growth. After the year, I estimate Campbell’s growth to slow down in steps into a perpetual growth rate of 1.5% – I usually estimate a perpetual growth of 2%, but as Campbell’s historical growth has been quite weak, I believe the lower figure is more accurate.

For Campbell’s EBIT margin, I estimate a stable figure for FY2024 at 15.1% due to one-time costs related to the acquisition combined with some achieved synergies. After the year, I estimate the synergies to have a slight impact – I estimate a margin of 15.3% in FY2025, that grows further into a sustained margin of 15.4% in FY2026. The estimated margin is a bit below Campbell’s long-term average of 16.6%, but as it stands, I don’t see catalysts that could expand the margin back into such a level.

The mentioned estimates along with a cost of capital of 5.86% craft the following DCF model with a fair value estimate of $55.54, around 41% above the current price:

DCF Model (Author’s Calculation)

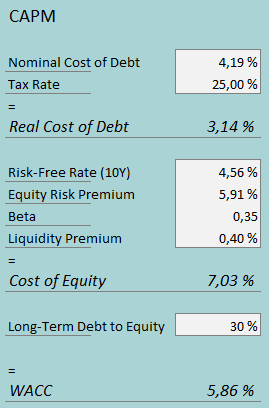

The used weighted average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Campbell had $49 million in interest expenses. With the company’s current interest-bearing debt balance, the company’s interest rate comes up to quite a low level 4.19%. Of Campbell’s current long-term debt, no part is in the current portion – I believe that the company can keep up a good interest rate at least in the medium term. With the acquisition of Sovos, Campbell’s capital structure will have a heavier focus on debt than currently – I estimate a long-term debt-to-equity ratio of 30%.

On the cost of equity side, I use the United States’ 10-year bond yield of 4.56% as the risk-free rate. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate made in July for the US. The beta of 0.35 is Yahoo Finance’s estimate using monthly data from a five-year period. Finally, I add a small liquidity premium of 0.4% into the cost of equity, crafting the figure at 7.03% and the WACC at 5.86%.

The WACC is remarkably low – I believe that the cost of capital is lower than with any company that I’ve analysed before. The low WACC is caused by Campbell’s low-risk operations in terms of systemic risk – as the company has demonstrated, demand for canned soups and snacks, among the company’s other products, stays very stable in a turbulent economy. The company also has a relatively healthy EBIT margin and a good amount of cheap debt.

Closing Remarks

Although Campbell’s investors aren’t probably looking at a skyrocketing return on the stock, I believe the stock is worthy of looking at due to its risk profile – the stock should yield a good long-term return compared to its very high safety. Although the company has a high amount of debt especially after the acquisition, I believe the debt is manageable as Campbell’s cash flows are quite steady. The company is at an interesting point in time regarding the acquisition of Sovos – I suggest keeping an eye on the success of the acquisition.

Read the full article here