We are disappointed at the Lab about Canadian Solar’s stock price performance (NASDAQ:CSIQ). In our initiation of coverage, we provided a neutral rating. Then, with a publication called ‘IPO Catalyst To Price In‘ released in mid-June, we decided to increase the company with an overweight target price. This was based on 1) the Inflation Reduction Act market opportunity and Canadian Solar bonus credits combined with a solid order backlog, 2) unlocking shareholders’ value with the CSI Solar IPO in China, and 3) a forecast of supportive results in Q2 with top-line sales estimates at $2.5 billion and a gross margin of 20.5%.

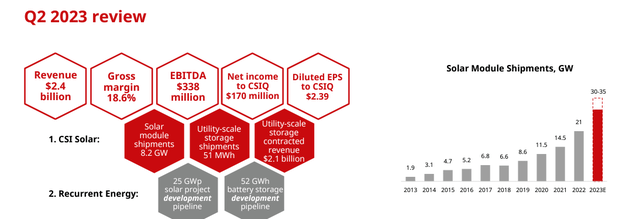

The company delivered a soft Q2 on revenue and gross margin that slightly fell our internal estimates. Looking at the details, CSI delivered shipments of 8.2 GW, signing a plus 62% on a yearly comparison (this is a growth company – Fig 1) and beating its internal guidance previously set in the range of 8.1 and 8.4 GW. Canadian Solar top-line sales recorded $2.4 billion (with a plus 2%) and a gross margin of 18.6%. These 200 basis points lower results cannot go unnoticed; however, looking at the details, the company’s gross margin was impacted by a $31m inventory write-off. Excluding this negative one-off, the gross margin would have been 19.9% (more in line with our estimates).

Canadian Solar Q2 Financials in a Snap

Source: Canadian Solar Q2 results presentation – Fig 1

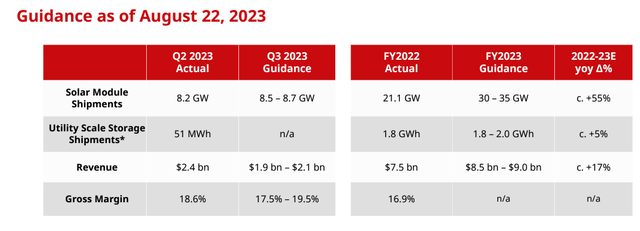

Looking ahead (Fig 2), the company provided its guidance for Q3 with shipments in the 8.5-8.7 GW range (a plus 43% on a yearly basis at the midpoint estimates) and top-line sales between $1.9 and $2.1 billion. The company already anticipated a gross margin sequential decline, with estimates between 17.5% and 19.5%. On a yearly basis, the company slightly reduced its annual sales from $9.0-9.5 billion to $8.5-9.0 billion, mainly due to a lower module price environment. The battery storage shipments division outlook was left unchanged.

Canadian Solar Q3 Outlook

Fig 2

Why Canadian Solar is still a buy?

- The company’s Q2 results were mixed with softer guidance; however, even though there is lower demand from solar, and we anticipated flat margins in Q3 and Q4, we see further upside potential. Here at the Lab, we positively report that Canadian Solar’s stock price decline (almost minus 40% since June 2023) is not matched by a fall in earnings expectations;

- In particular, management anticipates a better gross margin evolution in H2. This is based on clients’ de-stocking activities in the residential solar market and recovery from the B2B businesses (a strong pipeline backlog also backs this). Canadian Solar gross margins could also increase thanks to a full ramp of its cell capacity expansion and lower delay from logistics;

- Canadian Solar also provided estimates on December 2024 solar capacity targets for ingot/wafer/cell/module and is supportive of a period of double-digit growth rate;

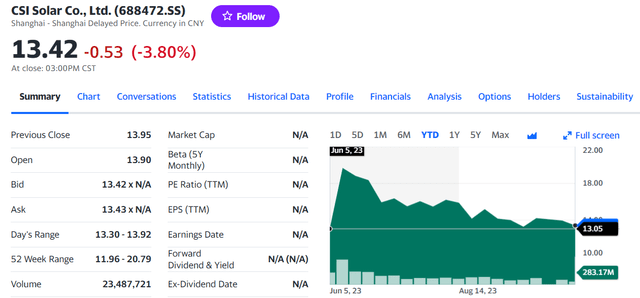

- CSI Solar (the recent Chinese entity spun off) is almost back at the IPO price offering (Fig 3). Looking at the company’s implied multiple, the entity is valued with a 2023 EV/EBITDA of 4.6x, below Canadian Solar’s current EV/EBITDA (3.2x). Looking at the press release, the company “owns approximately 64% of CSI Solar, assuming the over-allotment option is not exercised, or approximately 62% of CSI Solar, assuming that the over-allotment option is exercised in full.” Therefore, even considering the recent de-rating in CSI Solar’s share price, the company’s market cap is valued at $6.7 billion, with an implied valuation for Canadian Solar of $4.1 billion;

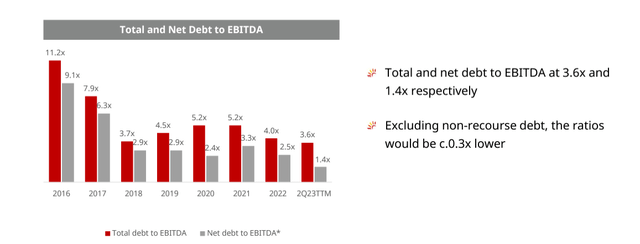

- we should also recall the Canadian Solar deleverage story (Fig 4). The company’s net debt to EBITDA is at a historic low of 1.4x.

CSI Solar Co stock price evolution

Source: Yahoo Finance – Fig 3

Canadian Solar netdebt/EBITDA evolution

Fig 4

Conclusion and Valuation

Aside from the Q2 results, as a reminder of our buy rating, we should recall Canadian Solar supportive demand for energy storage solutions given the higher adoption of renewable energy projects. The company is very diversified in terms of GEO mix and various solar pipeline stages of development. For the above reason, we reiterated our investment buy target and confirmed our price of $44 per share. We were already below Wall Street expectations (even in Q2), and aligning the company’s internal estimates, we forecast an EBITDA value of $1 and 1.3 billion for 2023 and 2024, respectively. Including a Sum-of-the-Part analysis, we see CSI Solar’ value underappreciated by the market. We believe that Wall Street analysts should switch to a different valuation methodology given the CSI carve-out with a listing in June 2023.

Read the full article here