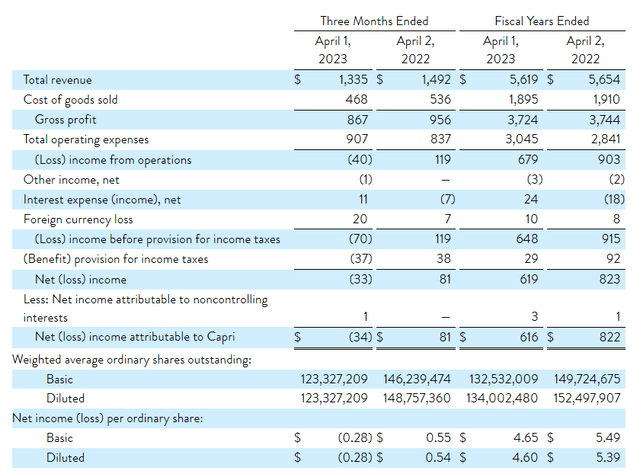

In recent months, luxury stock prices achieved monstrous growth, which has caused a significant revaluation of the sector. At the aggregate level, the industry is now trading at a 1-year price/earnings multiple of more than 25 times, and compared to the MSCI Europe index, it is trading at a 96% premium, significantly higher than its historical 5-year average of 62% and close to its 2020-2021 highs (Fig 2). Capri Holdings Limited (NYSE:CPRI) is a company that needs to catch up to this rebound. Here at the Lab, we initiated coverage with a holding rating (last Feb 2022), and then we decided to upgrade the company to buy, with no ‘luck‘ (yet). Analyzing the Q3 results, following disappointing financial guidance, we reduced our target price to $67 per share, still maintaining Capri Holdings stock as a buy. In the meantime, the company reported its Fiscal Year Q4, and after a brief comment, we highlight what could drive a company’s re-price.

Mare past analysis MSCI Europe vs Luxury Goods index

Source: MSCI Europe Textiles, Apparel and Luxury Goods Index – Fig 2

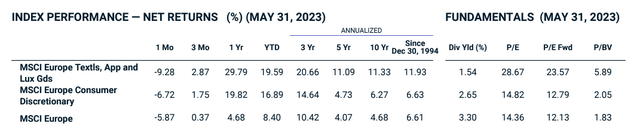

Q4 results

It was a subdued Q4 for Capri Holdings. The American group totaled top-line sales for $5.6 billion, down by 0.6% in the past twelve months. This was due to Michael Kors’ turnover, which went from $3.9 to $3.8 billion, while Versace and Jimmy Choo recorded positive sales performance on a yearly basis. In terms of margins, the player experienced a 25% drop in profit over the twelve months, from $823 to $619 million. Q4 numbers were critical, revenues significantly fell (-10.5% on a yearly comp), and on the profitability side, the group closed in red figures with a minus $34 million from the $81 million net profit recorded in the same period last year with an EPS of minus $0.28. On a positive note, net inventories amounted to $1.05 billion, signing a minus -3.6% year-on-year.

Capri Holdings Q4 Financials in a Snap

Source: Capri Holdings Q1 press release

Why are we still positive?

- John D. Idol explained, “While we recognize that there are near-term uncertainties in the Americas, we are encouraged by the strong trends in Asia and continued growth in EMEA.” Looking at the APAC region,

fashion luxury expenditure is always on the top wish list. Since the beginning of the year, Chinese purchases number have beaten expectations, and data from the last few weeks have shown an increase in subway traffic, considered a proxy for traffic in shops. Traffic returned to pre-COVID-19 levels, while in other metropolises such as Shenzhen or Chengdu, it has even grown compared to the first months of 2020. The latest Chinese macroeconomic data confirm the recovery, and this is the second consecutive month of higher industrial production growth, supported by Beijing’s recent decision to exit its zero-Covid policy. Here at the Lab, we are estimating a 12% growth in luxury fashion expenditure;

-

China’s offshore spending is also expected to surge as travel picks up after the disruption imposed by the pandemic, and we expect more Chinese to start spending abroad again. While in 2022, the majority of Chinese citizens spent in their own country, for this year, we expect around 15% of their spending to go abroad;

-

China and Asia, in general, represent an important market for Michael Kors, but in addition to continuing to develop the presence to return competitive in this region, the group’s plans include strengthening North America by restyling around 100 new designer brand stores. The boutique reorganization was particularly effective for Versace growth, especially in accessories sales. One of the company’s priorities is to increase stores’ productivity to achieve higher profitability;

- Related to point 3) for the other luxury brands, footwear represents about 25-30% of the business, and for Capri Holdings, this segment might represent an excellent opportunity for growth. As anticipated last year at the GS retailing conference, the company is now more focused on developing accessories, particularly footwear;

-

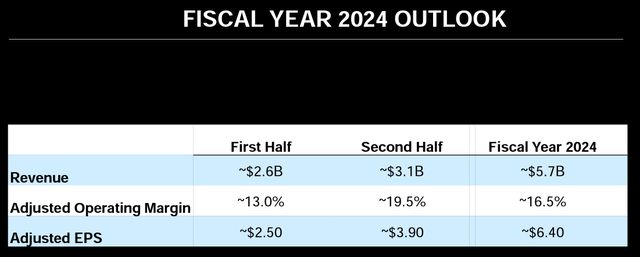

On the downside, the company returned $1.35 billion to shareholders. These positive results demonstrated Capri Holdings’ business model resiliency and brand power. In addition, the company set critical targets for the 2024 fiscal year, with revenue to increase at a single-digit rate to approximately $5.7 billion and earnings per share to roughly $6.40. This is also coupled with an ongoing buyback.

Capri Holdings 2024 guidance

Source: Capri Holdings Q4 results presentation

Conclusion and Valuation (with risks)

Capri Holdings is a growth stock but carries a value stock P/E. The company’s current price earning is at 6x. Wall Street thinks that Capri portfolio brands are weak and likely to shrink; however, we are more positive, and part of the company’s performance is related to macro factors that explain near-term weakness (inflation, country MIX, etc.). We see positive support from Jimmy Choo and Versace in the coming years. Given the latest results, we are lowering our revenue line forecast to $5.4 billion for the current fiscal year with an operating profit margin of 14.5% due to higher SG&A costs to invest in the company’s digital marketing strategy and higher OPEX on boutique renovations. Here at the Lab, we are confident that consumer pressure will incrementally weigh on the company’s top-line sales, so we are below management guidance. For this reason, we are lowering our EPS 2024 estimate to $5.5 per share. Continuing to value the company with a 20% discount on a five years historical average, we are lowering our target price from $67 to $61.6 per share. Among the critical issues for Capri Holdings are a possible change in sentiment in China, a slowdown in consumption in the United States, and a weakening of European consumer spending caused by the current uncertain macroeconomic environment.

Read the full article here