After experiencing whopping returns in the past few years, shareholders of Carlyle Secured Lending Inc. (NASDAQ:CGBD) may experience volatility and low returns in the near to mid-term. This is because Carlyle’s business is at high risk of negative overall growth due to muted portfolio growth, higher credit losses, and potential interest rate cuts. Its shares have already begun to underperform the S&P 500, with the expectation that pressure will increase further when growth actually turns negative in 2024. Although the current dividends appear to be completely safe in the short to medium term due to a low payout ratio, deteriorating financials could have a negative impact on the dividend growth potential. Therefore, investors seeking to earn market-beating returns in a current bullish market may look at other options.

Fundamentals Turning Challenging for BDCs

BDCs experienced spectacular financial growth in the previous year due to increased demand and rate hikes. In particular, a 550 basis points increase in Fed rates pushed BDCs’ weighted average portfolio yields into a low double-digit percentage, enabling them to generate a substantial 30% to 50% year-over-year net investment income growth. In fact, few BDCs with exposure to risky venture markets have seen portfolio yields surging to 16%.

However, future fundamentals suggest that BDCs may struggle to maintain their current growth rate. For example, the Fed’s pivot is approaching, which is bad news for their floating-rate portfolios. Furthermore, CME data suggests a couple of cuts in 2024, with the Fed’s rate ending the year around 4.25% to 4.50%. In addition, monetary easing may encourage early-stage companies to return to traditional lenders, potentially slowing demand for expensive loans from BDCs.

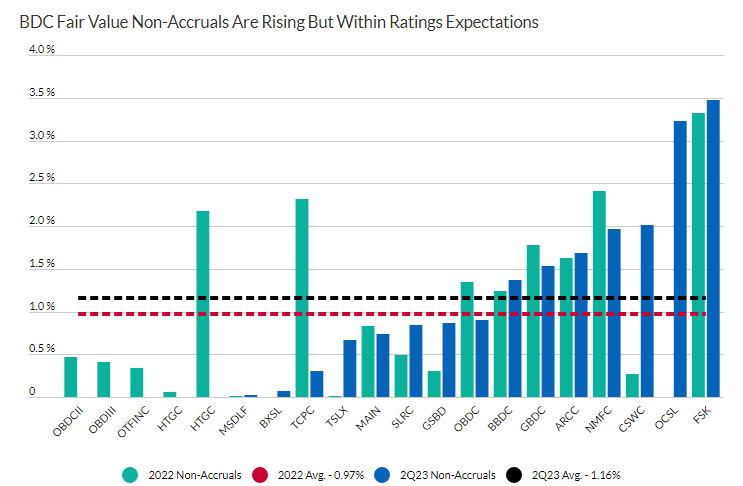

BDCs Non-accruals (Fitchratings.com)

The second point to consider is credit losses and net asset value. Non-accruals and write-offs have been increasing due to macroeconomic challenges. According to Fitch data, BDCs’ average non-accruals jumped to 1.16% at fair value in the first half of 2023 from less than 1% in 2022. The data also shows that the increase in the number of underperforming investments could lift credit losses in the second half and in early 2024. Moreover, muted portfolio growth is another factor that could hurt financial growth prospects in the coming quarters. BDCs have made significant investments in growth opportunities in recent years but rising credit losses from existing holdings and challenging market conditions have forced them to take a defensive stance.

Where Does Carlyle Stand?

Carlyle is an externally managed business development company that seeks to invest in high-quality sponsored-backed middle-market companies with a median EBITDA of $72 million. Moreover, its 98% floating rate portfolio is comprised of 130 companies across 25 industries with a single portfolio company weight of less than 1%. In the past few years, Carlyle has done well when it comes to income, earnings and other financial growth metrics. In particular, it saw a substantial 30% average income growth in the past four quarters, thanks to its floating rate portfolio in a high-rate environment.

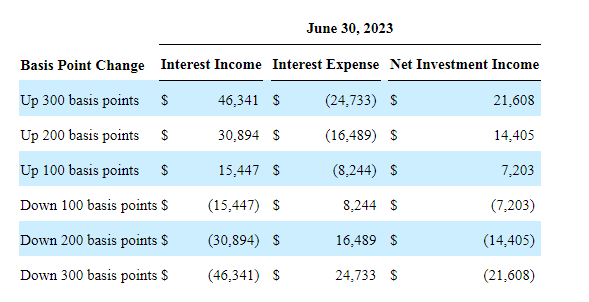

Impact of Rate Hikes on Net Investment Income (Form-10Q)

Besides past performance, it appears that Carlyle may face all of the challenges mentioned above. For example, the Fed’s pivot is likely to impact its floating rate portfolio. In the case of a 100 basis points rate cut in 2024, which is highly expected based on CME data, the company’s net investment income could fall by $7.2 million. As interest rates are expected to fall further in 2025, the company’s investment income and net investment income may continue to suffer.

Furthermore, slow or negative portfolio growth may make it more difficult to increase investment income. Carlyle’s portfolio value, which was around $1.89 billion at the end of June, plunged slightly over the past two consecutive quarters. The decline in portfolio value was mainly due to low new investment activity. Its funding of around $50 million in new investments in the June quarter was the lowest in the past four quarters and represents a substantial drop from funding of $200 million in the same period last year. Moreover, its CEO indicated in the second-quarter earnings call that the company will maintain its defensive investment strategy and be very selective in new investments in the coming quarter. This means that new interest income, which could also be crucial in reducing the impact of rate cuts, is unlikely to provide support to its investment income.

Carlyle’s earnings projections and Wall Street forecasts clearly signal deteriorating growth trends. The company expects its net investment income to come in the range of $1 per share for the second half of 2023, flat compared to the first half of 2023 and a significant decrease compared to $1.06 per share in the same period last year. Moreover, Wall Street forecasts Carlyle’s investment income and net investment income to decline at a mid-single percentage in 2024 due to a combination of potential rate cuts and muted portfolio growth. Overall, it appears that Carlyle’s overall business growth will turn negative and profitability will deteriorate ahead.

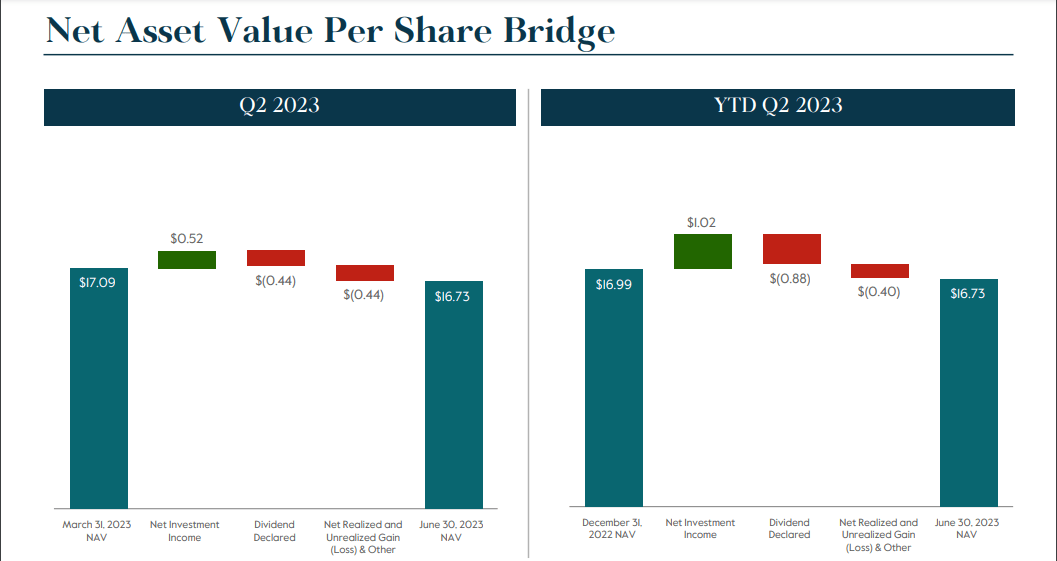

Net Asset Value (Q2 Earnings Presentation)

Credit losses are another risk factor for Carlyle. For the second quarter, the company posted an unrealized loss of $0.44 per share. Consequently, its net asset value plunged to $16.73 per share from $17.09 per share in the previous quarter. The risk of high credit losses could further erode its net asset value.

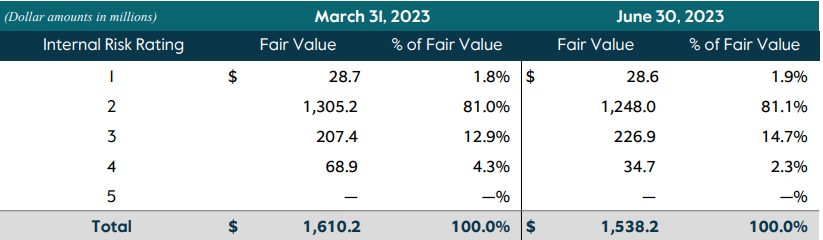

Portfolio Credit Rating (Q2 Earnings Presentation)

Meanwhile, its portfolio credit condition indicates that more losses are likely in the coming quarters. In the June quarter, $34 million of its investments in category 4 were already out of compliance with covenants, and the company may incur a loss upon exit. Furthermore, 14% of its debt investments performed below expectations, implying that some of these investments may also fall into category 4.

What Shareholders Can Expect to Earn?

Carlyle’s Total Return (Seeking Alpha)

The company generated enormous returns for shareholders in the form of share price appreciation and dividends in the past few years, thanks to strong financial growth trends and favourable market conditions. However, future fundamentals indicate that shareholders might not experience healthy and market-beating returns in 2023 and beyond. So far in 2023, Carlyle has underperformed, with total returns of 6% compared to the S&P 500’s total return of 17%. The underperformance is blamed on the sluggish share price performance. This also reflects investor concern over the deteriorating financial outlook.

Although its share price of $14.50 is down from its net asset value of $16.73, the stock doesn’t look like an appealing option because share price drivers such as net asset value, credit losses, and net investment income are likely to deteriorate in the coming quarters. Moreover, low valuations alone don’t make the stock a strong buy. Indeed, a combination of low valuations, robust growth and improving fundamentals make it an attractive option. On the positive side, the company’s strategy of keeping its base dividend payout ratio below 70% provides a lot of dividend safety. Even if its net investment income declines in a mid-single-digit to high single-digit percentage, there is no risk to its current base dividend of $0.37 per share in 2024. However, it could be challenging for the company to sustain its dividend growth momentum.

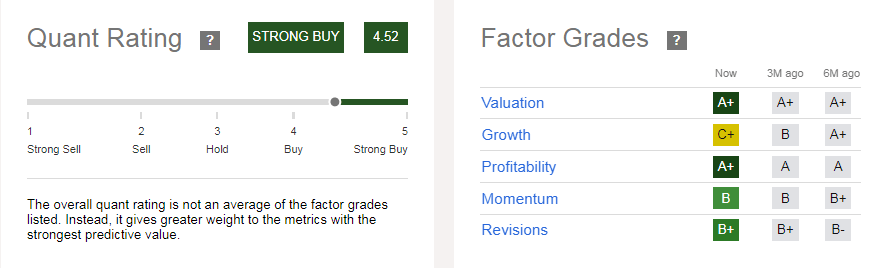

Quant Rating

Quant Rating (Seeking Alpha)

Carlyle has received a quant score of 4.52 and is rated at the lower end of a strong buy category, thanks mainly to valuations and profitability factors. As stated earlier, a low valuation alone doesn’t make a strong buy case unless it is accompanied by robust fundamentals and a financial outlook. Moreover, A plus score on its profitability factor is based on trailing gross profit, EBIT margin and net income margin. In fact, its profitability is likely to decline in the future. Although it earned a C plus grade on the growth factor, it would have been much lower if the quant analysis had only looked at future trends. Carlyle’s revenue and earnings growth rates are likely to turn flat or negative in the coming quarters and 2024. Its momentum factor score has dropped in the last six months due to share price underperformance.

In Conclusion

Due to challenging market fundamentals and a deteriorating financial outlook, Carlyle may not be the perfect option to buy for investors seeking to generate market-beating returns. Its shares are likely to remain under pressure and dividend returns alone can’t help achieve market-beating returns. In fact, I think it makes no sense to chase a stock with a high downside and limited upside potential when many other businesses in the same industry provide much higher returns with less risk. There are a number of other companies in the BDC space, such as Barings BDC (BBDC) and Golub Capital (GBDC) that offer robust share price appreciation and healthy dividend returns. Year to date, both Barings and Golub have generated around 18% in total return.

Read the full article here