Carriage Services (NYSE:CSV) is a company that engages in two businesses, namely funeral services and cemetery management in many states across the US. The company owns and operates a total of 173 funeral homes and 32 cemeteries, employing 2,500 people nationwide.

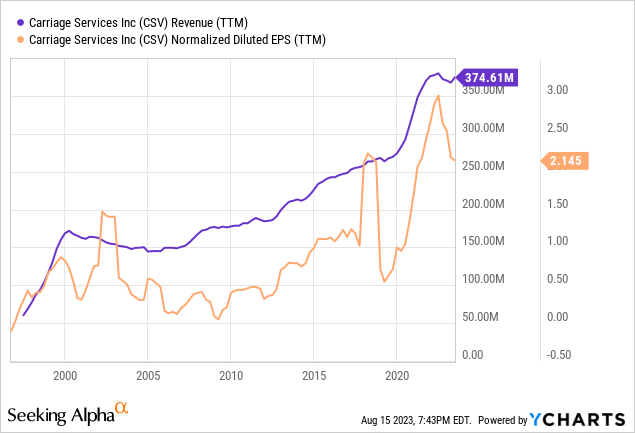

Over the years, the company has been able to post robust growth in its revenues and profits and its businesses received an extra boost in 2021 soon after the COVID pandemic due to higher rate of death in the country. Last year the results dropped a bit from 2021’s highs but they still remain above 2019’s levels and close to all time high.

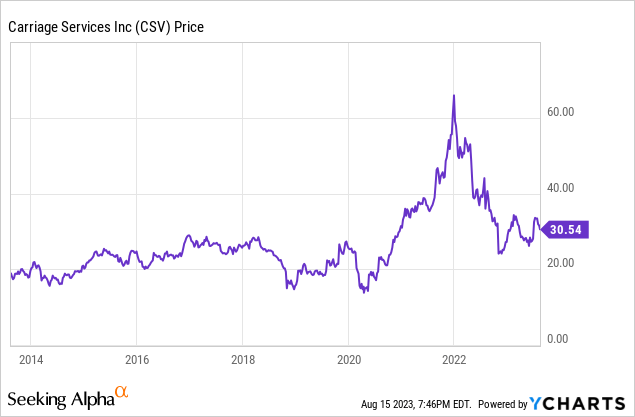

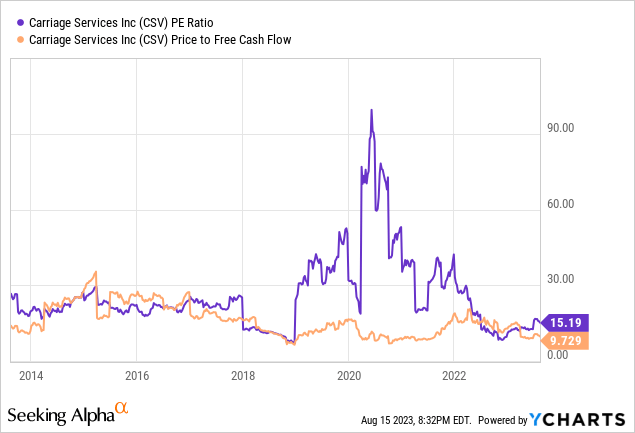

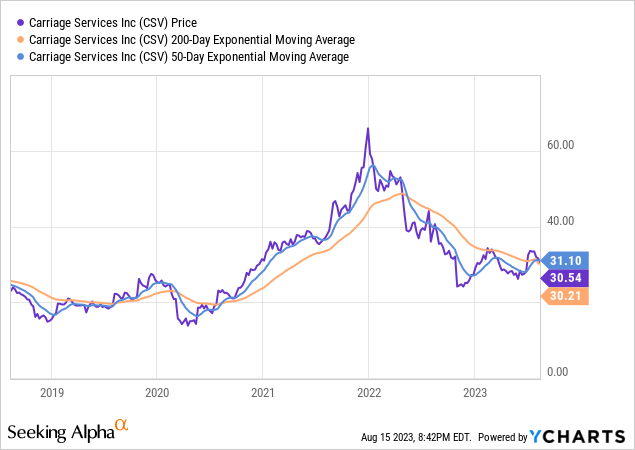

When the company’s business saw a boost from the pandemic, investors reacted by buying up shares in a hurry where CSV’s share price more than tripled from $20 to $65 but it came down to $30 since then since investors found out that the COVID boost was only going to be temporary even though the company’s business didn’t drop that much since then.

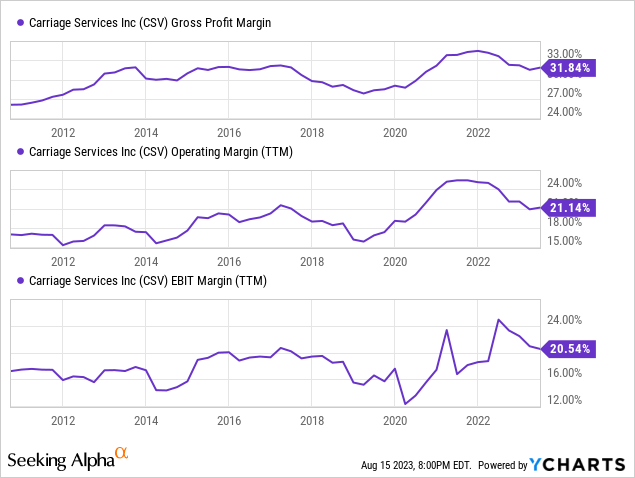

Over the years, the company’s business model provided healthy levels of cash flow and strong margins. The funeral service side of the company comes with multiple avenues of revenue generation such as merchandise sales, financing and certain upgrades. Financing is a big one because funeral services are becoming increasingly costly and many families have to take advantage of financing options if the deceased person didn’t have an insurance coverage for funeral costs. This is especially common in cases where death happens at an unexpected age. As a result of these additional revenue channels, the company’s margins have been pretty strong and somewhat stable over the years. Currently we are looking at CSV generating close to 32% in gross margins which is on the higher end of its decade long range of 24% to 33%, operating margin of 21% which is also on the higher end of the company’s 10-year range between 15% and 24%. The company’s current EBIT margin of 20.54% is above its long term average of 17%.

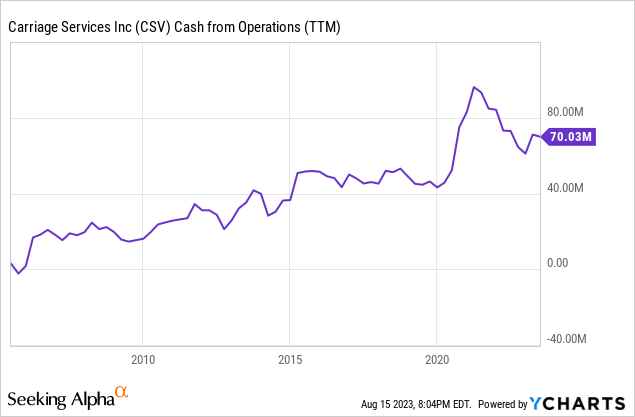

As a result of these strong and improving margins, the company’s operating cash flow improved almost consistently from year over for the last two decades. Current cash flow number of $70 million is somewhat below the company’s COVID pandemic highs but it is still on the higher end of the 20-year range which ranged from $0 to $85 million.

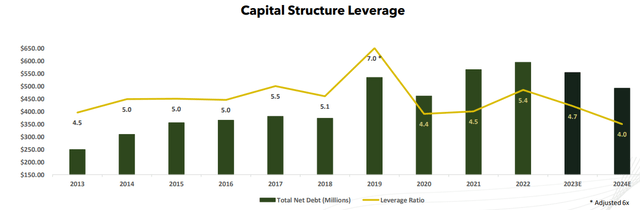

Not all of the company’s growth came organically though. Over the years, the company has made a lot of acquisitions which resulted in higher debt and leverage levels for the company. From 2013 to 2019, the company increased its debt level from $250 million to $550 million while increasing its leverage ratio from 4.5 to 7.0. Since then the company has been working on reducing its debt and leverage ratios and it targets a net debt level of $450 million and leverage ratio of 4.0 by the end of 2024. In order to achieve this, the company will have to slow down on acquisitions and save up some cash.

Debt and leverage levels (Carriage Services)

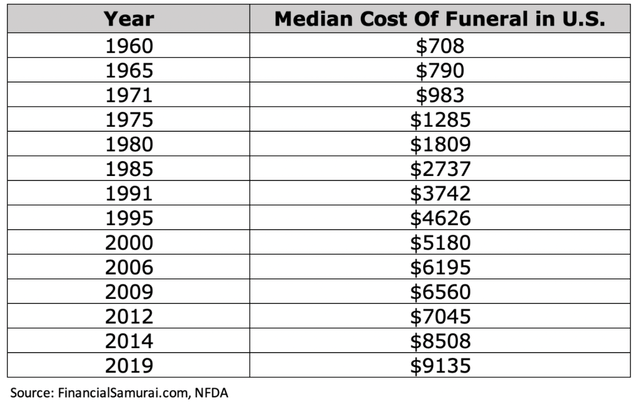

Funeral business is a unique business because there are aspects of it one would consider commoditized and then there are other aspects of it that are far from commoditized. On one side, the number of people who die every year doesn’t fluctuate much from year to year unless there is a major event going on such as a global pandemic. The population is growing at a steady but slow rate and there is only so much growth funeral companies can see. On the other hand, funeral services are highly specialized and costly services and this industry has shown a lot of pricing power over the years. Currently the median cost of a funeral in the US is north of $9k and it’s been rising at an exponential rate over the years.

Average cost of funeral over time (Financial Samurai)

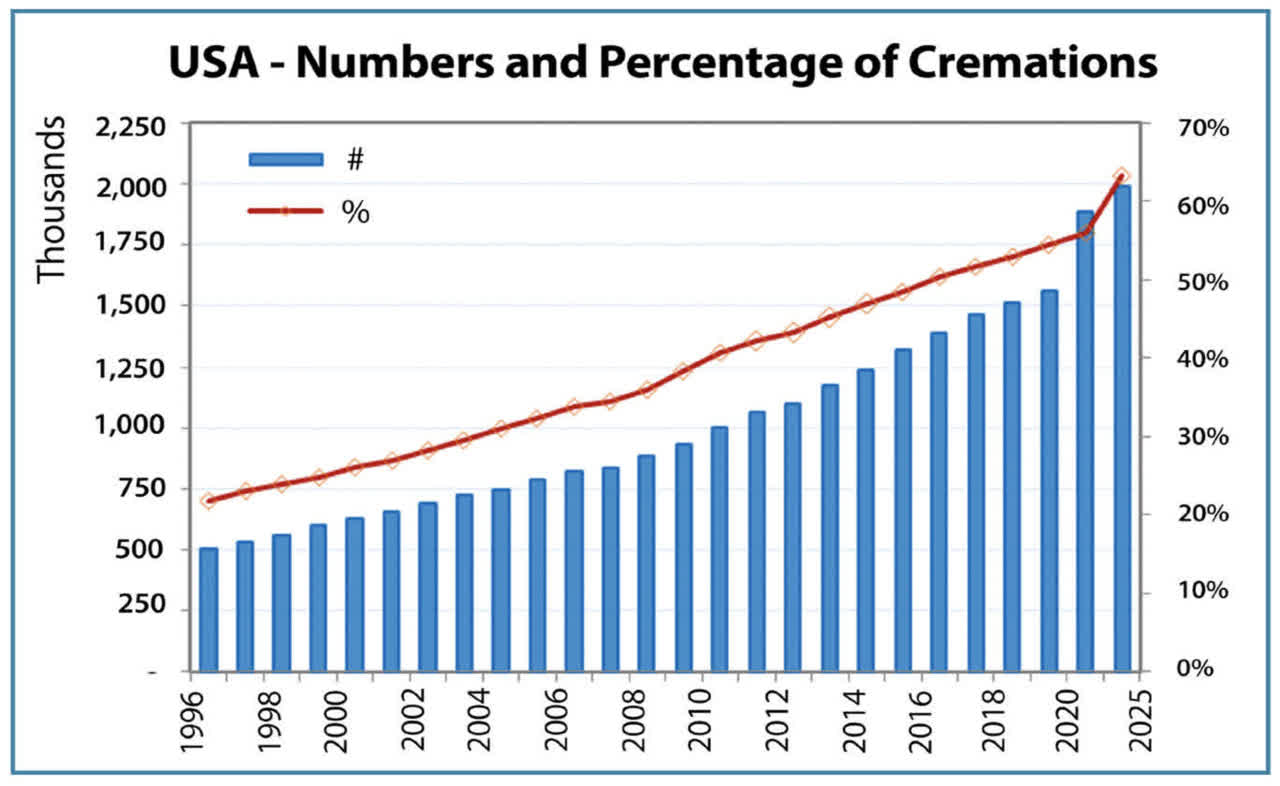

There is also another growing trend where a larger and larger percentage of people are choosing cremation over a traditional funeral which comes with a lower cost. This could be the choice of people who don’t have a type of life insurance that covers funeral costs.

Percentage of cremations in the US (funeralleader.com)

This means that funeral homes will have to look at further increasing their prices to make up for the lower volume of funerals but this might also result in more people opting for cremations if funerals become too expensive. Companies like Carriage Services will have to find a balance where they can generate healthy levels of margins without pushing away too many people from its services.

As much as valuation goes, the company currently trades for a price to earnings ratio of 15 and price to free-cash-flow ratio of 10. On one side, this is a fair valuation for a company growing in mid-single digits and generating healthy levels of margins but I wouldn’t call it dirt cheap either. On the other hand, keep in mind that the biggest competitor of CSV is Service Corporation (SCI) which trades at a higher P/E of 20. In comparison to SCI, CSV actually looks cheaper from a valuation standpoint.

From a technical analysis perspective, the stock is currently sitting at a crossroad of 50-day moving average and 200-day moving average. Historically these averages proved to be strong support levels for this stock which means it might not have much more downside left barring a market-wide correction event. If the entire market experiences a deep correction or pullback, it is likely to take this stock down with it but if the market is rising or at least stable, these support levels should be sustainable for the foreseeable future.

The company is currently working on a succession plan after its CEO Mel Payne had a stroke and there is now a new CEO Carlos Quezada who has been handpicked and developed by the previous CEO. Investors had been waiting since last year for this succession plan to be completed and new CEO to settle and now it seems to be completed and the company can move on. Mel Payne will continue to serve the company as the chairman of the board of directors and continue to offer mentorship to the current leadership team.

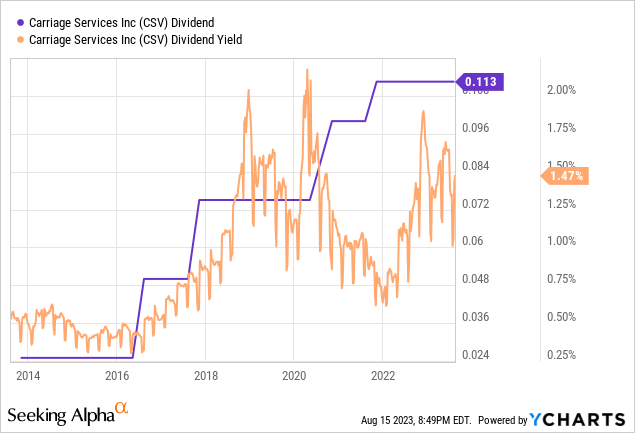

CSV also has a dividend history. The company has been hiking its dividends on a consistent basis since 2016 and it plans to continue growing its dividends over time but keep in mind that the current yield is about 1.5% which isn’t much for income oriented investors. If you have a long term horizon and looking for dividend growth plays, this might be an interesting play though.

All in all Carriage Services is an interesting company situated in a unique industry. The company enjoys some growth, strong margins, decent cash flows and fair valuation. This could be a worthy pick for certain types of investors that are looking for a stable and predictable business model with low valuations.

Read the full article here