Overview

Caterpillar (NYSE:CAT) stock hasn’t been having a particularly good year. While the stock started the year out trading roughly in-line with the S&P500 index, it was sold off significantly at the end of Q1 and is now trailing the index. Even when we account for the company’s dividend, we arrive at a negative 0.9% total return for 2023 so far.

Seeking Alpha

This recent share price performance has occurred against the backdrop of two earnings reports that differed as to their relative performance against consensus. Fiscal Q4 2022 earnings, reported in late January, had Caterpillar miss on EPS and generate in-line revenue performance. Fiscal Q1 2023 earnings, reported in late April, saw the company post a hearty 29.5% beat against consensus EPS while also maintaining expected levels of revenue growth.

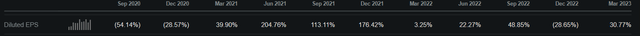

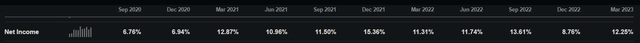

This recent variance in earnings is due to volatility within each of Caterpillar’s two core markets – construction and commodities – as well as ongoing inflation and foreign exchange effects. The combined effect of these factors netted out to a net margin of 8.76% for Q4 2022 and 12.25% in Q1 2023 for the firm. In turn, these operating margins respectively yielded a y/y EPS decline of 28.7% in Q4 ’22 and y/y EPS growth of 30.9% in Q1 ’23.

While variability as to operating margins and earnings per share is nothing new for Caterpillar, we must of course ask the question of which way things are heading now as well as how that will translate into results for the current quarter. In this article I’ll review the company’s financial trajectory and establish a view on how its next earnings report should play out.

Financials

I will begin by saying that top-line performance appears much steadier for Caterpillar and should continue to be less variable than its bottom line results. The last 4 quarters all showed a difference of less than 5% against revenue consensus expectations, indicating what is a consistently accurate read on the company’s revenues by Wall Street. Again, this did not play out in earnings per share, as the last quarter showed a beat against consensus by nearly 30%. There is evidently much more uncertainty as to bottom line performance at the moment. As such I think it is better to focus on earnings metrics for this stock.

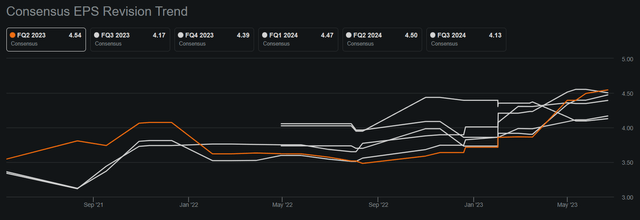

The first thing to note about earnings is that forward EPS consensus has been revised significantly in response to the company’s latest earnings report. While the run-up to the Q1 2023 earnings release saw forward expectations of $3.86 in EPS for the upcoming Q2 2023, this number has now been revised upwards to $4.54. This new number represents expectations of 42.9% y/y growth against the company’s EPS results in Q2 2022.

Seeking Alpha

While this may seem to be a particularly optimistic projection, it is worth noting that fluctuations of this level are par for the course when it comes to Caterpillar. When we consider the range of outcomes for y/y changes in earnings per share, we can see that EPS growth of 43% y/y is quite feasible for this stock.

Seeking Alpha

Evidently analysts are expecting that Caterpillar will continue its trendline from last quarter and maintain similar margins. We can evaluate what consensus is implying in more detail.

Listing the revenue and EPS results from Q4 ’22 and Q1 ’23, we can then fill in consensus expectations for revenues and EPS for Q2 ’23. Adjusting for revenues and calculating through, we see that current consensus is implying a net margin of 10.35% for Q2 ’23. These calculations assume an equal level of shares outstanding.

|

Q4 2022 |

Q1 2023 |

Q2 2023 |

|

|

Revenue |

$16.60 B |

$15.86 B |

$16.53 B |

|

Norm. EPS |

$3.86 |

$4.91 |

$4.54 |

|

Net Margin |

8.76% |

12.25% |

10.35% |

Data Source: Seeking Alpha

This implied net margin figure is interesting because it sits at the midpoint between what Caterpillar has generated over the last two quarters. On a longer time horizon, it actually appears to be fairly conservative. While Caterpillar has had 3 quarters of single-digit net margins across the last 10, it generally posts something in the low double digits. Across this trendline, an assumed net margin of 10.35% is not an aggressive assumption and can be considered a middle-of-the-road estimate.

Seeking Alpha

What I can conclude from all of this is that expectations have become optimistic for Caterpillar but are not distinctly or irrationally skewed to the upside. This relatively conservative scenario creates an opportunity for the company to outperform against consensus EPS expectations this quarter. When we consider this along with its weak share price performance year-to-date, good results from CAT could very well create an uplift in its shares. Of course, the company ultimately has to beat expectations for this to happen. This comes down to margins.

Margin Maintenance

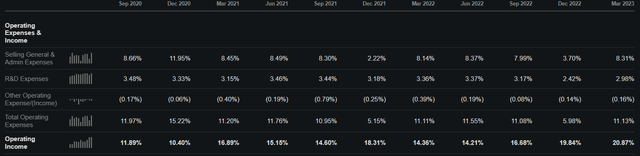

CAT’s earnings performance this quarter will be a function of its margins, and I expect it to perform according to expectations as to revenues. We must then look at how its cost profile has been developing to see how likely this may be. Since the variance here occurs at the operating level, we will look at margins there and assume an equal level of adjustments from things such as interest, depreciation, and taxes.

Looking at the last 10 quarters, we can see that Caterpillar has been increasing its operating margin over time. Last quarter’s operating margin of 20.87% is the highest that we’ve seen for 10 quarters running. It is also a higher number than any full-year result that the firm has posted for the past decade.

Seeking Alpha

Also worth noting here is that operating margins for CAT’s Q1 ’23 quarter came in higher than Q4 ’22 even as SG&A expenses picked back up, pushing overall operating expenses back to normal (Q1-Q3) levels of roughly 11%. This is part of a cyclical phenomenon wherein Q4 has a different cost profile for Caterpillar than other periods. Continued control of R&D spend as well as an ongoing decline in auxiliary operating expenses allowed for this to happen. This gives me confidence that the most recent period was not an outlier and that Caterpillar should be able to maintain these margins going forward.

Of course, other effects – both good and bad – continue to play out. The current situation nonetheless appears skewed to the upside. Caterpillar’s CEO, Jim Umpleby, highlighted this in a conference earlier this year. To summarize what he said, construction remains strong both domestically and globally. The firm is also slated to continue benefiting from the passage of the CHIPS Act and related infrastructure bills, something which is still in its early stages. Additionally, continued turbulence in global energy markets creates incentives for further drilling and excavation, leading to more orders for Caterpillar.

Overall it does not appear that these potential tailwinds are priced in, with revenue growth expectations still attuned to the current state of affairs. This could further benefit EPS if these various factors end up pushing revenue growth beyond expectations. Given the vast scope and scale of some of the infrastructure bills, that is quite possible.

Risks and Conclusion

The risk here is that Caterpillar gets affected by further pressures on its top or bottom line. This will lead to lower EPS and likely tepid or declining share price performance. Risks to revenue can manifest in the context of a greater macroeconomic recession, something which many market observers believe is both likely and imminent. Profitability may end up constrained by ongoing inflation in the company’s cost inputs.

Yet, Caterpillar has managed inflation in its own supply chain well thus far. Having improved its margins against a backdrop of rising costs, it has been made clear that the firm has a certain level of pricing power. As such I have a high degree of conviction in the company being able to maintain something quite close to its current margins. Along with this, it should continue to benefit from ongoing growth in construction as well as further infrastructure investments. This does not appear to have begun in earnest as of yet. Overall, this gives Caterpillar a steady footing and a clear upside case in the near-term. On that basis I believe it will be able to outperform EPS consensus for this quarter and should see its shares rise as a result.

Read the full article here