Summary

CAVA Group, Inc. (NYSE:CAVA) is a popular fast-casual restaurant specializing in Mediterranean cuisine that went public in what many would consider a very successful IPO last month. The company raised over $300 million in an upsized offering while shares have soared 125% from $22/share to $49.56/share at the time of writing. While there’s plenty to discuss around the company, let’s keep things simple and first look at some positives and negatives:

- Positives for CAVA

- Strong Margins: CAVA’s restaurant-level profit margin was 20% in 2022 and 26% in Q1 2023, well above its peers such as Sweetgreen (SG) and Shake Shack (SHAK).

- Healthy Cash Position: CAVA now has plenty of cash to invest in new store openings as the company looks to continue growing. Management was very clear this $300 million will primarily be used to expand its relatively small footprint across the U.S.

- Great Customer Reviews: The foundation for a successful fast-casual restaurant starts with a good customer experience, and CAVA can do it better than anyone. Online reviews are overwhelmingly positive and that has translated to growing sales. Same-store revenues were up 14% YoY in 2022.

- Negatives for CAVA

- Profitability: Investors should not expect CAVA to generate positive net income for quite some time. The company is focused on expanding despite positive restaurant-level margins. A lot of money is needed to construct new stores.

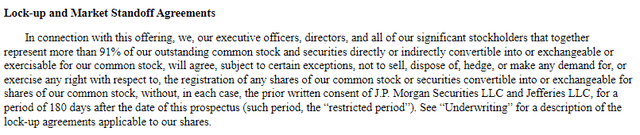

- Lock-up Expiration: Over 90% of the outstanding common stock cannot be sold for 180 days after the IPO. There is a risk that after the lock-up expiry insiders could begin selling their stock, putting downward pressure on CAVA’s share price.

- Valuation: Since the IPO, CAVA has more than doubled its $22/share offering. With a market cap of more than $5 billion, some investors may argue its valuation may be stretched.

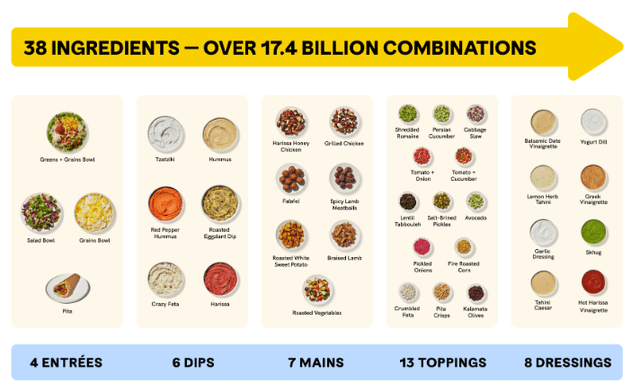

For those unfamiliar, CAVA is commonly referred to as “The Chipotle of Mediterranean cuisine” as the customer experience is very similar where you get to customize your order step by step. It’s a relatively quick process and is made as you go through the selections of entrees (base), dips, mains (protein), toppings, and dressings. The combinations are endless, and CAVA themselves cited in their 424B4 filing that there are over 17 billion different ways to make a meal!

SEC

The company had a ton of success across 22 states and Washington, D.C. during the second half of the 2010s, growing from 22 restaurants in 2016 to 263 restaurants as of the end of Q1 2023 (+40% CAGR). While CAVA isn’t generating Chipotle-type revenues yet, it certainly has the potential to do so given its overwhelmingly positive reviews from customers. Here’s a quick snapshot of CAVA by the numbers:

| 2022 | 2021 | YoY Change | |

| Revenue | $564 million | $500 million | +12.8% |

| Restaurant Level Profit Margin | 20% | 18% | |

| Net Income Margin | -10.5% | -7.5% | |

One of the biggest reasons I’m bullish on the long-term prospects of CAVA is its same-store revenue growth and restaurant-level margins. The company is not profitable yet because management is heavily focused on expanding its operations which requires a lot of upfront costs. Investors have to think about the bigger picture with CAVA, like five or ten years down the road when management decides to slow down growth and focus on profits. A big reason for this IPO was to raise cash to fund future new restaurant openings. This doesn’t change the fact that CAVA’s restaurant-level profit margins are impressive at more than 20% in 2022 and 25% in Q1 2023. Compare that to Sweetgreen at +15% or Shake Shack’s “Shack-level” operating profit at +18.8% in 2022.

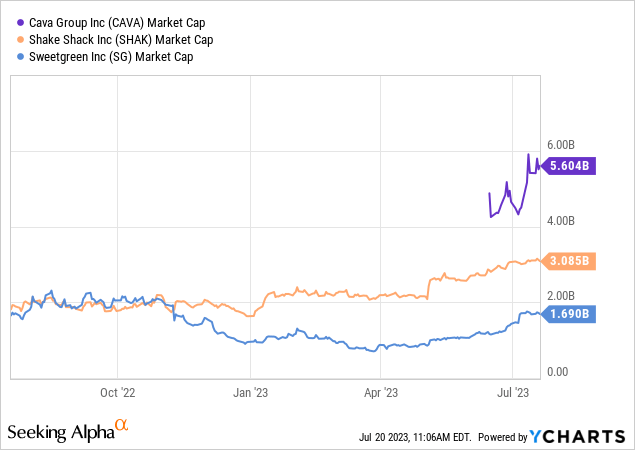

While these long-term profit margins are impressive and the growth rate is strong, it’s important to look at valuations. CAVA is not a cheap stock as things stand today. Its market cap is well above Shake Shack’s and Sweetgreen’s despite all three companies generating similar revenues and margins.

CAVA’s Market Cap Is Well Above Peers

It’s very hard to ignore this figure when deciding to invest in CAVA. While the IPO was a huge success, it doesn’t necessarily mean the rally will continue. I think a healthy pull-back following the lock-up expiration would potentially allow for a much better entry point for long-term investors.

Lock-up Expiration

Buying CAVA prior to the IPO lock-up expiration is very risky in my opinion since over 90% of the shares outstanding will potentially be eligible to trade. It’s difficult to predict what insiders will want to do and adds a ton of uncertainty around CAVA’s share price.

SEC

I personally think as retail investors it’s not worth the risk of trying to guess until this expiration occurs. In the near term, we’ll likely continue to see a ton of volatility around the share price as the equity float is so small.

Conclusion

CAVA has a ton of potential, but its valuation does appear a bit stretched at the moment based on market comparables. I plan to re-evaluate the company following the lock-up expiration in about six months and see where shares are trading then. Additionally, investors will have seen a couple of quarterly earnings reports/calls to get more insight into the company’s future plans.

To be clear, I am optimistic about CAVA’s future overall. It’s a unique company with a great reputation that will expand exponentially in the years to come. Timing and patience will be key here as an investor. I’ve had a difficult time trying to find a catalyst that could propel shares even higher after this 125% run-up. We’ll need to listen in on a few earnings calls to gauge management’s views around 2024 and beyond, along with any insight into margin improvements.

Read the full article here