Cavco Industries, Inc. (NASDAQ:CVCO) manufactures and sells factory-made homes. The company is facing some current issues as demand is challenging due to the current economy. Although Cavco has short-term challenges, I believe the current price reflects an opportunity to buy – as the company seems undervalued with my estimates, I have a buy-rating for the stock.

The Company

Cavco manufactures homes in four factories, of which two are located in Arizona, one in Texas, and one in North Carolina. The factory-made homes are a form of affordable housing, as the manufactures homes are generally quite low-price compared to most alternatives such as built-on-site houses. Cavco’s homes include numerous options, such as the following ones:

cavco.com

In addition to the home sales, Cavco has a financial segment in which the company provides financing and insurance for the homes.

As demand for affordable housing has seen a surge in the United States, Cavco’s stock price has followed – the stock has increased its price by almost 3000% from 2003, making the stock’s CAGR a remarkable 18.7%.

20-Year Stock Chart (Seeking Alpha)

The company doesn’t pay a dividend, but I don’t see it as a negative aspect – Cavco has further reinvestment opportunities into organic growth and acquisitions to gain further market share.

Acquisitions

In the company’s recent past, Cavco has made two significant acquisitions. In July of 2021, the company bought out The Commodore Corporation for $153 million. The Commodore Corporation, a modular home manufacturer, had sales of $258 million in FY2021, about a quarter of Cavco’s revenues prior to the acquisition.

The second significant acquisition was the buyout of Solitaire Homes, announced in October of 2022. The acquisition was somewhat smaller than the previous one, as the acquisition cost Cavco $93 million. The press release about the acquisition didn’t mention financials of Solitaire Homes, but did mention significant synergies between the two companies. Solitaire Homes had 22 retail locations alongside its manufacturing facilities.

Cavco’s acquisitions seem to create shareholder value – the company communicates that it can achieve cost synergies, making the acquisitions worthy. The stock’s price history also speaks volumes – a CAGR of almost 19% isn’t maintained with sloppy use of capital.

Financials

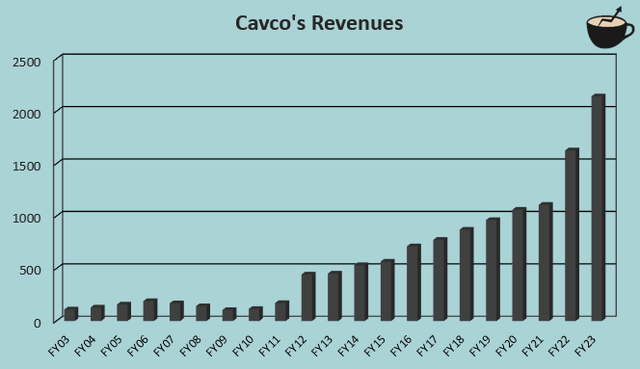

Cavco Industries has an impressive history of growth – from FY2003 to FY2023, Cavco’s compounded growth rate has been 16.0%, achieved both organically and through acquisitions:

Author’s Calculation Using TIKR Data

I believe the growth is partly caused by a surge in demand for factory-made homes – the home type is more affordable than ones built on-site, and as real estate prices continue to soar, more people are considering cheaper alternatives. If the thesis is correct, the growth trend should continue into the foreseeable future, if one is to believe that the real estate prices should continue their long-term trajectory.

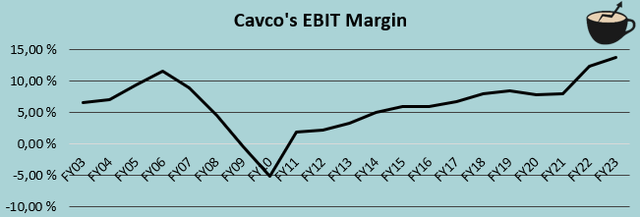

Along with impressive growth, Cavco’s operating margin has scaled quite significantly alongside revenues after a weak FY2010 caused by the financial crisis:

Author’s Calculation Using TIKR Data

After the weak year, Cavco’s EBIT margin has only seemed to scale up – in FY2023, the company achieved its all-time EBIT-margin high of 13.8%.

Cavco doesn’t seem to leverage debt in its balance sheet – the company currently only has $1.7 million of long-term debt. The home manufacturer hasn’t leveraged significant debt in a long time either, as Cavco has only seemed to pay off a long-term debt of $81 million that was initiated in FY2012. Cavco also has a healthy cash balance of $352 million, providing an opportunity for further acquisitions.

Current Issues

Cavco’s financials haven’t only been a smooth ride, though – in the current fiscal year, the company seems to be facing demand issues as interest rates have risen. The issues are represented by Cavco’s soft Q1 /FY2024 result – the company had a large revenue decrease of 19.1% along with an EBIT margin fall of 1.5 percentage points from the previous year’s level.

Related to the soft demand, CEO Bill Boor communicated in the company’s Q1 earnings call that most of Cavco’s plants have moved onto a four-day schedule in production to maintain a good margin level. The CEO did seem confident that demand should eventually return – I am on the same lines. Although the challenging situation will probably continue into upcoming quarters, the long-term trajectory shouldn’t be any different even with a soft Q1.

Valuation

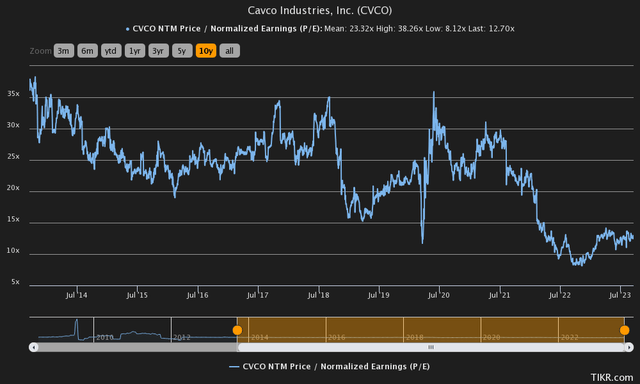

Cavco’s current forward price-to-earnings ratio stands at 12.7 – compared to the company’s ten-year average of 23.3, the ratio seems to be very low.

Historical P/E (TIKR)

The mentioned issues are baked into the forward estimates, with which the company is already quite modestly priced considering the company’s growth – the current price seems like an opportunity to buy.

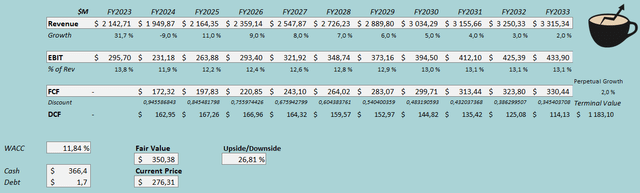

To further analyze the valuation, I constructed a discounted cash flow model as usual. In the model, I estimate Cavco’s revenues to fall by 9% in the current fiscal year as the demand seems soft. Going further, I estimate the long-term growth trend to somewhat continue – although lower than the historical rate of 16%, my estimate of 11% for FY2025 seems reasonable as the model doesn’t account for acquisitions. The growth in my DCF model goes down in steps into a perpetual growth of 2%, representing a CAGR of 6.1% from FY2024 to FY2033.

As for the EBIT margin, I estimate Cavco to have a drop in the current year due to a soft demand, as demonstrated by the company’s Q1 result – I estimate a drop of 1.9 percentage points in FY2024. Going forward, I estimate Cavco’s margin to slightly scale back slowly into a margin of 13.1%. This estimate is in my opinion somewhat conservative, as Cavco has achieved constant operating leverage. The margin of 13.1% is also below FY2023’s level, but I believe a conservative approach is most sensible.

These estimates along with a cost of capital of 11.84% craft the following DCF model scenario with an estimated fair value of $350.38, around 27% above the current price:

Author’s Calculation

The used weighed average cost of capital is derived from a capital asset pricing model:

Author’s Calculation

As Cavco hasn’t used interest-bearing debt in the medium-term history, I believe a very low long-term debt-to-equity ratio of 5% is reasonable. As for the interest rate, I believe the approximate of 6% is fair – the interest rate would be well above the United States’ 10-year bond yield of 4.34%. I believe the interest rate also represents a current typical rate for a company of similar size and nature as Cavco.

For the risk-free rate on the cost of equity side, I use the mentioned United States’ 10-year bond yield. The equity risk premium estimate of 5.91% is Professor Aswath Damodaran’s latest estimate made in July.

Takeaway

Although Cavco is facing current issues related to demand, I believe the long-term demand trajectory should still be intact with long-term rising real estate prices. The company could create further shareholder value through acquisitions with its significant cash balance, and as the stock already seems modestly underpriced with my DCF model estimates, I have a buy-rating for Cavco Industries, Inc. stock.

Read the full article here