Description

CCC Intelligent Solutions (NASDAQ:CCCS) 1Q23 results were strong, with revenue and EBITDA margin coming in slightly higher than expected. The significant factor behind the growth, I believe, was primarily the successful upselling of emerging products to major customers during contract renewals. Furthermore, management’s FY23 forecasts were reaffirmed, and the outlook for 2Q23 was in line with expectations, all of which I believe sends a very encouraging signal to the market. With the ongoing strength in growth, I believe my thesis stays intact for CCCS stock, and think that there is now a decent upside in the share price as I expect multiples to continue to climb up back to 20x forward EBITDA. I recommend a buy rating.

Business updates

Both customer gross retention (at 99%) and software net dollar retention (106%) are solid indicators of CCCS’s ongoing success. Success in bringing on board new logos is encouraging, but what really impressed me was how much of the expansion was due to upselling to the company’s existing clientele – which I believe was made possible due to the renewal of contracts. This development tells me that there are still gaps in the customers workflow processes that CCCS can develop a solution to capture, and also that the growth runway is still very long as CCCS growth is still not focused on adding new clients. Continuing on the point of growth runway, I also liked management continuous effort to develop new solutions that are gaining a lot of traction, which collectively contributed 1pt of growth in 1Q23. Importantly, management raised its FY23E lower end guided range, which I view as positive given the current market environment sentiment.

AI updates

It’s encouraging to see that CCCS isn’t falling behind the curve when it comes to AI, which is a hot topic in many sectors. Looking back over the years, we can see that CCCS has been making significant AI-related investments; their deep learning AI has already processed over 14 million auto claims, collects over 500 million photos annually, and has access to over $1 trillion in historical data. Because of the importance I place on this data set, the company’s management has taken precautions to prevent it from being used as training data by outside parties. To maximize return on investment, I expect CCCS AI solutions to increasingly integrate AI into existing customer workflows. For the next few years, I plan to keep an eye on the company’s margins to see if they begin to inflect upward, at which point I anticipate the market will place a higher valuation on the business due to its structurally higher margin.

Margins

In my opinion, the weakness in this 1Q23 result is margins. Gross margin declined 120bps to 76.4%, and EBITDA margin also shrank by 70 bps, landing at 38.8%. While new product launches did hit gross margin with higher depreciation costs, the company’s current outlook calls for year-over-year margin improvement to be evident in 2H23E as CCCS laps its hiring from 2H22. Considering the company has admitted in the past that it had trouble attracting and retaining talented employees, I do not see the reported 1Q and expected 2Q23 margin decline as negative. It is still my firm belief that CCCS can sustainably increase EBTIDA margins to in excess of 45% over the course of the next few years.

Valuation

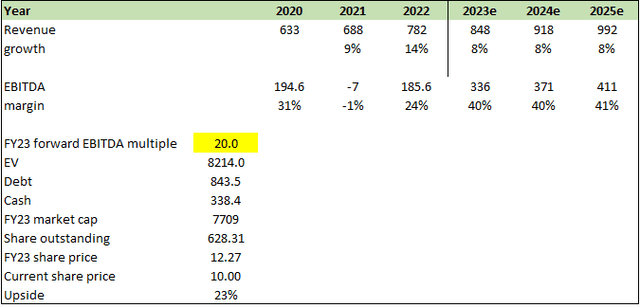

Previously, my belief was that valuation multiple will stay at 18x forward EBITDA as there are no catalyst to drive valuation upwards. However, my view is different now in that CCCS has continuously to drive growth with strong underlying metrics – which is a catalyst for valuation to go up. Management is also confident about margins improvement over time, which if true, should support a 20x forward EBITDA multiple (note that this is the historical average).

Own calculation

Summary

Based on CCCS’s strong 1Q23 results, I maintain my positive outlook on the company. The successful upselling of emerging products to major customers during contract renewals played a significant role in driving growth. Management’s reaffirmation of FY23 forecasts and positive outlook for 2Q23 further support my bullish stance. With ongoing growth and positive indicators, I believe there is considerable upside potential in CCCS’s share price, and I recommend a buy rating.

Read the full article here